Australia’s luxury retail industry continues to be bolstered by increased visitation and spending from Chinese inbound consumers. As of February 2017, the luxury retail industry was valued at about 2 billion with Chinese consumers accounting for about 30 percent of purchases. And the sector is expected to experience 6-8 percent growth over the next year, according to the Deloitte Global Powers of Luxury Report that was released in September.

David White, National Retail Lead for Deloitte, shared key insights from the report at the newly opened Mercedes Me Showroom on Collins St. in Melbourne for The Business of Luxury Retail and Destination Summit.

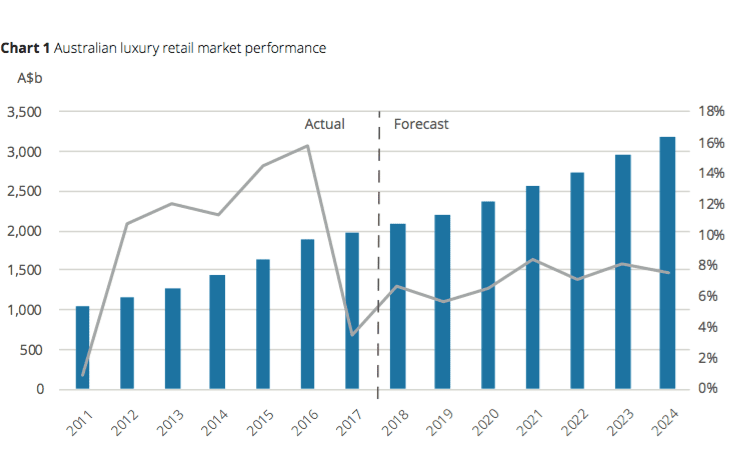

Over the last seven years, the luxury market in Australia has been particularly positive, with growth peaking at 16 percent in 2016. While growth slowed in 2018, IBIS World forecast growth over the next seven years to be double that of the broader retail market which sits at 3 percent per year.

Chinese tourists are not only the largest tourism source market for Australia, but they are also the highest spending--nearly double the amount compared to travelers from other markets. Chinese travelers spent AUD 1.3 billion in the 12 months ending March 2018. Chinese travelers also have a significantly higher spend per visitor than any other nationality, further supporting luxury sector growth.

Australia’s proximity to Asia, in particular, China, has attracted significant growth in purchases from high spending tourists visiting and shopping in the country. Retailers have responded by opening new stores in peak tourist areas, as well as international airports which are now referred to as "sixth continents," where retailers are targeting consumer segments based on travel times, destinations and even language, White said. Airport retailers are able to analyze flight arrival and departure times and allocated Chinese-speaking staff and ensure that preferred products are prominently displayed.

Several key strategies have emerged as Australian luxury retailers all compete to attract these young and affluent shoppers:

New Brands:#

There has been an acceleration of new brands, both international and Australian, entering the market or expanding their operations. Australian brand A-Esque has opened a store on Collins St. and has taken a large concession in David Jones and opened a new flagship store in South Yarra. A-esque is the only brand from Australia available in Lane Crawford, an area popular with Chinese tourists.

Flagship Stores:#

Flagship stores are becoming increasingly important as retailers see the in-store experience as influential in attracting Chinese shoppers. Both Melbourne and Sydney have experienced huge growth in flagship stores. Tiffany, Cartier, and Bvlgari are expanding operations, and Chanel is reinvesting and expanding their flagship stores in each major market. German camera brand Leica, which attributes 50 percent of its sales in Australia to Chinese shoppers, is opening a flagship store on Collins St. in November.

Airport Retail:#

Major Australian airports are renewing marketing strategies to account for the increased number of visitors and are creating more unique and engaging experiences at airport locations to entice and retain Chinese visitors. Bvlgari will soon launch their opulent store at Sydney Airport. Airport retailers are able to identify where passengers are coming from and what time they will be passing the stores, which allows for more sophisticated and targeted strategies with product ranges that appeal to Chinese shoppers. The strategy also helps stores in planning to provide Chinese-speaking staff during peak periods.

Tech and Social:#

Brands are integrating Chinese social media platforms, AI and AR into the marketing mix.

- Major shopping centers such as Westfield, QV Building and Vicinity Centres are setting up local WeChat accounts.

- L’Oréal is increasingly focusing on AR to enhance customer experience: in March 2018 they acquired ModiFace, an internationally recognized leader in AR and AI applications used by the beauty industry.

- YOOX's "Try, Share and Shop" initiative partnered with Lumyer in 2017 to produce an AR camera app that enables users to try handbags, sunglasses, and jewelry from YOOX in virtual reality.

- Burberry has used ARkit by Apple as part of its digital marketing strategy through immersive story-telling.

And while it remains a challenge to ensure they are loyal to brand values, incorporating these technology elements will continue to be very important. It is no longer enough to generate likes; for the next generation of Chinese luxury shoppers, engaging and interactive content will be key.

The overall outlook for the luxury goods industry in Australia remains optimistic, according to Deloitte, particularly for brands that respond quickly and create engaging and authentic online and offline experiences for the new generation of consumers.