Report Notes Emergence Of Mainland Chinese "Super-Collectors", Strength Of Domestic Auction Houses, Strong Confidence In Contemporary Artists#

Last December, art market analysts ArtTactic released a survey that indicated confidence in the Chinese art market, which had taken a hit in the wake of the global economic crisis, showed signs of recovery over the course of 2009. From February 2009 to November 2009, ArtTactic's confidence indicator for the Chinese art market rose from 16 to 57, reflecting more positive than negative sentiment.

Additionally, 70% of respondents said they expect the Chinese art market to recover within two years. As Jing Daily wrote at that time, the findings of ArtTactic's survey, along with other recent developments, hint that buyer confidence, comparatively affordable pricing, and decreased output by blue-chip Chinese contemporary artists would lead to a brisk rise in prices this year:

As more Mainland collectors appear on the scene, and as the resultant scarcity of works available by the top artists favored by Mainland collectors grows, we can expect that 2010 will see prices of contemporary art by China’s top artists to approach pre-crisis levels. As the ArtTactic survey notes, most respondents believe prices will fully recover within two years; if more New Collectors on the level of Liu Yiqian and Wang Wei burst on the scene looking to get their hands on every Zhang Xiaogang, Wang Guangyi or Yang Fudong piece they can, however, we might see even faster price shifts occurring.

This week, ArtTactic's newest report confirms many of the predictions we expected to see in 2010, namely, the continued momentum of the mainland Chinese consumer base (led by a handful of so-called "super-collectors") and indications that the Chinese government itself is increasingly putting a premium on promoting arts education. (Previously on Jing Daily)

Among the findings of ArtTactic's latest report:#

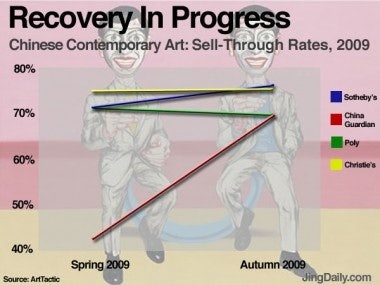

1.) The second half of 2009 was extremely strong for international and domestic Chinese auction houses, with the volume of Chinese art reaching US$1.21 billion, vs. $928 million in 2008 -- a year-over-year increase of 41%.

2.) Poly Auction's sale in the autumn of last year became the highest-ever grossing sale in mainland China, and in 2009 Poly became the biggest player in the Chinese contemporary art market with total turnover of US$20.5 million.

3.) Poly's sales in 2009 surpassed both Sotheby's (17.2 million) and Christie's ($14.7 million)#

, indicating that the auction house is likely to become a serious challenger to both Sotheby's and Christie's sooner than most expected.

4.) According to media sources, around half of the top 10 highest-priced Chinese lots were purchased by only

three#

mainland Chinese "super-collectors": Liu Yiqian (previously on Jing Daily), Chen Yu, and an undisclosed buyer from Shanxi province.

5.) Liu Yiqian spent $180 million on art last year, including $22.6 million on a Wu Bin painting previously owned by Guy Ullens. According to ArtTactic, "The sale signals a wider ambition of domestic auction houses and collectors to reclaim work of important cultural and historic value from Western hands." We'd like to point out that Liu is not the only one in his household purchasing the artwork: his wife Wang Wei said in an interview last year (translated by Jing Daily) that she and Liu plan to open a private museum in the hopes of improving arts education in China.

6.) A growing number of Chinese banks now offer art investment and art banking services, including Minsheng Bank (which offered its first such fund in 2007 and second in January of this year), China Merchants Bank, China Construction Bank, and Citic Bank. According to ArtTactic, "these financial institutions will bring new capital and high-end buyers into [the] art market, which is likely to further accelerate the development of [the] Chinese collector base."

7.) New cultural relics and artwork auction standards will take effect in July of this year in China, which ArtTactic expects to standardize and improve the development of the Chinese auction industry.

8.) The vast majority of respondents feel the Chinese art market has stabilized#

, with only 10% expecting it to fall further.

9.) The overall perception of risk in the Chinese contemporary art arket has reduced nearly 20% since February of last year.

10.) Yang Fudong leads the Chinese art market confidence rating, and Ai Weiwei leads the Chinese art market longevity ratings.

11.) Domestic Chinese auction houses China Guardian and Hanhai reported a 70% increase in volume between 2008-2009.

12.) The strong growth in volumes among domestic Chinese auction houses "suggests a power shift away from Hong Kong towards the mainland,"#

and mainland auction houses have proven they have the ability to attract top quality consignments.

13.) The popularity of Zeng Fanzhi#

(previously on Jing Daily) continues, and Zeng "remains one of the few artists of the last boom to maintain his position at the top of the contemporary art market."