More than just an alternative to cards and cash, mobile payment methods are fast becoming a way of life for the Chinese.

While the Middle Kingdom might have been one of the first cultures to start using coins as a form of currency, it is now one of the most cashless societies in the world. Though only introduced a few years back, the uptake of mobile payment options in China has been staggering.

Figures from the Payment and Clearing Association of China show that the number of monetary transactions made through non-banking mobile apps increased from 3.777 billion to more than 97 billion from 2013 to 2016, with a compound annual growth rate of over 195%. This reality of an increasingly cashless society prompted Tencent Research Institute (the social-economic research branch of tech and multi-media conglomerate Tencent) to conduct a comprehensive study on this. Here are our five main takeaways:

1.One Phone To Rule Them All#

In most Western countries, credit and debit cards are the main platforms used for cashless transactions and mobile payment vendors the likes of Apple Pay and Android Pay struggle to make inroads. In China, however, mobile payments take the lead. At the end of December 2016, Tencent’s active mobile payment accounts and daily payment transactions both exceeded 600 million.

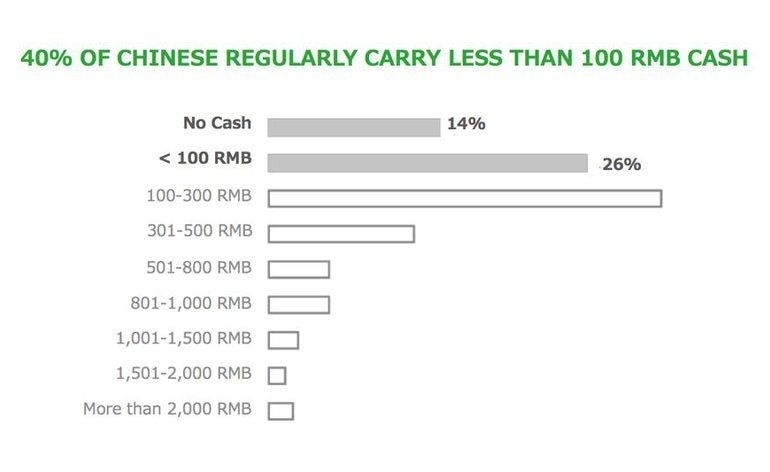

In fact, over 40% of Chinese carry less than 100RMB in cash around with them daily, relying on mobile payment methods for the bulk of their purchases. WeChat Pay, the mobile payment arm of China’s most popular social media platform WeChat (developed by Tencent), is the platform of choice.

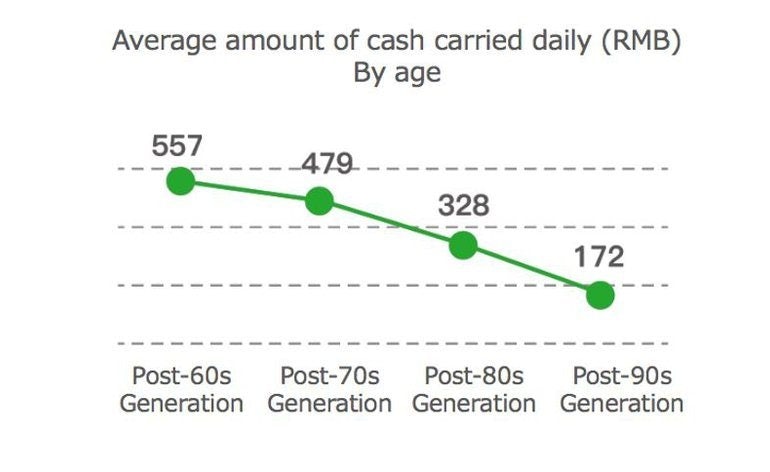

2.The Post-90s Generation Prefer Mobile Payment Methods#

Having grown up in the Internet age, it is perhaps unsurprising that this segment has embraced mobile payments the most. It is interesting, however, to note that the average amount of cash carried around on a daily basis decreases with the age of the respondent.

3.Cash Is No Longer King#

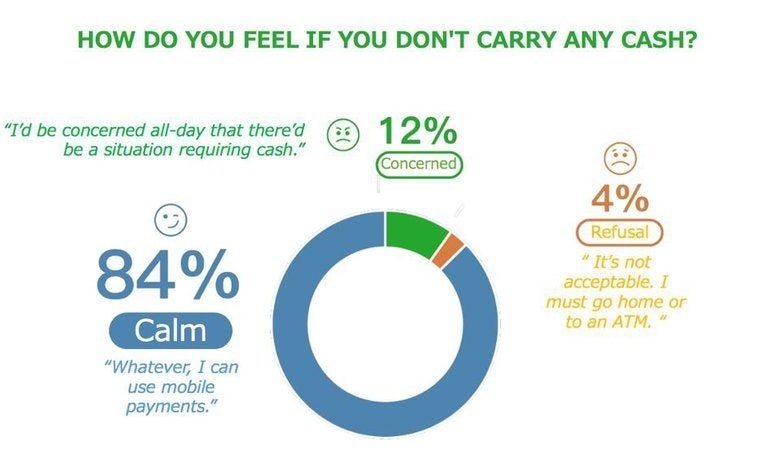

The study also revealed that 74% respondents felt they could survive on less than 100RMB in cash a week. Not only did they feel completely at ease going about their daily lives with little to no cash on hand, most of them cited mobile payments as the chosen alternative payment method.

