Additional reporting by Ruonan Zheng#

The rapid expansion of China’s wealth in recent decades has given birth to the country’s mass affluent male class (M.A.C), which wields massive purchasing power and directly affects luxury brands. However, research focusing on uncovering this group’s tastes and habits of luxury consumption is scarce.

In Jing Daily’s February report in collaboration with the consulting firm Carat, we first studied this demographic to understand who they are, how they differ from previous generations, and what they look for in luxury purchases.

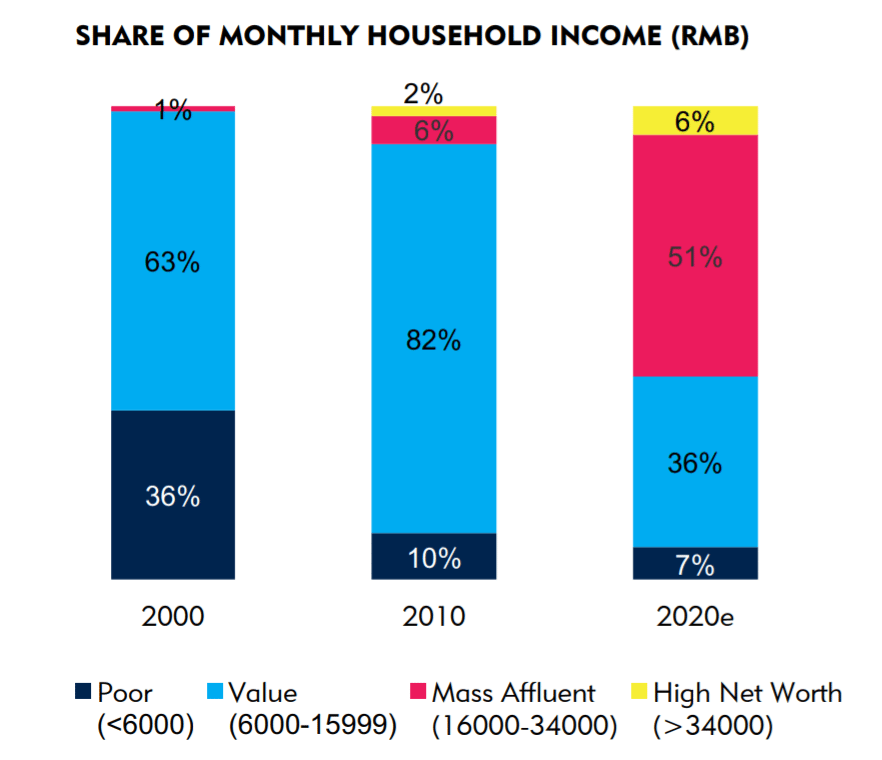

In the report, we defined M.A.C. males to be people between the age of 25 and 40 years old whose monthly household income ranges from 16,000 to 34,000 yuan (5,139). By 2020, the size of this class is expected to account for 51 percent of China’s total male population. Compared to the generations before, M.A.C males are much more educated and westernized. Their approach to luxury consumption has been refined and enhanced constantly through their daily interaction with luxury brands and retailers. Some traditional notions associated with luxury consumption, such as status and power, have been replaced by experience and self-expression.

To further expand our knowledge of this group, Jing Daily spoke to eight Chinese M.A.C males based in the United States and China to gain insight into their luxury shopping habits. We summarized three trends that we observed, which have a direct impact on luxury brands and retailers:

China’s M.A.C Males Look for Shopping Ideas from E-tailers’ Editorial Content#

Conventional wisdom holds that the decision-making process of male consumers is more straightforward and practical than that of female consumers. When the need to purchase a product arises, men like to meet it quickly without doing too much research to compare and contrast different options. However, our discussion with our interviewees paints a very different picture of China’s M.A.C males.

Two interviewees, aged 27 and 29, respectively, told us that they actively looked for shopping ideas online during their leisure time, and e-commerce websites, particularly Alibaba and Net-A-Porter, were major sources of inspiration.

