Work By Blue-Chip Artists Still Scarce In Market#

With the autumn auction season approaching, major auction houses are taking stock of what we can expect to see in the Asian art market in the remainder of the year, following lower overall volumes despite record-breaking sales in Hong Kong this past spring. In the wake of a three-year-long string of rising sales -- which saw the Chinese art market crowned the largest in the world in 2011 -- total sales for Sotheby's Hong Kong, Christie's Hong Kong, China Guardian and Beijing Poly dropped 32 percent in spring 2012 vs. fall 2011, as auction houses found it more difficult to procure quality artwork and existing collectors held onto pieces rather than trying to "flip" them for a quick profit. Additionally, supply has been hit by increasing connoisseurship and expertise among new buyers, as well as the building of many private collections that have taken many key works out of the market.

Despite this drop in Hong Kong sales, however, sales for the same segments rose in Europe and New York, a trend that indicated that Asian collectors weren't cutting back on their buying, they were just looking further afield for quality artwork and antiques. According to Christie's, the number of Asian clients registering to take part in auctions in New York and London has risen 31 percent. This is perhaps expected, as Hong Kong has been hit by lessening supply of top-quality work over the past year. As François Curiel, president of Christie’s Asia, told the New York Times, the comparatively lackluster performance of the Asian art market in the first half of 2012 vis-a-vis the US and Europe, boils down to a drop in supply rather than demand.

Said Curiel, "We had fewer works of art for sale in the first half of 2012...[O]ne of the reasons being that there is so much financial uncertainty at the moment around the world, so many sellers are hanging on their property, rather than selling and having to decide how to invest the funds: in Hong Kong dollars, U.S. dollars, renminbi.” The market has also been hit by unsustainably high expectations, as 2011 sales were so much higher than those in 2009-2010 owing to an influx of new Chinese collectors and more readily available supply.

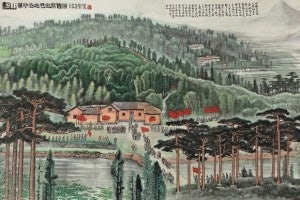

Influenced by slower economic growth at home, auction houses expect that Chinese collectors may show even greater discretion at upcoming sales. This is probably a safe bet, as they've become more discerning in the artists and segments they're buying anyway. What this means is: don't expect to see Chinese collectors buying top-flight Western art this fall. Do expect to see them bidding selectively and focusing on the most "solidly performing" Chinese artists, such as Zao Wou-Ki, Qi Baishi, Zhang Xiaogang and Zeng Fanzhi. As Carson Chan, managing director of Bonhams Asia, told the Times, “I think Chinese buyers are now buying more carefully and more selectively...They will only invest in pieces that have both a historical significance and art value. So you have to have extremely clean provenance and background, and this goes across the board between paintings and ceramics.”

Auction houses probably have good reason to be optimistic about the long-term potential of the Chinese collector, particularly now that speculators are increasingly leaving the market or staying away altogether. For one thing -- as Jing Daily has consistently pointed out -- Chinese collectors tend to be highly pragmatic, buying partly for interest and partly for investment. Having relatively few alternative investments at their disposal, these collectors should continue to look towards the art auction market as other asset classes have shown mediocre performance in 2012. As François Curiel said, “Art is still viewed as a good investment in the Chinese collector’s mind...I have yet to meet someone who buys art and think they are going to lose money.”