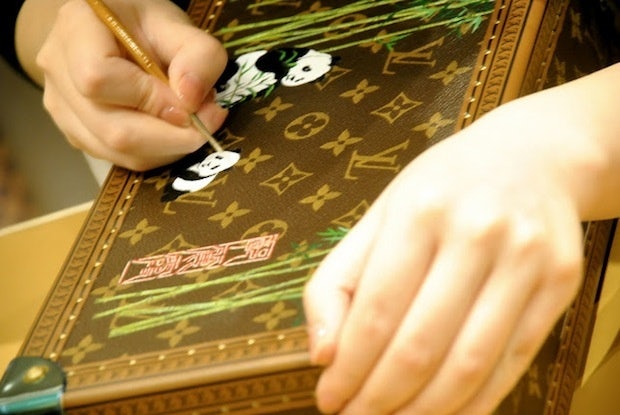

A scene from Louis Vuitton's Shanghai Maison opening in 2012. (The Clothes Whisperer)

“All happy families are alike; each unhappy family is unhappy in its own way” –Leo Tolstoy, Anna Karenina

What makes a luxury brand successful with Chinese consumers? What sends a luxury brand home from China with its gilded tail between its legs? Variations on these two questions are what I have been asked most often during my years helping luxury companies build their businesses and brands in China and with global Chinese consumers.

Ten or fifteen years ago, the answer was fairly straightforward. Be a mega-luxury brand from Europe with a long history and heritage; go to China early; capitalize on lack of competition and lack of consumer sophistication; invest heavily in people, infrastructure, and brand building; have the stomach to lose money for several years; break even; reinvest; expand; and then watch the profits grow.

This model still has some merit, but so much has changed in China and with Chinese consumers over the last ten years that it’s no longer enough to ensure success.

The truth is that the formula for success has gotten much more complicated: by e-commerce, diversification of luxury consumer demographics, fiercer competition, the cost of doing business, and a more global Chinese luxury consumer. Yet, what my clients and questioners all seem to sense is that the brands who do make it have one—or actually several—things in common, while the brands that don’t make it fail for unique reasons.

The topics and strategies that a luxury brand has to consider are legion. These include:

- Moving strategically into second- and third-tier cities

- Understanding if you are charging too much (or too little)

- Avoiding bad real estate deals

- Avoiding bad distribution deals

- Expanding too rapidly (or too slowly)

- Plotting and executing successful e-commerce plays

- Controlling your intellectual property (IP)

- Controlling your supply chain and distribution

- Ensuring product quality

- Hiring the right people from store floor to C-suite

- Understanding culture, language, and mindset

To break down how to ensure the right strategy and execution for all of the above would take up far too much space, and in practice, takes many months of strategic planning and execution.

Instead, I offer you the following: four common traits whereby “all happy luxury brands are alike” in China.

1. Patience#

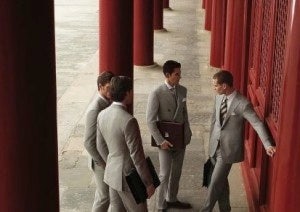

An Ermenegildo Zegna ad shot in Beijing.

Ermenegildo Zegna was the first luxury men’s brand to open a fully owned and operated menswear store in China (Beijing 1991). The company now has 70 stores and China is now the largest and most profitable market in the world for the company. But it wasn’t always that way. Zegna started small, endured slow sales, lost money, invested heavily in brand building and education, and most important of all in my opinion, expanded incrementally. It took 20 years to go from one store to 70. That is not the model all luxury brands need to follow, but the lesson is clear: learn the market, make mistakes, regroup, expand incrementally, and have the patience of a Zegna, and you are one-fourth of the way to success. With a solid foundation like Zegna’s, a luxury brand can weather the ups and downs of the Chinese luxury market.

