80% Of Wealthy Male Chinese Consumers Between 18-44 Years Of Age#

This May, Jing Daily translated an interesting Chinese-language article that outlined an emerging trend it called "he fashion" in major Chinese cities, exemplified by a growing number of relatively wealthy, younger men spending freely on everything from designer clothes to personal care items. According to that article, major luxury brands are making a mistake by more directly targeting female consumers in China, since men still account for the majority of luxury sales in China (PDF). Though, as we pointed out, 50% of luxury purchases last year in China were made with the intention of giving the items away as gifts.

This week, AsiaOne looks at the "he fashion" demographic, noting that the comparatively flashy sense of style being fostered among the younger fashion denizens in some of China's wealthier cities presents an opportunity for fashion houses that doesn't exist anywhere else in the world at the moment, save perhaps for Dubai or Moscow.

From the article:

A total of 80 percent of wealthy male Chinese consumers are aged between 18 and 44, have an annual household income of more than 250,000 yuan (S$51,075) , are well educated and are open to the acquisition of luxury products, said Kunal Sinha, Regional Cultural Insights Director, Ogilvy & Mather Asia Pacific, Shanghai.

"The male Chinese market is huge and it's an untapped wealth. The key driver here is not only that they want to look good and have the money to splurge but it's also to express their masculinity.

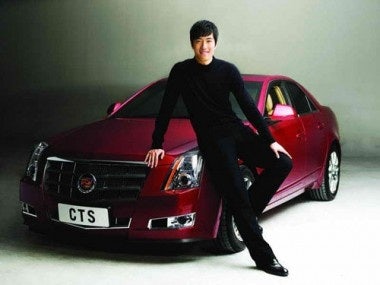

"It's an expression of confidence in society and to show their wealth. Take the power suit as an example." Indeed, a tailored suit gives the impression of power, importance and confidence to the wearer. Other manifestations of masculinity include buying big cars. An estimated 20 new models of SUVs are expected to be launched in China this year alone.

Demand for services and products outstrips supply in most cases. Spa de Feng, one of Beijing's few discreet spas for men, raked in good profits during its first month of operation after it was opened by owner Xu Feng four years ago.

"Previously, the proportion of my expat and local clientele stood at a 90 to 10 ratio. Today, it's a ratio of 40 to 60. It's a healthy evolution," said Xu.

The article goes on to (rather insightfully) discuss the promotion of an "alpha male" image in marketing efforts by some luxury brands, noting that the faces chosen by these brands to advertise their products tend to reflect in some way the Asian image of a successful alpha male.

Glorified images of the alpha male - men who have a high social position, are confident among the fairer sex, know what they want and go for it, and are sensitive to effeminate traits - appear in glossy advertisements embodied by the usual suspects of Asian male megastars such as Liu Xiang (the mainland's Olympic 110m gold medallist), Jincheng Wu (a Japanese-Taiwanese model and actor), Daniel Wu Yanzu (a Hong Kong-based American Chinese actor), Rain (a Korean pop singer) and Jay Chou Jielun (a Taiwanese singer).

Specifically Chinese issues such as the competitiveness unleashed by the country's rapid growth and societal change, the one-child policy, urban-rural divide and gender imbalance are highlighted as a source of opportunity for entrepreneurs who know where to look:

"The family-planning policy has created a culture of competition among Chinese men," said Sinha. "It's competitive at work, dating and marriage for them. When we look at the statistics, there are 33 million more Chinese men than women in the country and that is sitting at the back of their minds.

"Hence the expectation of men to have apartments, cars, and stable careers. Added to that is the mistress market - young women who are willing to be mistresses to older men who have money."

Sinha continued: "The Chinese are generally exposed to luxury goods. What we found in many cities was that people are cash rich but there is a shortage of products and retailers."

For entrepreneurs, this means good business.

The highest number of Humvee buyers is in Taiyuan, in North China's Shanxi province, the country's largest coal mining center. They are seen as a status symbol and sign of ruggedness.

Beer consumption in China is currently at a low level when compared with Japan, America or Europe. "As a result, there are lots of opportunities here," Sinha said. China's average per capital consumption of beer stood at 22 liters annually; Consumption in Japan is 51 liters and in the US 82 liters.

While much of this has been covered here and elsewhere, the article does make good points about how crucial it is for brands to put as much effort into their outreach -- especially digital -- for men as they do for women. While a more assertive, more independent female demographic is developing quickly -- and will probably be the defining force not only in the fashion and cosmetics segments but even wine, cars and technology -- for the next few years at least, the Chinese luxury industry is still "a man's world."