Key Takeaways#

:

- Consumer spending for COVID-19 health and medical, food, and home care may dilute spending on fashion, but it’s also an opportunity for brands to embrace this trend.

- Local brands are riding a wave of patriotism, which means it’s time for foreign brands to “do local for local.”

- Participation in livestreaming shopping for this year’s Singles’ Day on Nov. 11 is expected to be high. Younger Chinese consumers and those from lower-tier cities are more likely to buy through livestreaming.

For each traditional and man-made holiday, brands are eager to learn what consumers want, but most of the time they can only perform a post-mortem on what sold and by whom. AlixPartners, a global consulting firm, is hoping to add actionable insights into these questions and more with their latest consumer survey released on October 28.

“We want to provide brands and retailers some insights into what consumers want during this Double 11 event so that they can adjust their plans accordingly,” said Jason Ong, the company’s director in Shanghai, China. The global consultancy’s third edition of their Singles’ Day report, named “Eastern Promise,” was based on an online survey conducted between September 30 and October 6. It features just over 2,000 Chinese consumers aged 15 and above across all demographics and income levels, who intend to participate in the annual shopping extravaganza this year.

Below, Jing Daily handpicked four key findings that are relevant to China’s fashion and beauty sectors.

Consumers are more willing to spend, thanks to China’s recovery momentum and government encouragement.#

The percentage of consumers who intend to spend more this year (39 percent) compared to last year is more than double that who intend to spend less (15 percent), but what is behind the numbers might be more nuanced than one can imagine.

While pointing to the strong recovery momentum and the government’s dual circulation strategy, Ong said that the survey shows that “the virus is not far from consumers’ minds.” In tandem, the company expects some spending to be COVID-19-related — buying medical supplies, cleaning products, and food in case of a winter spike — and that consumers may take the opportunity to stock up as retailers and brands might discount heavily to shore up sales in an otherwise dismal global year.

Consumer spending for COVID-19 health and medical, food, and home care may dilute spending on fashion, but it’s also an opportunity for brands to embrace this trend.#

In 2020, 39 percent of survey respondents say that they intend to buy clothes, fashion, and accessories, which presents a sizable drop from 45 percent in 2019.

“I think this is a great opportunity for brands to embrace the health and wellness trend, of which sustainability, healthy eating, and exercise are key,” Ong said. He offered a host of ways with which brands can remain relevant: second-hand trade, the Consumer-to-Manufacturer (C2M) model championed by Alibaba and JD.com, personalized subscription services, the upstream exploration of recycled fabrics and utilizing 3D designs to ensure a better fit and less waste.

Local brands are riding a wave of patriotism, which means it’s time for foreign brands#

