Do Swiss Luxury Watchmakers Affect Chinese Consumers? Or Vice Versa?#

China Brand Ambassador, Chen Daoming (Image © TAG Heuer)

According to the Bain & Co. 2010 Luxury Market Survey, Chinese domestic luxury consumption of over 200 global high-end brands totaled 68 billion yuan (US$10.2 million) in 2009, with most of that spending within the mid-price range (25,000-50,000 yuan, or US$3,857-7,714). But not all of that money went to fast cars and flashy apparel. Of the billions spent by Chinese consumers in 2009, a Research in China study found that US$2.2 billion went towards luxury watches, one of the most popular early purchases of the newly wealthy. Interestingly, Bain identified only five brands -- Cartier, Longines, Omega, Rolex and Tudor -- as accounting for roughly half of all watch sales in China in that last two years.

In the wake of the global economic crisis, it was Chinese consumers that helped keep many major Swiss watchmakers afloat. As the New York Times wrote last year, the increasing importance of the China market for these Swiss brands is clearly visible in the limited-edition lines and China-focused designs they're creating to tap the country's spending power. But these trends cut both ways; as the New York Times suggested, the return of classic, ultrathin designs is as much of a reaction to leaner economic times as it is to the tastes of mainland Chinese consumers.

It's been well-established that China is very much in love with the luxury watch. But what is it that appeals to Chinese consumers?

Love I: Retro#

Visitors to this year's Geneva Watch Fair (SIHH) and Basel World -- two of the most important events in the global watch industry -- will have undoubtedly noticed that many of the world's top watchmakers are heavy on retro designs this year. As Hublot CEO Jean-Claude Biver (recently interviewed by Jing Daily at the Prestige Brands Forum) told Chinese Business, it's no accident that retro designs are now so prevalent, as Swiss watchmakers created these lines in an overt attempt to target Chinese consumers. As wealthy Chinese still prefer more conservative designs, in comparison to their Western counterparts, major watchmakers have been pushing simpler designs with large dials.

In a recent interview, Christopher Babin, CEO of TAG Heuer recently echoed Biver's observations, noting that Chinese consumers prefer simple and elegant watches, and in fact, TAG's best selling collection in China is its more retro Carrera series.

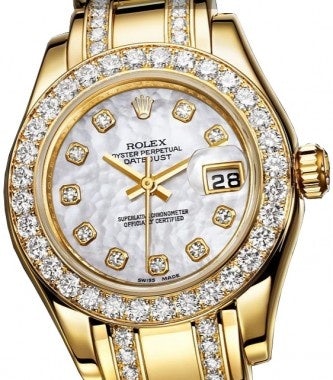

Gaudy to some, gorgeous to others

Love II: Diamonds and Gold#

However, simplicity and elegance aren't enough for many Chinese consumers. Many want a bit more flash, and watchmakers have been quick to respond. As Omega Greater China president Lu Keqin said in a recent interview, early on in Omega's China operations, only a few models were diamond-studded, but the company has added a number of new diamond models in response to their immense popularity in China. According to a Cartier company spokesman, Cartier's three best-selling watch series in China all feature rose gold and diamond options.

Apparently, to really shine in the Chinese watch market, your watches have to sparkle, in a way that may be considered overkill in more mature watch markets like Europe or the United States.

Love III: Crossovers#

One byproduct of China's increasingly attractive (yet increasingly crowded) luxury watch market is the entrance of brands not traditionally known for their watchmaking pedigree. Due to consumer obsession in China with Western fashion brands, the watch segments of luxury brands like Louis Vuitton, Chanel, Prada and Dior face fewer hurdles in China than they might in other markets. While serious watch aficionados may turn up their noses at a Louis Vuitton timepiece and opt for a comparably priced model by a brand that actually specializes in timepieces, the LV name is enough to convince many Chinese consumers.

Naturally, like everything in the China luxury market, tastes will change and brands will adapt. Right now, though, with China still in an early -- yet incredibly free-spending -- stage, retro/classic styling, a good selection of models outfitted in gold and diamonds, and crossover appeal are three important draws. But as the market matures, and consumers become more discerning, look for the Chinese to continue leading the Western brands this time around, rather than vice versa.