What happened

After more than two years of COVID-19 restrictions, China has finally reopened its borders — a relief to travel-starved locals and weary nationals waiting to return from abroad. Although the hard work of recovery has just begun, the World Travel and Tourism Council (WTTC), a global forum that analyzes the economic impact of the travel industry, is confident in the country’s trajectory.

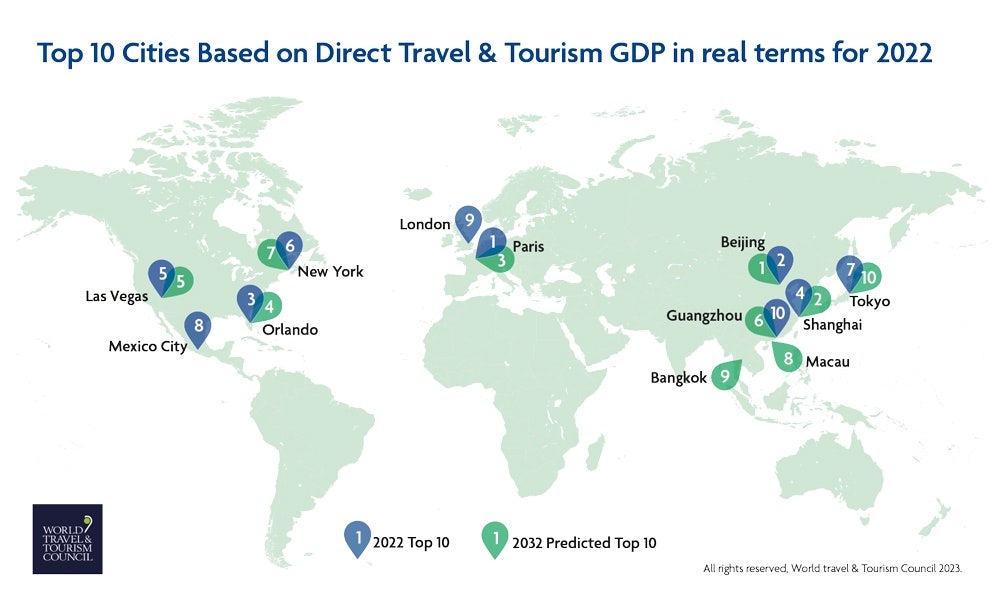

Beijing will become the world’s most powerful city destination by 2032, more than doubling the size of its travel sector from 33 billion to 77 billion (in terms of direct GDP contribution to the city), according to WTTC’s recent report. This would put the city ahead of Paris, which is currently crowned as the top city destination with a travel sector worth almost 36 billion. Meanwhile, Shanghai is expected to rank second in direct travel and tourism GDP in 2032, followed by Guangzhou and Macau at sixth and eighth place, respectively.

The Jing Take

While major cities such as London, Paris and New York will remain global powerhouses in the short term, Beijing and Shanghai are poised to move up international travel bucket lists. “Tourists will always have favorite cities that they will return to, but as other countries prioritize travel and tourism, we are going to see new and emerging destinations challenging the traditional favorites,” Julia Simpson, WTTC President and CEO, explains in the report.

And China is prepared to welcome these tourists, making investments in new hotels, transportation, and tourist destinations over the last decade. Take Macau, where the travel sector represents 40 percent of its total economy; in December 2022, the territory’s biggest hospitality and gambling giants pledged a total of 14.9 billion toward non-gaming projects over the next decade, with plans to develop theme parks, convention and exhibition centers, fine dining and performance venues. In fact, the WTTC forecasts that Macau will rank second worldwide in terms of international traveler spend by 2032, surpassed only by Hong Kong.

Similarly, Shanghai has released measures to boost inbound tourism. In 2021, the city announced a five-year plan to achieve an annual tourism revenue of 108 billion (700 billion RMB) by 2025, via promoting high-end consumption, international popular exhibitions, and festivals that highlight Chinese culture. Earlier this month, the national government also announced a pilot program that would open service sectors, including tourism, to foreign investment, impacting local businesses in Shanghai, Chongqing, Tianjin and Hainan.

Naturally, as both local and foreign tourists start to pour into these cities, luxury brands with brick-and-mortar locations stand to gain. But to differentiate themselves from the competition, they have to offer top-tier experiences. In addition to rolling out new retail concepts, it is important to recognize how consumption habits, particularly for Chinese tourists, have changed because of COVID-19. According to tourism service platform New Lvjie, camping, AR and the metaverse were popular investment fields in the tourism industry, while health-centered lifestyles, high-quality customized travel, and the Guochao trend (characterized by traditional Chinese cultural activities) will continue to power future travel plans.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.