Emergence Of "New Chinese Collector" On Global Auction Scene Marked Beginning Of Trend To Watch In 2010#

2009 will, in coming years, likely be seen as a turning point for Chinese collectors, as they emerged as a formidable and contentious group on the world auction scene. This year has been marked by a marked shift in focus towards the East, as auction houses like Sotheby's and Christie's put extra emphasis on their Hong Kong auctions -- not only of contemporary art and antiques but also wine, watches and jewelry. As we wrote yesterday, wine in particular was a popular investment for Chinese collectors, both in Hong Kong and the mainland, and Chinese buyers took advantage of the post-global-financial-crisis adjustment of asset prices to snap up contemporary, modern, traditional and antique pieces -- regularly going well above and beyond high estimates for many.

As we saw in this autumn's auctions in Hong Kong, where frenzied bidding (often in Mandarin) set the tone, New Chinese Collectors are shaping up to be some of the most important, and most motivated, buyers in the world, and 2009 was definitely their year to emerge from behind the curtain.

As we wrote earlier this year, one of the interesting trends in 2009 was the sort of coagulation of prominent Chinese collectors of Chinese contemporary and revolutionary-era art into "groups," a development we noticed in a Chinese-language article about the first-ever symposium of Chinese collectors held at the Songzhuang Art Festival in October. In 2010, we can expect to see more meetings like this, where Chinese critics and collectors discuss art not only as an investment, but also as a form of "cultural creation" (as identified by influential Chinese critic Li Xianting):

What is so fascinating about this group [of New Chinese Collectors] is the way that mainland Chinese collectors have really developed organically, and come together out of collective interest in the subject to become more informed about what art is out there, how much it costs — and should cost — and which artists they should be buying for their personal collections.

This year, one of the most unusual [events held at the Songzhuang Festival] was the “First Annual Conference of Collectors of Chinese Contemporary Art” (首届中国当代艺术收藏家年), headed by art critic Li Xianting (栗宪庭). As the domestic audience becomes increasingly interested not only in museums and galleries but in specific types of art, and the middle class continues their (new) tradition of diversifying assets, it will become even more important for the domestic “New Collector” to understand the art and the market itself. At Songzhuang, the “all star cast” of attendees is a good indication that many in China are motivated to help their art market (and art audience) mature and develop rapidly.

What identified New Chinese Collectors in 2009, particularly in the second half of the year, was the fire apparently lit inside them to catch up with their Western counterparts, whom many Chinese critics and collectors feel have had a head start in collecting some of the best Chinese artists and artifacts for decades. Indeed, there has been a renewed focus in China to not only buy contemporary pieces by top Chinese artists like Zeng Fanzhi and Liu Ye (some of which were previously owned by important Western collectors like Charles Saatchi), but also to "repatriate" antiquities. This range of interests, and ostensible patriotism driving purchases, shows that a large number of Chinese buyers aren't getting into art collecting simply for investment reasons. We should expect to see this motivated buying continue in 2010.

As a Forbes article today points out, a trend that many observers expect to see emerge in the year ahead is even more buying by new collectors from emerging areas:

After a major contraction following the September 2008 market crash, art prices in most categories have found their level...This year, the art market will be driven by non-American buyers.

It isn't a stretch to project that Chinese New Collectors will make up a significant proportion of these "non-American buyers," along with Middle Eastern and Indian collectors. In short, 2009 has been a pivotal year for the New Chinese Collector. Although they're such a new group that buying habits remain somewhat scattershot, with some (like Wang Wei and Liu Yiqian) buying everything, from contemporary to "Red Classics" to jewels, and others focusing only on antiquities or homing in only on top Chinese contemporary artists or modern artists like Zao Wou-Ki (who was very popular this year with Chinese buyers), the Eastward shift in priority among auction houses has proven that these collectors are expected to be a source of sustainable growth (particularly as they mature and become more highly defined).

As we noted in October, Chinese New Collectors are a group to watch, as they both follow buying trends (e.g., beefing up contemporary collections with antiquities) while simultaneously setting new trends (e.g., buying every bottle of Bordeaux that heads their way, investing heavily in watches), particularly in the Asia market:

“

The Chinese are out in force

,” said Jerome Chen, 60, a Hong Kong-based collector…“

It’s hard to outbid them

.”

Low-key and unassuming, the Chinese buyers at yesterday’s auction sat mostly clustered in the back rows, watching their rivals and whispering into mobile phones between bids. China’s accelerating growth and a 50 percent gain in the benchmark Shanghai stock index from the same time last year have generated wealth and stirred buyer confidence.

Sotheby’s wouldn’t say how many buyers were Chinese, only that nearly all were Asians. Yesterday was the third day of Sotheby’s sale, which is expected to fetch a combined HK$780 million. The Chinese also dominated the weekend wine sale, paying a record $94,000 for a 6-liter bottle of Chateau Petrus 1982.

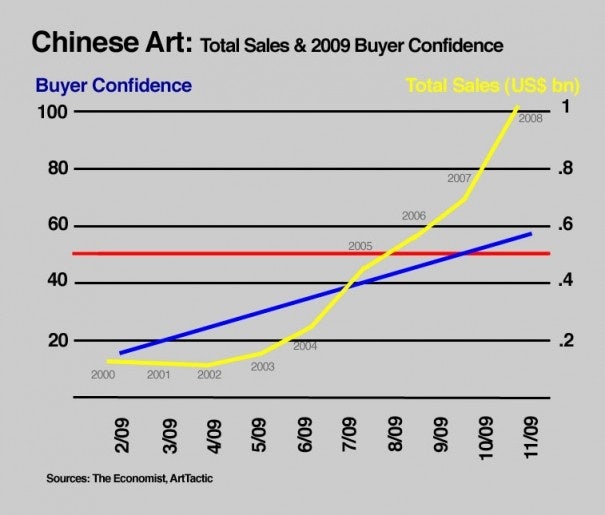

So what can we expect to see from the New Chinese Collector in 2010? As we wrote at the beginning of this month, prices of contemporary art should continue creeping upward, especially among artists popular with emerging collectors, such as Zeng Fanzhi, Yang Fudong, Ai Weiwei, and Xu Bing (as reflected in the confidence these artists have instilled in buyers over 2009, according to the recent ArtTactic survey). Depending on the speed at which "mega-collectors" like Wang Wei and others pop onto the scene, scarcity could become an issue among more prominent artists, and particularly among certain classes of antiquities (especially those from the Qianlong period, which have proven staggeringly popular in China):

As buyer confidence presumably continues to rise as more Mainland collectors appear on the scene, and as the resultant scarcity of works available by the top artists favored by Mainland collectors grows, we can expect that 2010 will see prices of contemporary art by China’s top artists to approach pre-crisis levels. As the ArtTactic survey notes, most respondents believe prices will fully recover within two years; if more New Collectors on the level of Liu Yiqian and Wang Wei burst on the scene looking to get their hands on every Zhang Xiaogang, Wang Guangyi or Yang Fudong piece they can, however, we might see even faster price shifts occurring.

Previously