The interior of the upscale Johnnie Walker House in Chengdu. (Courtesy Photo)

As the Chinese government continues to crack down on officials for hosting fancy banquets with top-shelf alcohol, international high-end wine and spirits companies have taken a major sales hit. Regardless, rising consumer demand for wine, spirits, and beer still means that China is an increasingly important growth market for alcoholic beverages, according to a new report on the global industry outlook for alcoholic beverages published by Dagong Europe Credit Rating.

“In 2014, the results of alcoholic beverage manufacturers have shown some vulnerability,” says Francesca Russo, Dagong’s director of the corporate analytical team, stating that “producers with higher exposure to premium and super-premium spirits” were “negatively influenced by the Chinese government’s campaign against exuberant spending and gift-giving."

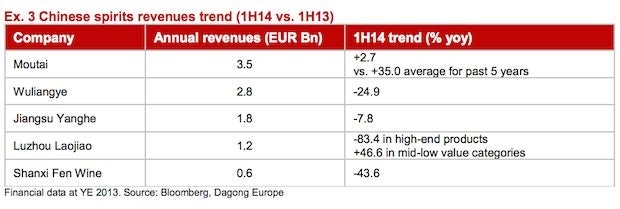

Asia currently takes up 28 percent of the total global alcoholic beverage market, says the report. China’s anti-corruption campaign caused the alcoholic beverage industry in Asia grow by 2.6 percent year-on-year in 2013, a rate lower than the previous 10-year average of 3.9 percent. The end of 2014 is predicted to remain “below historical levels,” and premium Chinese baijiu brands have fared especially poorly as a result of their heavy reliance on government banquets for business.

According to the report, the market slump won’t last for much longer, however—it expects medium-term growth (within the next two to three years) to stabilize. It states that the spirits segment is expected to “gradually recover” thanks to “diversification strategies”—namely, more offerings of mid-range spirits affordable to China’s growing middle and upper-middle class. In addition, it notes that European winemakers can expect to see high demand in China in the coming year while benefiting from free-trade agreements and favorable import duty regulations. China remains the fifth-largest wine market and top country for red wine consumption in the world.

Another alcoholic beverage that has especially benefited from middle-class demand is beer, according to the report. International beer companies can expect to see “high single-digit” growth for their 2014 results, according to the firm, which states that they’ve benefited from increasing Chinese demand for international beer brands as Chinese consumers look beyond Tsingtao.

“China is gaining in importance in the global alcoholic beverages market,” says Richard Miratsky, Dagong's corporate analytical team sector head, “and despite regulatory risks remaining high, large international manufacturers continue to enter strategic alliances with local manufacturers to take advantage of favorable demographic trends and diversify their revenue streams.”