One of our interviewees emphasized the importance of Taobao and Tmall in his daily fashion life. He disclosed that he subscribed to the editorial content produced by Alibaba and read it frequently. Editorial content, similar to what is shown above, advises consumers on what to wear and includes links to products that can help them achieve this "look." This not only informs consumers but then facilitates an immediate purchase.

“The editorial content produced by Alibaba is helpful on two levels. Sometimes I don’t know what I want to buy but have the desire to do it, I look to them and get fresh ideas that fit the current season or mood,” said Chris, 27, who works in the financial industry in Shanghai. “There is also the time when I want to buy a particular item, like a jacket. Their content can give me a list of brands that make jackets with price information so that I don’t need to check [it] out by myself.”

However, Chris said he did not necessarily purchase luxury products that he found on Taobao or Tmall from these two sites as he was aware of risk of buying counterfeits. He is likely to visit the brands’ official websites and order from there.

We also asked him if he followed any fashion bloggers and KOLs, who produced high-quality content that could inspire shopping ideas. He said no, as he felt following fashion bloggers was a girlish behavior.

“Taobao and Tmall are search engines for fashion and luxury items to me. They are the beginning of my shopping journey.”

Jing Daily’s interpretation:#

The habit to look for shopping ideas on e-tailers by M.A.C males reflects the advanced development of e-commerce culture in China. According to a report co-released by Alibaba and Boston Consulting Group in June, Chinese consumers view online shopping as an experience. Chinese consumers value the sense of discovery and exploration associated with online shopping, enhanced by their daily engagement with friends, celebrities, and cyber influencers. However, with the emphasis on e-tailers’ editorial content from our interview, luxury brands should expand their approach in enriching Chinese consumers’ shopping journey.

Chinese M.A.C Males Are Immune to Luxury Brands’ Ads on WeChat#

Nowadays, luxury brands are rapidly expanding their WeChat strategies, viewing it as one of the most important spaces for them to create meaningful conversations and engage with their audience. However, seven out of the eight Chinese M.A.C males who we interviewed said they did not subscribe to any luxury brands on WeChat and had no interested in seeing their new campaigns.

For them, luxury brands' WeChat posts are pure advertisements which are not worth spending time on to read. Smart and value-added content is what they look for.

“People don’t click on things that they don’t learn from. People like to learn new stuff .”

Jing Daily's interpretation:#

The content strategies of luxury brands on WeChat has long been under scrutiny. According to an early report by the digital intelligence firm L2, the role of WeChat as a content-producing platform has been lessened over the past year owing to readers' low interests in reading luxury brands' posts. WeChat has transformed into a multi-functional channel that luxury brands can use as a central hub to manage customer relations, commerce, online-to-offline, and more.

Chinese M.A.C Males Demand Personal Luxury Shopping Assistance#

Flourishing online shopping activities do not make the offline market less important, at least to China's M.A.C male consumers. According to three interviewees, the quality of personal shopping assistance, which is common in high-end department stores, has crucial affect upon their experience with luxury brands.

Marc, who is 26 and owns his own business in New York, told us that he liked personal shoppers in department stores, as they help him navigate stores and keep him updated about new items. As the relationship with personal shoppers gets deeper, he was also invited to attend several special events organized by brands, which made him feel respected and valued.

Another M.A.C male named Patrick echoed Marc's view and added that the relationship that personal shoppers build with him was also key in shaping his fashion taste and style. The longer the personal shoppers work with him, the more they are familiar with his needs.

“I like the feeling of being served.”

Jing Daily's interpretation:#

The demand for personal luxury shoppers once again shows that the sense of exclusivity that luxury brands are traditionally known for has not become irrelevant in the digital era. Some digital platforms like WeChat and Whatsapp can help extend the exclusive service provided by personal luxury shoppers even after clients leave the stores.