Key Takeaways:#

- Video-sharing platform Bilibili has broken out of its singular focus on anime, comics, and games and gone fully mainstream in recent years.

- The platform has more than 267 million monthly active users (MAUs) and is expected to surpass 400 million MAUs by 2023.

- Yet rising marketing costs, mounting debt, and pressure from Beijing regulators have sent Bilibili shares into freefall over the past 10 months.

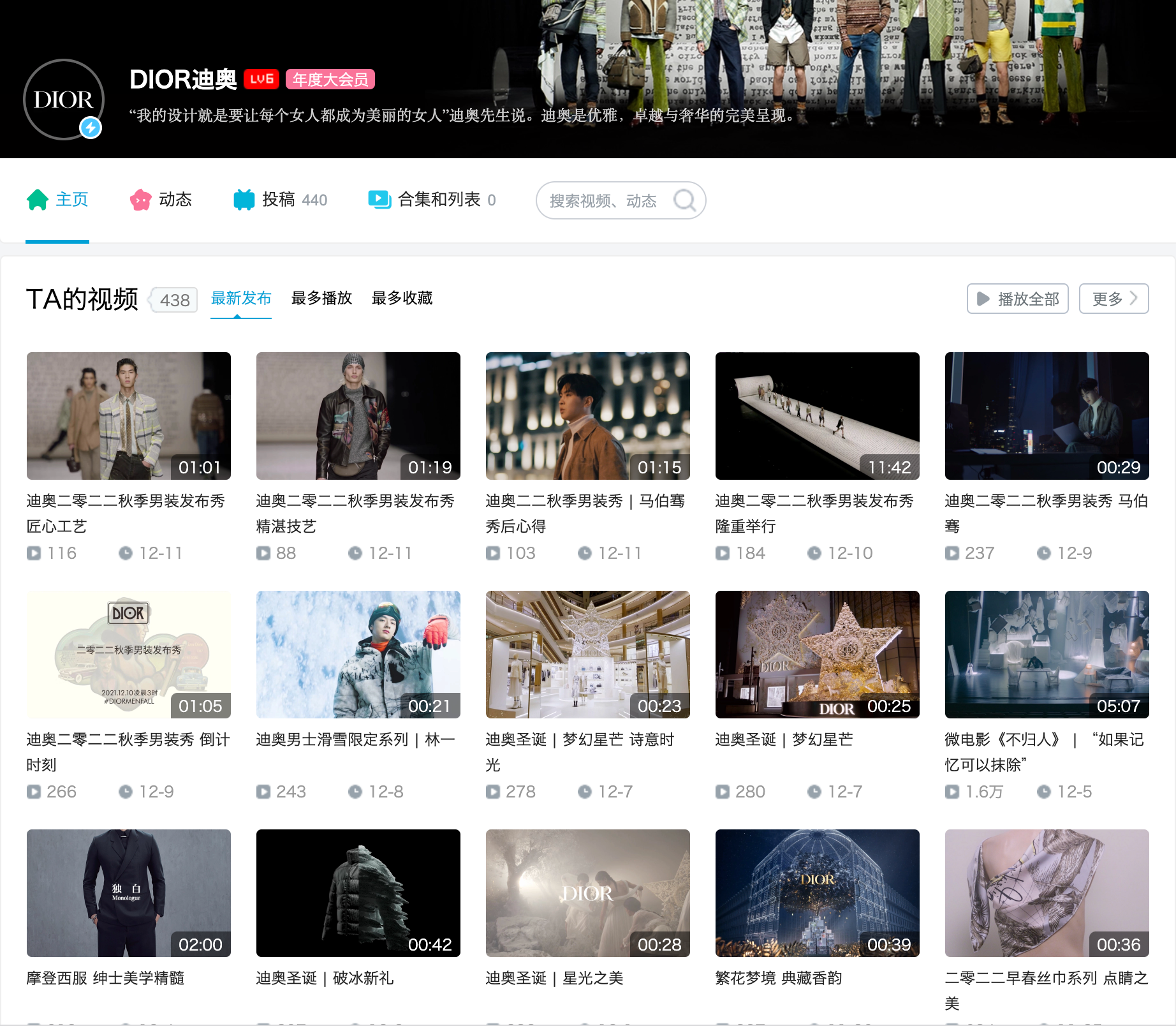

After years of steady growth as it cornered the once-niche “ACG” (anime, comic and games) subculture, the nearly 13-year-old Nasdaq-listed video-sharing platform Bilibili (Nasdaq: BILI) has only gone mainstream in China over the past few years. In that time, the platform — famous for its “bullet chats,” real-time comments that fly across the screen while users watch videos, and a vast amount of professional, user-generated content — has attracted tens of millions of new users. But perhaps more importantly, the platform has piqued the interest of brands across the consumer spectrum, among them Dior, Shiseido and Mercedes-Benz, drawn to the platform’s long-term growth potential.

