There's a gold rush for men among brands in China. As the female market grows saturated, the luxury industry is looking to affluent men for growth, yet companies remain largely in the dark about the demographic's behaviors and preferences.

A 2017 report by Jing Daily and Carat helps better define the male Mass Affluent Class opportunity. They are referred as M.A.C. men, a group that includes men between the ages of 25 and 40 whose monthly household income ranges from 16,000 to 34,000 RMB (2,526-5,139). By 2020, they will account for 51 percent of China’s total male population.

Thanks to the rapid growth of wealth, M.A.C. men today have shifted their attitudes towards fashion and lifestyle significantly. They are confident, competitive, and desire to look good. Although they're unlike women, who are more sensitive to new trends, M.A.C. men have demonstrated a new willingness to experiment with style and colors, but may not know how to pursue that interest.

As fashion undergoes a digital revolution, e-commerce holds a strong appeal for M.A.C. men. Online channels allow them to access information and advice with relative ease and peace of mind, making shopping less of a chore. The report shows that men are typically more loyal shoppers than women. When they find something they like, they'll keep coming back.

Both online platforms and brands have recognized the great potential e-commerce holds for reaching male consumers. Notably, designer menswear site Mr Porter was launched in early 2011, and Gilt Groupe also launched a full-priced men’s retail site Park &Bond. Luxury brands Giorgio Armani, and Saks now have e-commerce operations focusing on the male market. But none has expanded aggressively in China.

As Chinese customers are already accustomed to shopping online, e-commerce sites that target M.A.C. males are growing rapidly, however, and local competition is heating up. Below are three approaches to how emerging players in this sector have evolved in China.

1. Content Sells Products#

In previous interviews with M.A.C. males in China, we found that they consume editorial content on e-commerce sites, namely Tmall and Taobao, for inspiration. Buy directly button on the site streamline the process. By starting their purchase journeys with editorial content, they feel they are able to make informed decisions.

A lot of e-commerce platforms now offer editorial content. Du Shaofei (杜绍斐), which started as a WeChat channel for wealthy men, has accumulated 20 million fans in just a few years. In its earlier phase, Du Shaofei's content focused on useful styling tips, but now it covers various lifestyle topics, from suits to dating and politics. It also brought on GQ writers as content consultants. As mentioned in the report, the way M.A.C. men display their wealth has shifted away from a blatant show of status to one of sophistication, intelligence, and influence, something deeper than fashion alone.

2. Efficiency Matters#

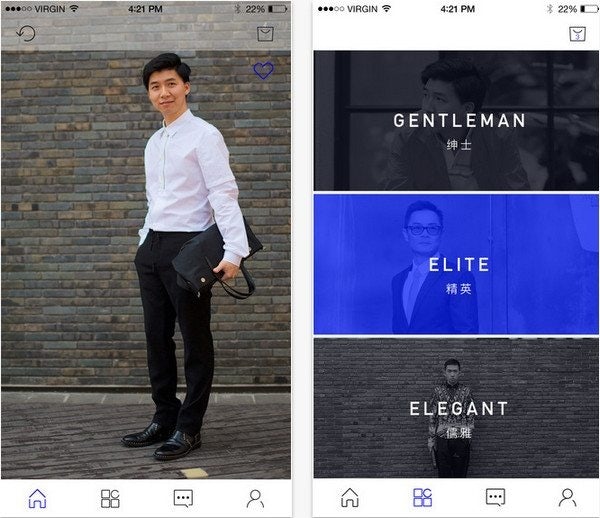

What’s the most efficient way to complete a purchase decision for a M.A.C. man? According to the high-end male fashion platform DIWUXI (第五系), it’s swiping left and right on pictures of clothing, Tinder-style.

“For a man, rather than giving him many clothing choices, it’s better to go through each style one by one. He will pass on some, and purchase those he likes,” said DIWUXI founder Jason. As the user keeps swiping, the system's algorithm generates a preliminary user portrait. And using the same sort of machine learning that powers Little Red Book, DIWUXI gradually starts to recommend products that better meet user preferences.

