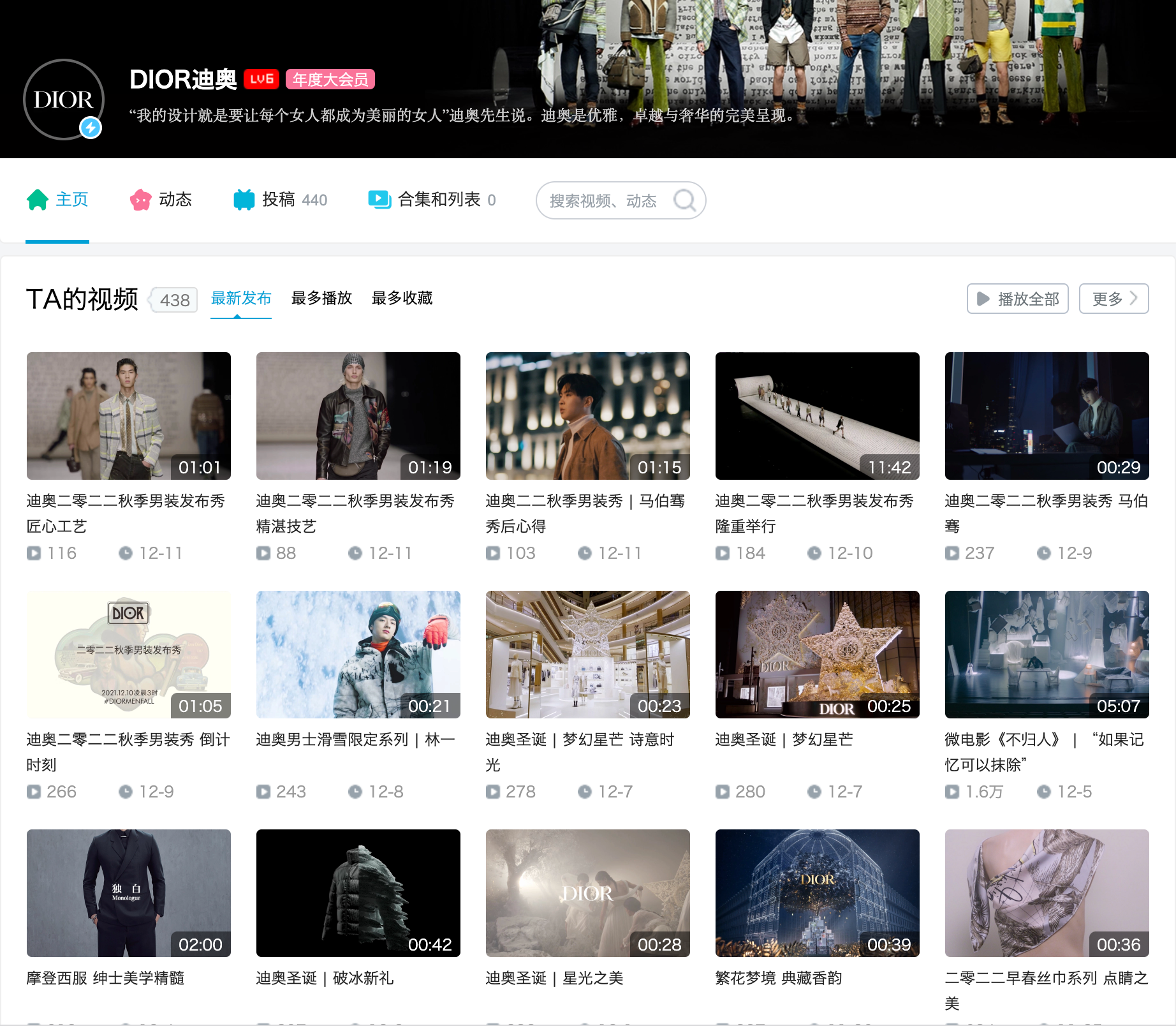

Despite years of steady growth as it cornered the once-niche “ACG” (anime, comic and games) subculture, the 13-year-old video-sharing platform Bilibili has only gone mainstream in China over the past few years. In that time, the platform — famous for its “bullet chats,” real-time comments that fly across the screen while users watch videos, and a vast amount of professional, user-generated content — has attracted tens of millions of new users and piqued the interest of brands like Dior, Shiseido and Mercedes-Benz.

But the past year has shown that Bilibili’s position is far from secure, with recent financials revealing a clear disconnect between user growth and revenue. In Q2 2022, Bilibili reported quarterly revenue of $733 million (4.9 billion yuan), an increase of just 9 percent. This indicates that the slide in revenue growth that began early last year is only worsening. In the second quarter of 2021, Bilibili boasted more than 70 percent growth in revenue year-on-year, with total revenue topping out in the fourth quarter of the year and steadily dropping ever since.

Bilibili’s core problem is translating its still-impressive user growth to actual profitability. The platform has operated at a loss since listing on the Nasdaq in 2018, and it is unlikely that Bilibili can achieve its previously stated goal of getting in the black by 2024.

While the Shanghai-based company pointed to the impact of pandemic lockdowns in the second quarter of this year, Bilibili’s cash flow problems could also come down to a handful of simple elements: yawning expenses, China’s crackdown on gaming, lower enthusiasm among advertisers, and lukewarm interest in e-commerce among its users. In the second quarter of this year, Bilibili's operating costs totaled $606.3 million (4.2 billion yuan), an increase of 19 percent, which the company attributed to increased revenue sharing and content costs. The company’s mobile gaming business also struggled, recording a 15 percent drop in revenue year-on-year, which the company blamed on a lack of “popular new exclusively distributed game releases,” but was likely due just as much to Beijing’s tighter regulation of the sector. Bilibili’s advertising revenue also disappointed, growing an anemic 10 percent over the quarter, while e-commerce revenue grew just 4 percent.

These figures are particularly disheartening considering monthly active users continue to grow, albeit at a notably slowing pace, reaching 305.7 million in the second quarter, a 29 percent increase year-on-year (down from a high of 38 percent in the second quarter of 2021). Looking to paint a rosy picture of Bilibili’s user base, CEO Chen Rui said this June that user retention is high, with 65 percent of the platform’s earliest users remaining on the platform after 13 years.

Yet user growth and stickiness do not mean more profitability, nor do they assuage the concerns of investors. Bilibili stock prices dropped more than 15 percent on the Nasdaq and Hong Kong stock exchanges after the company released its Q2 2022 financials last week, and it remains to be seen whether the company’s highly publicized restructuring efforts this July will pay off later in the year.

Perhaps more importantly for Bilibiili and its market image, it remains to be seen whether the platform can lure back more global luxury brands as advertisers — or active users for that matter. Recent efforts to boost video views, and thus advertiser interest, like a TikTok-style vertical story mode have shown some potential. (Daily views for this mode increased 4x in Q2 2022 year-on-year.) But will it be enough to lure international brands, especially if they take a wait-and-see attitude to advertising in China over the next quarter?