User acquisition remains robust, with Bilibili’s average monthly active users (MAUs) rising 35 percent year-on-year in Q3 2021 to 267.2 million and mobile MAUs increasing 36 percent to 249.9 million. According to a company release, by 2023 Bilibili’s MAUs are expected to reach 400 million, with the majority of those users millennials and Gen Zers. For brands, the platform remains attractive owing to its predominantly young user base — 86 percent of Bilibili users are under the age of 35.

These young users are engaged and eager to use the platform to create, not just consume, content. This month, the company released its first creator report, which claimed 2.7 million active uploaders per month, a rise of 61 percent year-on-year, and more than 10 million monthly video uploads, up 80 percent in just one year. While user stickiness is trending downward somewhat as Bilibili becomes more mainstream, it remains high with the average user reportedly spending 88 minutes per day on the platform.

Where Bilibili really shines is in its ability to attract and retain paid users and advertisers. In the third quarter of this year, Bilibili’s average monthly paying users (MPUs) rose 59 percent year-on-year to 23.9 million while total net revenues leapt 72 percent year-on-year to RMB 4.49 billion ($705.5 million). In the fourth quarter of this year, Bilibili expects net revenues of between RMB 5.7 billion ($895.87 million) and RMB 5.8 billion ($911.59 million).

The company is also beefing up its exclusive content partnerships and branching out from its core ACG wheelhouse. This month, Bilibili won the broadcast rights for English soccer’s FA Cup in mainland China, which extend until the end of the 2023/2024 season. The platform will stream games for free on an official FA Cup channel, offering live viewers special activities and perks. This comes after two years of Bilibili focusing on offering more long-form content, such as feature films, to keep viewers engaged for longer.

Yet all of this success comes at a price, and like other Chinese tech giants, Bilibili is struggling to offset the great expense of wide-ranging digital marketing and user acquisition efforts. According to its latest earnings report, Bilibili’s net quarterly loss in Q3 2021 reached RMB 2.68 billion ($421.2 million), more than double its RMB 1.1 billion ($172.86 million) net loss in Q3 2020. But Bilibili is also being squeezed by China’s tech crackdown and an ever-changing regulatory environment. It’s this environment that has pushed Bilibili and other domestic tech firms to diversify their income streams.

Bilibili, for one, has decreased its dependence on gaming, one area that Beijing has had in its crosshairs over the last half of this year. Where 80 percent of Bilibili’s revenue once came from mobile games, as of the third quarter of 2021 this had lowered to a little under 27 percent. Currently, Bilibili is reportedly testing a shopping cart feature for its livestream pages, indicating the company is ready to take on dominant livestreaming e-commerce players Alibaba (via its Taobao Live segment) and Douyin. According to Technode, Bilibili is likely to try to stand out in the increasingly crowded market “by selling products relating to its core content of [ACG].” This move indicates the company is serious about growing its e-commerce offerings, as it contributed a modest 14 percent of Bilibili’s revenue in the third quarter of this year.

Going into 2022, Bilibili finds itself in the same unusual situation as other leading Chinese tech companies, with revenue up, new users continuing to join, and existing users upgrading to paid users, yet investors spooked and share prices sliding. Bilibili shares on the Nasdaq currently sit around $60, roughly where they were last November but way down from their high of $153.12 on February 12 of this year. Share prices plummeted in the second half of the year owing in no small part to increasingly heavy-handed regulation of China's tech industry by government regulators since this past winter and the more recent announcement by Bilibili that it will issue $1.4 billion worth of notes that can be converted into shares of the company.

However, there is a potential silver lining in that it’s possible Bilibili has already weathered the worst of Beijing’s tech crackdown, or at least made enough concessions to appease government regulators, meaning things could be looking up. So for investors, the question is whether a tightened regulatory environment going into next year’s National Congress in Beijing equals anemic tech stocks — or a boost for Bilibili — in the next 12 months.