to “do local for local.”#

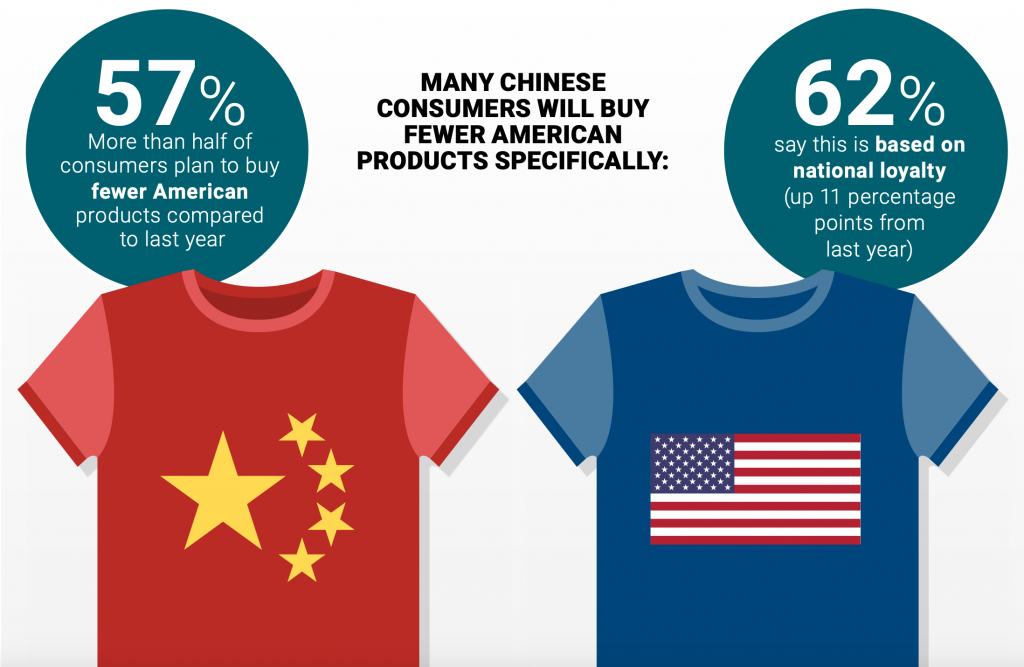

A few years ago, Chinese consumers might still see foreign brands as part of their social cache, but the tide has been shifting. This year’s survey also found a continued growing preference for local Chinese brands, with 66 percent of consumers saying they will prefer local brands over foreign ones for Double 11 this year, up from 61 percent last year. For which, “patriotism” was the most-cited reason.

Foreign brands, on the whole, are expected to have a drop in popularity from 30 percent last year to 28 percent this year, but this might be an opportunity for foreign brands to “do local for local,” said Michael McCool, a Managing Director & Greater China Lead for Consumer and Retail practice at AlixPartners.

Ong agreed, elaborating that “foreign brands need to market less of their ‘foreign-ness’ and focus on the value their products bring to local consumers. Fashion and beauty brands need to develop the right products for China, in China, and for the Chinese market.”

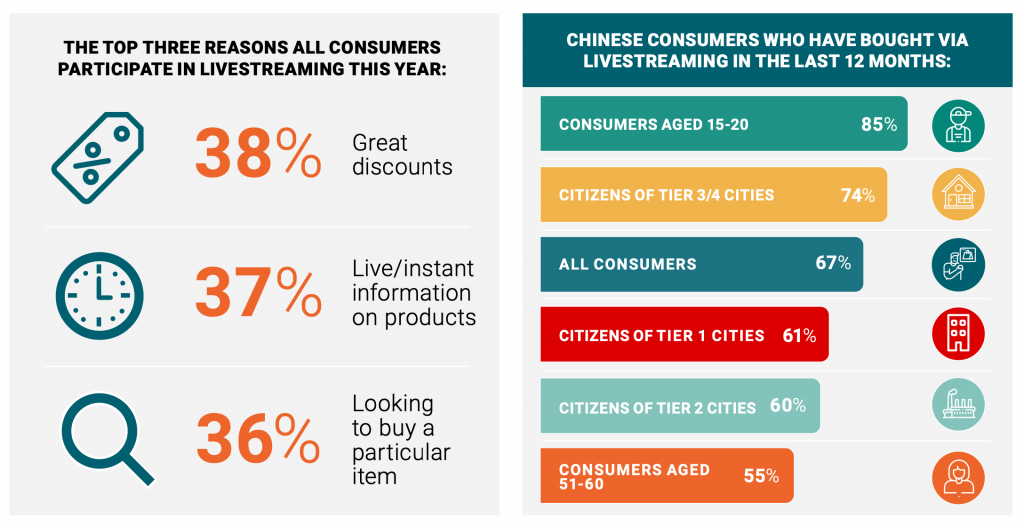

Participation in livestreaming shopping for this year’s Singles’ Day is expected to be high, as younger Chinese consumers and those from lower-tier cities are more likely to buy through livestreaming.#

Participation in livestreaming shopping for this year’s Singles’ Day is expected to be high — only 19 percent of respondents of the survey don’t plan to shop via livestreaming. Younger consumers and those living in tier-3 to -5 cities particularly would embrace the livestreaming commerce format, while 93 percent of participants born post-2000 are expected to make purchases via livestreaming, the report states.

Moreover, Chinese consumers’ livestreaming spending habits also have something to do with their income level. The highest income consumers (more than 420,000 yuan, around $62,500/year) would be spending the most through livestreaming, with 30 percent intending to buy between a quarter to all of their purchases this way.