2. Have a Great History, Compelling Story, and Authentic Heritage#

A great story can and often does start with a great visionary and founder—someone who sets the tone for a company’s quality and values for 100 years or more—think of Coco Chanel, Enzo Ferrari, Louis Comfort Tiffany, or Mario Prada. The great luxury story can also be associated with a city or region (Swiss watches, French wines, American cosmetics), or simply the story and history of a great product. Chinese luxury consumers place a premium on authenticity and history, and successful luxury brands in China have genuine and interesting histories and stories to tell in one of more of these categories.

3. Excellent Communication#

Having a noted founder, a great story, and a long history are meaningless if you cannot effectively communicate these assets to your audience and if you do not know which audiences you are communication with.

As I point out in all of my columns, China is not a monolithic single “market,” nor are Chinese luxury consumers a heterogeneous group of buyers reading, watching, and absorbing the same media.

Understanding the three main groups of luxury buyers in China and where and how to tell your story to them is the third thing successful luxury brands have in common. In article worth reading in its entirety for its breakdown on luxury branding in China, Labbrand breaks down these three main categories:

Chinese luxury consumers can be generally categorized into three groups. First is the nouveau riche (ultra-rich) group who acquired their wealth over the past decades. These consumers and their families are purchasing luxury goods within mainland China and are not sensitive to the dramatic price differences. A majority of this nouveau riche group reside in 1st to 3rd tier cities. Second is the gifting group; consumers in this group are generally buying luxury goods within mainland China for gifting (mainly for business or government-related purposes). They are not sensitive to price differences because costs will be covered by their corporations. The third group, and by far the biggest in population, is the Chinese middle class consumers who are brand-conscious. These consumers are price sensitive. They often work and reside in 1st or 2nd tier cities.

4. To Change or Not to Change? That is the Question#

Perhaps one of the most difficult balancing acts in branding and selling luxury goods in China is understanding when and if you should begin producing marketing, messaging, and products with a more distinctly Chinese look, feel, and focus, and when and if you should add lines or products in the accessible luxury categories.

Successful luxury brands in China have a good sense of whether they should stick to their guns and continue to put their exclusivity and traditional messaging front and center and to not alter their product lines for a Chinese demographic at all. Some good examples include Ferrari, BMW, Chateau Lafitte, Louis Vuitton, Rolex, Michael Kors, and again, Zegna.

Others have as good an instinct as to when to make these changes/additions.

Take Estée Lauder for example.

According to The New York Times, “China itself represents the company’s third-biggest market—after the United States and Britain—accounting for about $500 million in annual sales." Not content to rest on their laurels, Estée Lauder introduced a luxury line of cosmetics just for the Chinese market.

General Motors, which has successfully branded and sold Buick as a luxury brand in China, hopes for 10 percent market share of luxury cars in China by 2020. They plan on introducing “Chinafied” Cadillacs to overcome a tepid response to their current U.S.-styled Caddies.

According to Reuters,

With a refreshed version of the top-selling Cadillac SRX crossover and local production of the Cadillac XTS sedan this year, GM aims to triple Cadillac sales in China to 100,000 units within two years.

Cadillac's China sales jumped 74 percent year-on-year by volume in May, after nearly doubling during the previous month, making Cadillac the fastest-growing among GM's brands in the country.

The fourth thing that successful luxury brands in China practice is understanding when, what, where and how to change their products, messaging and audience.

Creating and sustaining a successful luxury brands in China is an art and a science that requires a brand to have a sense of its own and China’s history, culture, mindset, motivations, strengths and weaknesses.

Failure can take a thousand forms but the answer to “How to build a successful luxury brand in China” I believe lies in the four pillars of patience, a great story, great communications and a feel for when and when not to change.

Opinions expressed by columnists do not necessarily reflect the views of the Jing Daily editorial team.

Michael Zakkour#

is a principal at the global consulting firm

Tompkins International#

, where he heads the China retail, luxury, and fashion practice. He has more than fifteen years’ experience in international market strategy and implementation, primarily in China and Asia. He has assisted more than 250 multinational and SME companies in their assessment of opportunities in China and their resultant entry and growth strategies and implementation. Email: mzakkour@tompkinsinc.com; Twitter: @michaelzakkour