Hermès Reported 13.4 Percent Rise In Q2 2012 Sales#

Following two years of staggering growth in China's luxury sector, major luxury brands with huge retail footprints in mainland China have had a more challenging year, with Burberry and jeweler Chow Tai Fook recently recording lower (but still double-digit) growth rates. But, according to reports this week, others apparently remain bulletproof in China regardless of broader trends.

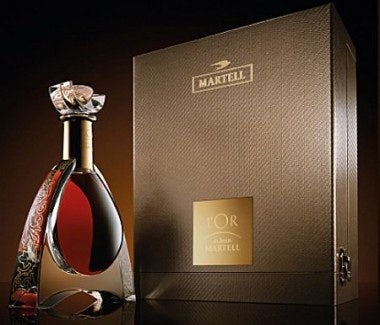

Continuing its winning streak in the Greater China market, led by the region's insatiable thirst for high-end cognac, the French spirits group Remy Cointreau beat forecasts in the first quarter of this year, rising 24.4 percent , driven by cognac demand in Asia and the United States. Making up 62 percent of Remy Cointreau's cognac sales, Asia remains the company's top-selling region by far, with China in particular responding well to intensive marketing efforts by the group for its US$2,500 Louis XIII cognac.

As Remy CFO Frederic Pflanz said this week, "For our market in China we have not seen to date any slowdown. There is continued consumer enthusiasm for our high-end products." Pflanz went on to play down fears that a Chinese government crackdown on officials funneling public funds to buy luxury goods would impact sales.

Hermès, which currently operates 21 locations in 14 mainland Chinese cities, reported a 13.4 percent rise in Q2 2012 sales, led by a 26.9 percent rise in sales in the Asia-Pacific region (excluding Japan), which itself was led by strong China sales. As Hermes Chief Executive Patrick Thomas told Reuters, "We see no slowdown in China." With sales in France and the US remaining sluggish, Asia sales have become increasingly important to Hermès, and now, outside of Japan, accounts for 32 percent of sales.

Clearly, prestige and pricing play a role in the sustained popularity of the Hermès name in China -- particularly compared to aggressively expanding brands like Burberry or Louis Vuitton -- but, as Forbes notes this week, factors like the growing presence of luxury second-hand stores and rising demand from buyers in Southeast Asia could impact the coveted image of Hermès mainstays like the Birkin bag in China:

Masako Kumakura, a global communications practitioner who recently moved to China, believes that the Birkin has become a bit démodé especially among the stylish set. “Too many people who are not all that fashionable have it. And they carry it everywhere. In Asia, I have seen women carry their big Birkins to dinner parties. So not chic,” she said.

“Since almost everybody has a Birkin bag, more and more ladies are opting for bags made from exotic skins now, not necessarily Birkins,” shared socialite and Singapore PR maven Olga Iserlis.

Regardless of looming ubiquity among a certain demographic in Asia, others believe that Hermès' long-standing connotation of status remains as unshakable in Asia as it has been in Europe or North America:

[T]o a lot of people, the fact that the Birkin is a handbag is beside the point. It represents success, achievement and status. It shows that the wearer is a card-carrying member of the $10,000 handbag club. “It is still the ultimate status symbol, for first-timers who save for months on end to buy their first very Birkin to those seasoned collectors who must have every new color or size in their wardrobe. Because the Birkin is more than just a bag, it’s a lifestyle.”

Now, all eyes will be on next week's earnings report from LVMH. Will China's shifting demand benefit the luxury giant's spirits and jewelry sales to the detriment of LVMH's flagship brand, Louis Vuitton? (Which itself is having a very busy week in China.)