Results also showed that 73% made use of cash for transactions only when necessary – that is, when cash is the only accepted form of payment at the establishment.

4.Mobile Payments Methods Are Highly Preferred In Brand Retail Stores#

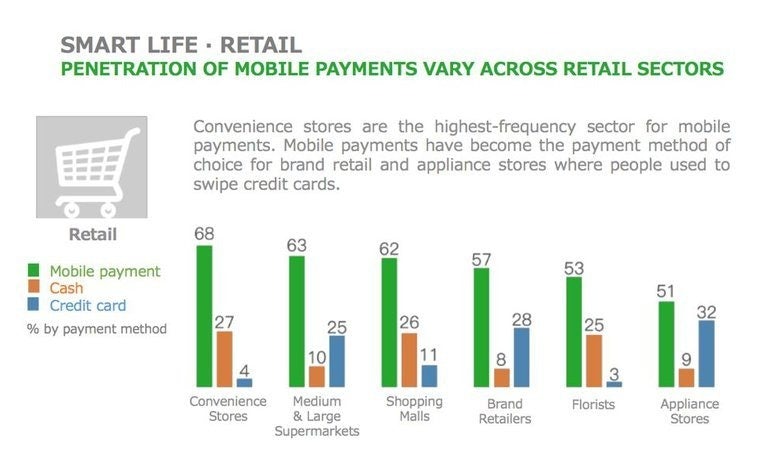

As part of its Smart Life Solution push back in 2014 to integrate online and offline marketplaces for its users, WeChat enabled mobile payments for everything from dining to shopping. Today, WeChat pay is accepted in millions of stores across China.

While mobile payments are clearly most popular in convenience stores, it should be noted that for brand retailers, where cash is the least popular mode of payment (with the assumption being that such purchases are of a much greater value), mobile payments are highly preferred.

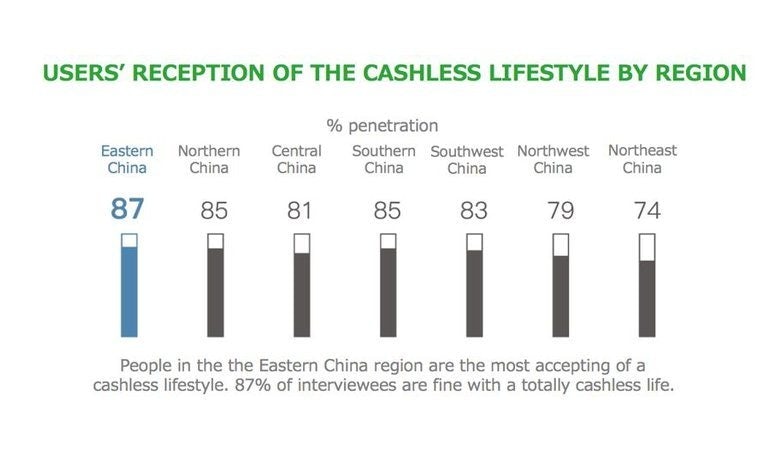

5.The Eastern Chinese Are Most Receptive To Cashless Living#

Comprising bustling metropolises like Shanghai, Hangzhou and Beijing, Eastern China is most receptive to the notion of living in a cashless world. Over 87% of individuals surveyed from the Eastern region was comfortable with living with digital money.

“Beside being a clear indicator that we are living in an increasingly digitised world, this sends a strong message to brands that offering mobile payment methods is the key to targeting Chinese consumers,” comments Elsie Zhang, the client services director of DLG China. She has helped several luxury brands in the definition of their digital and marketing strategies, as well as e-commerce.

“Brands, even luxury labels, should start addressing this in order to draw individuals in. They should also note that Chinese consumers travelling abroad will expect the same ease of use they enjoy at home, and develop their mobile payment infrastructures accordingly,” she adds.

*All data and images are courtesy of China Tech Insights, Tencent, Chongyang Institute for Financial Studies at Renmin University of China (RDCY) and Ipsos. The full report can be accessed by clicking this link.

A version of this article originally appeared in Luxury Society.