The platform focuses on urban elite men aged 25 to 45 whose monthly earning is above 25K RMB. Unlike most e-commerce platforms, which categorize by brand and pricing, DIWUXI organizes products in a way that immediately demonstrates their utility. Products are categorized by different everyday scenarios, such as work, weekends, outings, and so on.

DIWUXI mainly sells products from luxury brands and emerging independent designer brands — Armani exchange, Jil Sander, and Alexander McQueen, to name a few. They cooperate with brands such as Mercedes-Benz, LV × Supreme, and Jimmy Choo to host exclusive events, which fits M.A.C. males’ need to impress. According to the report, providing exclusive money-can’t-buy experiences for M.A.C males and their peers is another way of drawing them out.

3. Add a Personal Touch#

The boom in online shopping doesn’t make the personal touch any less important, especially to M.A.C. men. According to our previous interviewees, the quality of personal shopping assistance, which is common in high-end department stores, has a crucial impact on their interest in luxury brands.

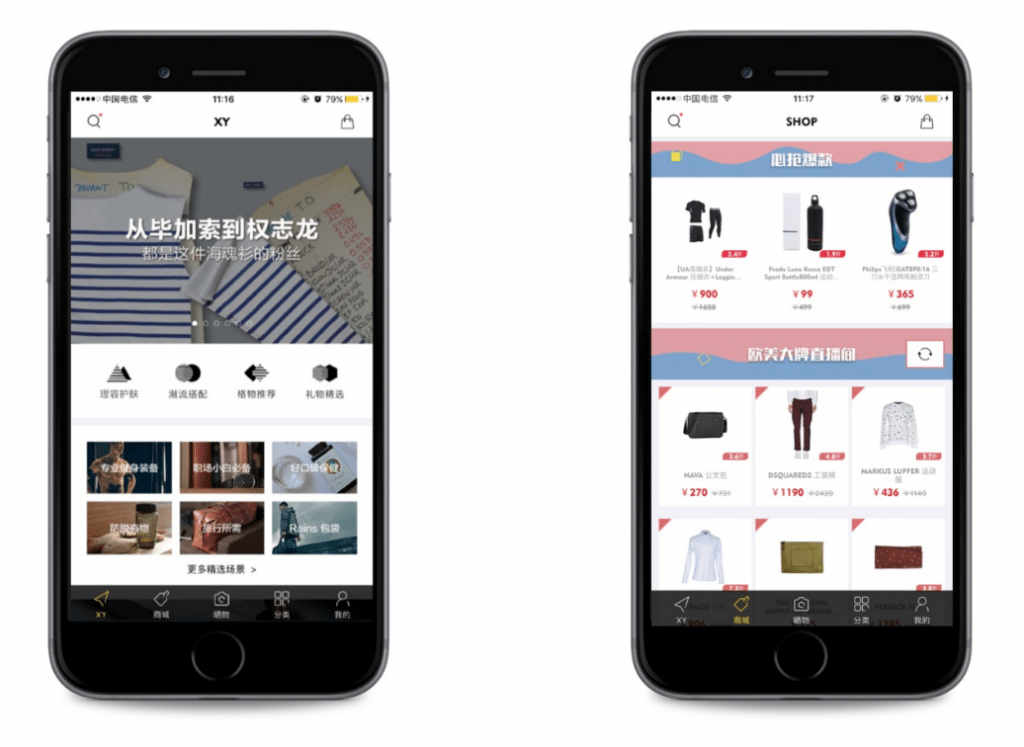

Founded in 2015, male lifestyle e-commerce platform XY Here is a good example of how a business attempts to provide a high level of service online.

XY has a professional fashion buyer and a team of stylist to provide advice on image management, trends, and searching for specific items. Its WeChat channel acts as a key interface with customers, where virtual stylists tailor their guidance to each individual's specific needs. In 2016, the platform announced a million dollar series A funding round led by Chenxing investment management group and IDG.