The Landmark, a luxury hotel in London. (The Landmark)

Luxury retailers and hoteliers across London have been waiting with intense anticipation for an expected influx in Chinese visitors to the UK—which is going to have some major impacts on the British tourism industry.

Although London has seen a major increase in Chinese visitors over the past year, it still lags far behind France thanks to a cumbersome visa policy—while France received about 1.4 million Chinese tourists in 2012, estimates suggest that London only received 270,000 in 2013. One main reason for France’s dramatic lead is the fact that a separate visa is required for visitors to Europe’s Schengen Zone to enter the UK. Since Chinese visitors to the European Union have 22 countries to choose from on the same visa, filling out an extra application for the UK doesn’t seem convenient or appealing.

However, since the UK announced that it would make it easier for Chinese visitors to attain visas, the annual number of Chinese visitors has been predicted to more than triple to 650,000 by 2020. According to a new report by global real estate firm Savills, this is going to have a major impact on UK hoteliers. Below are four main trends they can expect to see as Chinese traveler numbers pick up:

More Chinese Luxury Hotels#

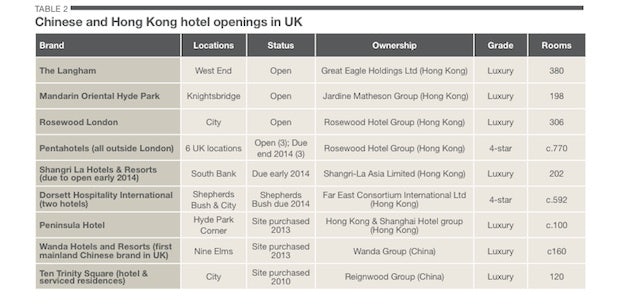

Following a trend that’s already in full force in Paris, London is set to see a major influx of Chinese branded hotels in the coming years. This will be the case not only for Asian-branded global companies like The Peninsula, Mandarin Oriental, and Shangri-La, but also mainland Chinese hotels just starting to embark on global expansion such as Wanda Hotels and Resorts. In the chart below, Savills lists the many Hong Kong and mainland hotels slated to open in the UK over the next several years—Wanda may be the first mainland luxury hotel to open in the UK, but it won't be the last.

Mid-Range Hotels To Win Big Off Luxury-Shopping Middle Class#

Chinese tourism to Europe and the UK is currently dominated by tour groups, and luxury shopping is usually a key part of these travelers’ budgets—taking up an average of 40 percent of all their travel expenses. As a result, these tourists “are more cost-conscious when it comes to accommodation,” meaning that “large budget hotels in city fringe locations” are set to benefit along with luxury retailers.

A Growing Number Of Independent Guests#

However, tour groups are being accompanied by growing numbers of independent Chinese tourists more likely to stay in hotels in core locations. Independent travelers including demographic groups such as “young affluents” (visitors in the age range of 18 to 30), “senior professionals” (aged 45 to 55), small friend groups, and families are all expected to travel more freely in the coming years. The report predicts that “international brands already established in mainland China such as IHG, Accor, and Starwood” have an advantage with these travelers due to existing familiarity with them in China.

More Chinese Hotel Acquisitions#

In addition to Chinese hotels moving into the UK, more Chinese companies are also expected to make acquisitions of Western luxury hotel brands. Over the last five years, Chinese investors have spent an estimated £1.6 billion on hotels outside their home market. Savills predicts this number to reach 10 percent of the total value of cross-border hotel acquisitions in the next three years, up from the current 4 percent it currently comprises.