"The Process Of...Accepting A Culture Of Contemporary Art Has Also Been A Gradual One In China"#

A roundup of news from China's art market, from speculation on the next steps in its contemporary scene to auction house China Guardian's moves to take on Sotheby's in Hong Kong and the growing stature of Asia's collectors on the world stage.

What's Next For China's Contemporary Art Scene? (ArtDaily)#

Contemporary art advisor Michael Frahm weighs in this week on the future of the Chinese contemporary art market, noting that it's come a long way in a very short time, led more by domestic -- rather than the formerly dominant Western -- collectors:

The Chinese art market has come an incredibly long way in a relatively short space of time. We have witnessed the evolution of a global market created by Westerners to now a more inward facing, localised market largely driven by the major interest from Chinese buyers. But global and now also ‘local’ interest in the Chinese art market is still only in its infancy. As time goes on the quality of work will reach new levels, education in the region will improve and the impact of censorship will decline, driving prices higher and higher.

In years to come I predict we will look back at today’s market and realise that this was only the very beginning.

Before 2006, global awareness of Chinese contemporary art was somewhat limited. Despite China being included in the Venice Biennale for the first time in 1993 and exhibitions such as 'Magiciens de la Terra' at the Pompidou in Paris, which included Gu Dexin and Huang Yong Ping, taking place in 1989, the number of individuals aware of Chinese art remained very limited. At this point in time Chinese exhibitions were rarely at the top of the ‘not to be missed’ lists and a lack of knowledge and understanding in the region curtailed growth in the market and prevented it from operating at its optimum level.

...

The Chinese contemporary art market has achieved a great deal in a limited amount of time. In order to continue along this path of growth, the market must focus on enhancing awareness and understanding, embrace artistic freedom and treat quality as a priority. Only then will people stop questioning the sustainability of this market, which has only just begun.

Michael and Nicolai Frahm on the current state of art investment in China and elsewhere:

China Guardian To Take On Sotheby's, Christie's In Hong Kong (Artinfo)#

As major global auction players like Sotheby's, Christie's, Bonhams and others continue to invest heavily in Hong Kong to tap regional and Chinese demand for art, wine, jewelry and watches, Beijing-based China Guardian -- the fourth largest auction house in the world -- is poised to join the fray. As Artinfo notes this week:

[China Guardian] has made no secret of its international aspirations — just last year it opened an office on New York’s Park Avenue — but up until now its efforts have been directed to attracting international clients and consignments to their auction rooms in Beijing. The Hong Kong decision is a tacit admission that Beijing, despite its dynamism, is not proving to be a magnet for players beyond China. Doubts over the mainland market abound, with non-payment being just one issue among many, while Hong Kong’s credibility as a market hub has grown exponentially.

Its status as a free port, its transport, storage, and other facilities, and its transparent legal system are all plusses for the Harbor City

, which is now the third largest auction venue in the world after New York and London.

Guardian’s first foray on the Hong Kong scene is set for early October

when Sotheby’s Hong Kong traditionally holds its fall season. Both houses are strong in Chinese traditional modern painting, so a fascinating head-to-head contest looms in that quarter. Much interest will also focus on whether Guardian can offer serious competition in Chinese porcelain and works of art, where Sotheby’s and Christie’s have few rivals. The great private collections in these sectors remain outside China, and Guardian’s ability to tap them will be a measure of the success of their Hong Kong venture in the long run.

Though Sotheby's and Christie's are well entrenched in Hong Kong, don't discount the very well-capitalized China Guardian, which has proven itself increasingly capable of sourcing quality works by top Chinese artists (particularly in the traditional and modern art segments) and has a fast-growing global footprint.

Chinese Art Funds On A Risky Road To Maturity (The Art Newspaper)#

The Art Newspaper looks at the rise of art funds in the China market, a segment that has grown in popularity in recent years as Chinese investors have looked to diversify assets and get involved in the country's booming art market. Despite the potential of these funds, the newspaper notes that the industry has spawned new funds that range from legitimate to very much "buyer beware":

The strength of the Chinese art market, the world’s leading economy for art and antiques, has spawned a parallel boom in art funds and other art-investment vehicles worth more than Rmb5.77bn ($900m), according to the Chinese-language publication Eastmoney.

There are billions more held in art-related products offered by investment trusts and art exchanges that enable people to buy and sell shares in individual works. These have been embraced by Chinese buyers keen to broaden their portfolios at a time when traditional investments are performing poorly and are increasingly subject to government restrictions.

Experts caution that many of these vehicles are loosely regulated, that they lack a legal framework and that their managers have no experience of a down market—a pressing concern, given that the World Bank is forecasting the weakest growth in 12 years, and a slowdown in China’s economy could signal leaner times for the art trade. “Art investment in China is new, and it’s very much ‘make the rules up as you go along’,” says Bobby Mohseni, the Hong Kong-based director of the art advisers MFA Asia. “It lacks a lot in terms of clarity and compliance, and it’s hard to gauge whether the level of professionalism is there.”

...

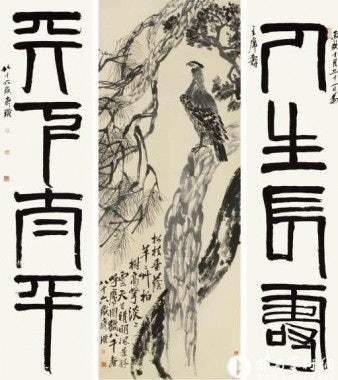

Funds are said to be active at auctions in China and Hong Kong, and are rumoured to be behind recent records including the sale of a work by the Chinese master Qi Baishi for $65m at China Guardian in May last year.