Despite hazards like the property market’s instability (an issue that's far from over), China’s luxury market ended 2021 in good shape. It grew by double digits, with some brands up 70 percent, according to Bain & Company’s China Luxury Report 2021.

The boom is not a surprise. Chinese nationals have been corralled within their frontiers, thanks to tight COVID-19 travel restrictions over the last two years, leaving them no option but to shop on their doorstep. Repatriating high-end spending from hubs like Paris, Milan, and New York has been an aim for the Chinese government for years, and COVID-19 accelerated that process dramatically.

China has cleverly pulled luxury spending back inside its borders, and the Mainland will retain a high share, regardless of changes to future international travel rules.

Giving Hainan Island duty-free status about a decade ago was the first step in a hugely successful localization project. In 2021, the island’s duty-free stores generated almost 9.5 billion (60 billion RMB) in sales, up by about 90 percent, with beauty accounting for more than half of that spending. More operators will surely expand the market, and price competition will likely intensify.

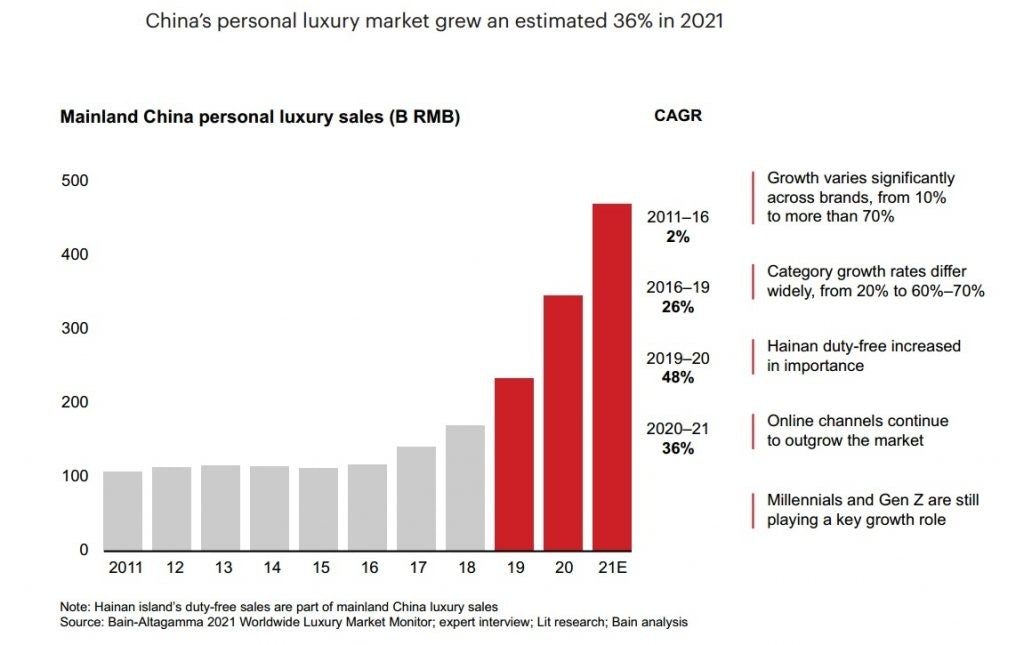

Across China, domestic sales of personal luxury goods grew by 48 percent in 2020, cooling to 36 percent in 2021 to reach 74.3 billion (471 billion RMB) — “a near doubling in just two years,” noted Bain. That’s impressive under any circumstances, but during a global pandemic, it is a monumental leap and means China will likely overtake the United States as luxury’s leading market within a few years.

“Globally, Mainland China’s share of the luxury market grew from about 20 percent in 2020 to approximately 21 percent in 2021,” said Bain & Company partner Bruno Lannes, a co-author of the report. “We anticipate this growth to continue, putting the country on track to become the world’s largest luxury goods market by 2025 — regardless of future international travel patterns.”

But even Chinese consumers who are unable to travel to Hainan can often get their desired products through parallel channels, such as daigous or new formats like the e-commerce platform Dewu. This innovative site allows individuals and brands to register and sell overseas luxury products to Chinese buyers. Dewu’s monthly active users grew from 12 million in 2019 to 35 million in 2021 (source: QuestMobile).

Warning signs that cannot be ignored#

Yet, the good news is tempered with some bad. Not only was the growth rate in 2021 significantly down in 2020, but it also fell drastically in the second half of last year.

Key luxury categories, led by leather goods and fashion/lifestyle, had strong year-on-year increases — between 40 percent and 100 percent in the first half — while growth over the next six months collapsed to between zero and 25 percent, year-on-year, based on Bain’s estimates.

Some factors that impacted the market were:#

- Continuing COVID-19 outbreaks across various cities in China

- Weakening consumer sentiment due to the cooling of stocks and worries over liquidity in real estate

- Tightened restrictions on e-commerce players and KOLs/celebrity influencers

It is difficult to determine whether these impacts will be short-lived or not. However, structural shifts, such as the Hainan market and further digitalization, are long-term trends that should offset them.

As everywhere, digitalization accelerated during the pandemic, and more marketing and consumer engagement moved online. Although offline stores remain essential for brand building and conversions, online luxury sales are growing faster than offline across all categories — at roughly 56 and 30 percent, respectively.

Given the slowdown in recent months, Bain is forecasting low double-digit growth for luxury this year, but it should pick up in the second half. “Overall, we expect Chinese consumers’ luxury purchases to recover to pre-Covid levels between the end of 2022 and the first half of 2023,” said report co-author and Bain partner Weiwei Xing.