If 2022 was the year luxury officially entered the metaverse, 2023 is looking to be when beauty takes over it.

“We believe that the future of beauty is physical and now also virtual, and this is why we have been digitizing and innovating the beauty consumer journey,” Manon Cardiel, global digital innovation manager at L’Oreal told Jing Daily during the “Measuring Your Success In The Metaverse” webinar last year. “With this, we can expand from product to experiences that offer us new adventure, new exploration, new tests and learnings. It’s just the beginning.”

Beauty groups worldwide are rushing to capitalize on the fast-evolving trend of Web3. With beauty reaching an estimated market value of 57 billion, it’s a shift that’s set to shape, and disrupt, the industry over the next few years.

Although still in its infancy, players are already establishing themselves as leaders of the new beauty wave; an example being cosmetics powerhouse Charlotte Tilbury, which ramped up its virtual strategy last year by launching metaverse activations. These include an online store dedicated to its hero “pillow talk” product, as well as its holiday-inspired “Charlotte’s Beauty Realm.”

Beauty gamifies#

Capturing the attention of virtual consumers isn’t easy. To achieve mainstream appeal, brands are turning to gamified experiences to burnish their allure.

A popular port of call that’s surfaced is gaming platforms. Previously exclusive to Gen Z and gaming fanatics, the space has grown to become a retail powerhouse — and the key to cultivating steadfast communities.

Roblox in particular has made an impact. Currently, the title has 67.3 million daily active users and around 214 million monthly active users, making it a goldmine of opportunity and sales potential.

“Beauty activations in Roblox work because they allow a user to express themselves virtually, in the same way they do with clothing,” Charles Hambro, founder of data platform Geeiq, explains.

Over the past year, a number of names from the sector have constructed their own dedicated experiences within the realm. A select few have performed better than others.

Why? It’s all down to their community-building efforts. For online spaces like Roblox, it’s less about the product itself, and more about the experience that can be built around the brand to bump up storytelling and audience engagement.

“When it comes to specific products like perfume, brands have always faced a marketing challenge. How do you showcase a scent in print media, on TV or now, in virtual experiences?” Hambro says. “I'd argue that environments like Roblox are a natural evolution of these traditional channels, but they allow brands to present their offering in a three-dimensional sense, rather than a 2D one.”

Consumers may not be able to try the products on, physically. But these limitations are pushing brands to think outside of the box and push the parameters of their creativity. That means they have to get creative. Nars Color Quest is a prime example. The group leveraged its traditional branding strategy by creating a collection of islands that each represented a different product. A decision that was ultimately far more immersive and more aligned with Roblox’s audience.

