It is no secret that Beijing is fighting hard to outlaw domestic crypto mining in China. But despite the ban, some underground miners “have figured out ways to continue operations and evade detection,” according to CNBC. Multiple experts told CNBC that 20 percent of the world’s bitcoin miners remain in China.

Apart from illegal, underground mining movements, China also has well-established and semi-centralized “alliance” blockchains controlled by private companies and scrutinized by the government. For obvious reasons, Alibaba, Tencent, JD.com, Baidu, and Xiaomi currently have the most advanced blockchain infrastructures. Meanwhile, the most surprising development comes from the government, which plans to launch a state-backed NFT industry unconnected to cryptocurrency.

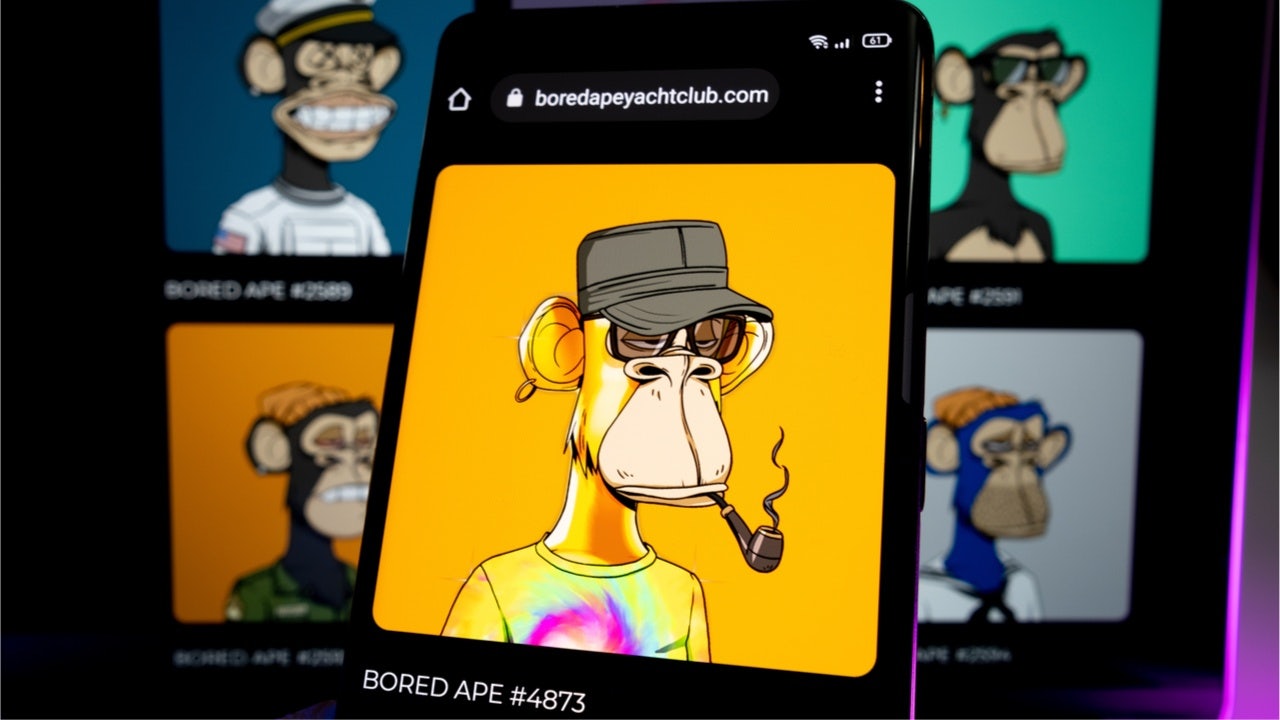

The BSN-Distributed Digital Certificate (BSN-DDC) network is a platform for developing NFTs that complies with Chinese regulations, said the Blockchain-Based Service Network (BSN) in a press release. Coin Desk reports that instead of public blockchains like Ethereum, the platform will provide ten Open Permissioned Blockchains available on the BSN-DDC, stating that DDCs are the same as NFTs but renamed to emphasize their uses for certification.

What are the implications for luxury brands?#

China’s approach to crypto mining is both a gift and a curse for Western brands. Some foreign brands might wonder if they would want to release “digital collectibles” so closely linked to Chinese blockchain infrastructures, especially when they would be under the control of the Chinese government. That might seem like a risky gamble considering the government has the power to “regulate” the market and “sanction” brands that don’t give in to Beijing’s demands.

Let’s say Brand A is an American label that provoked Beijing's ire last month and now released digital collectibles for Singles’ Day. Brand A lists a digitized version of its top-selling T-shirt for 3,200 Chinese yuan (503). Seller A is a fan of the brand, so he pays the full price for the digital collectible. But after finding out about Beijing’s ire and the nationwide call to boycott the label, he decides to resell his digital asset at a lower price. Seller B, who acquires the asset, is a nationalist consumer who accepts larger losses and sells it again at an even lower price. With each transaction, the digital asset drops in value, and the brand loses equity and appeal. As you can imagine, this can cause brand dilution.

At the same time, Beijing might decide to stop the transaction altogether and ban the “digital collectibles” from Chinese networks. Yet, on the flip side, luxury brands could also benefit from China’s approach. The biggest risk that comes with NFTs is the volatility of cryptocurrencies. In this case, the financial risks would be vastly minimized as all payments are made in RMB, and transactions don't get connected to cryptocurrency.

Equally important is that China’s blockchains offer additional protection for brands and investors, compared to a decentralized platform like Ethereum. In China, all users must verify their identities to comply with relevant laws. As the industry operates under the supervision of the government, there’s no room for unlawful activities like money laundering.

In general, Western companies are advised to stay cautious. The market comes with immense opportunities but also a host of risks.