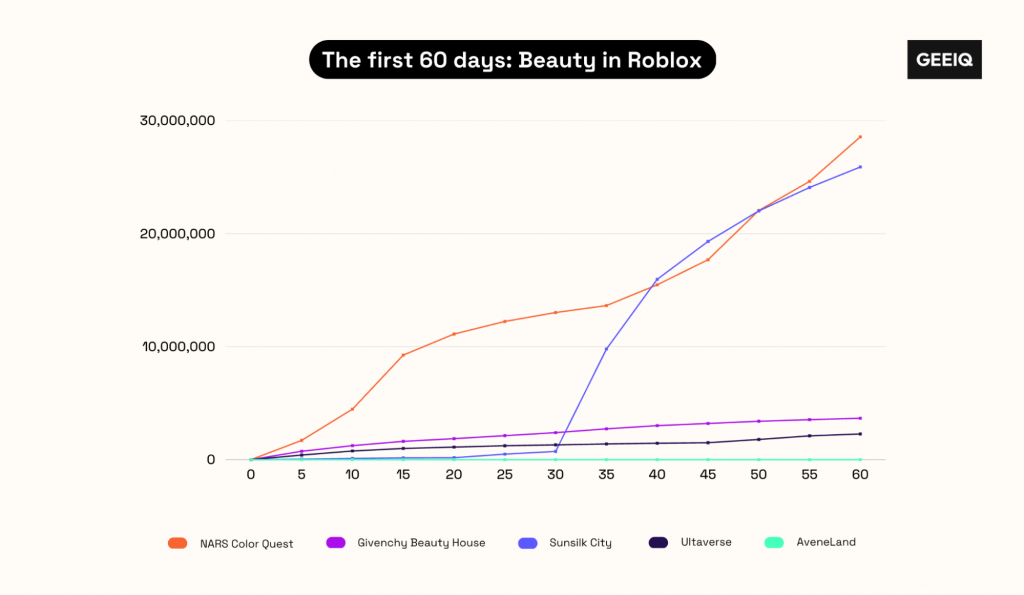

The graph below shows how brand experiences — including those for Avene, British hair care brand Sunsilk, and American cosmetics chain Ulta — performed in Roblox during their first 60 days of activation. Throughout the timeline, the brands each launched new strategies within their space, which boosted engagement and traffic.

This can be seen through the spikes in popularity for Sunsilk, which saw a massive uplift on day 30, the result of the brand dropping a collection of free User-Generated Content (UGC) items.

But immediate success on platforms like Roblox isn’t guaranteed. The graph highlights how brands need to be consistent with new concepts to keep up longevity and avoid interest plateauing.

They also still need to be savvy about what it is they are offering, and understand who their active audience is. A case in point is AveneLand, which launched its experience in French. This was arguably a wrong decision given that 76 percent of Roblox's followers are based in the US (according to GEEIQ platform) and less than 1 percent are based in France.

China’s new beauty wave#

The trend has caught on in China, too, but the mainland’s approach is different. With platforms such as Roblox banned across the country, the industry is pivoting its focus away from cross-media collaborations and exploring other avenues of appeal.

Retail giants like Tmall are offering this opportunity. As the country’s behemoths invest in building and improving their dedicated virtual spaces, brands are tapping the divisions to launch their own online experiences.

Following a dip in brick-and-mortar traffic and the shuttering of 14 stores across China, Maybelline developed a limited-time virtual universe in Tmall ahead of Alibaba’s Double 11 shopping festival, in a bid to bounce back from pandemic-induced repercussions and outperform local competitors.

The same goes for L’Oréal, which over the past year has channeled its efforts into capturing China’s spending power through the metaverse.

“Our brands have immense opportunities to engage with beauty consumers,” says Camille Kroely, Chief Metaverse & Web3 Officer at L’Oréal Group. “These open new avenues for immersive brand storytelling very much rooted in brand DNAs. There are also new epicenters of influence, as well as new kinds of partnerships for our brands, in the rapidly evolving ecosystem.”

During the webinar, Cardiel explained what these opportunities involve. “We have been creating our own virtual experiences through these spaces. For example, we launched a rose garden on Tencent in China in order to recruit new audiences, but also to offer an immersive experience through the brand storytelling. It was really interesting to connect that to e-commerce. At the end of the day, consumer lifetime value is a key metric that we as a brand follow.”

L’Oréal and Maybelline are key players in the beauty segment’s development in the Chinaverse, with Lancôme being a recent newcomer.

In partnership with China Duty Free Group, the brand unveiled its Lancôme Super Serum immersive virtual pop-up, where visitors could participate in a customizable 3D avatar experience, to coincide with this year’s International Women’s Day.

“This cements Lancôme’s long-standing authority in skincare, as we reiterate our leadership through constant innovation and cutting-edge technology to elevate the consumer experience,” says Linda Wang, General Manager of Lancôme Travel Retail Asia Pacific, in the activation’s press release.

Whether in China or globally, beauty’s success in Web3 falls or flies on its ability to attract, build, and maintain a strong, reliable community in the virtual realm. As explained by Cardiel, “Everything is around brand storytelling, but specifically around consumer engagement.”

To date, the arena is still largely the preserve of tech-savvy shoppers, gaming enthusiasts, and Web3 natives. But it is beginning to resonate with the masses. With more options to let the imagination run wild and a bigger focus on community, the industry may be on its way to officially outpacing luxury in Web3.