10 Findings From Market Research Firm Huicong D&B#

Zhai Shuqing of Huicong Market Research

This week, the Chinese market research firm Huicong D&B (慧聪邓白氏研究) released its annual R.CHC (Chinese High-End Consumers) report on trends currently shaping the Chinese luxury market. Started in 2008 with a pilot research program in Beijing, Huicong's annual survey now covers ten cities throughout China (Beijing, Shanghai, Guangzhou, Xi'an, Chongqing, Chengdu, Dalian, Shenyang, Shenzhen, Hangzhou), with plans for further expansion.

At a media event held to mark the release of this year's survey, Huicong general manager Zhai Shuqing (翟树卿) presented a brief overview of her company's findings in a presentation entitled, "10 things you might not know about the China luxury market." While not all of these findings are groundbreaking, we find it a valuable snapshot of the industry as it stands in first- and second-tier cities. Via Huicong (translation by Jing Daily team):

1. The annual income of Chinese luxury consumers increased 11 percent over last year, outpacing CPI#

Consumers between the ages of 25-40 accounted for 75.6 percent of total high-end purchases last year, with a slightly higher ratio of male to female shoppers, and 73.4 percent of luxury consumers hold Bachelor's degrees. Respondents noted that their annual income increased on average 11 percent last year, surpassing the consumer price index (CPI) increase of 6.4 percent.

2. Luxury consumers are becoming more discriminating#

Luxury consumers in surveyed cities have moved on to a second phase of high-end consumption, in which their purchases are motivated by a desire to improve quality of life rather than simply show off. These consumers now have a better understanding of the value of luxury goods and more discriminating tastes. Seeing the added value of luxury goods, particularly during a time of economic uncertainty, they see the act of purchasing luxury goods as an act of "collecting," one that helps them express their identities and set themselves apart from the general public.

3. Jewelry and accessories, apparel, watches and leather goods are the most popular buys#

Expenditure on jewelry and accessories currently accounts for 20.5 percent of total luxury consumption in China, with watches and leather goods making up a similar (but slightly smaller) percentage.

4. Hong Kong is the most popular destination for mainland Chinese consumers to buy luxury goods#

As of this year, 51 percent of respondents chose Hong Kong as their preferred city for purchasing luxury goods, followed by major cities like Beijing, Shanghai and Guangzhou, as well as Japan, Europe and the US. As for Shenzhen-based respondents, almost all of their luxury purchases are now made in Hong Kong, which Huicong calls "a true shopping center for Shenzhenese."

5. Online shopping finally catching on, but lags behind demand#

The most popular online buy for respondents this year is luxury watches, with jewelry and accessories ranking second. One noticeable trend in the Chinese luxury market is that 67 percent of regular luxury consumers cite online shopping as their primary motive for Internet use, a massive shift that's only picked up steam over the past year. However, as Huicong points out, China's online shopping market is still young, and most of the high-end purchases made by respondents were small items.

6. Luxury consumers spending more rationally and managing money more wisely#

While respondents know how to spend money, they also know how to save and invest it. 32.8 percent of respondents invest a significant amount of their savings in stocks and funds. Huicong finds that gold is also becoming more popular among luxury consumers, accounting for around 20 percent of their total investments.

7. Word-of-mouth and opinion leaders have great influence#

Huicong finds that the top deciding factors that drive luxury consumption are brand (with 79.2 percent saying it's important), style (68.6 percent), and after-sales service (30 percent). Apart from quality, in terms of brand communication, respondents cite word-of-mouth as a validating factor. This, Huicong notes, is cultural, as "Chinese consumers have strong family values and like to do things as a group." Usually, the report adds, the leader of the family or group of friends serves as an "opinion leader," recommending what they like to the rest of the group.

Huicong points out five attributes common to opinion leaders: 1.) Enjoy trying new things; 2.) Share similar values and lifestyles with other members of the group; 3.) Very active in the group; 4.) Have strong personal charm and authority; 5.) Very knowledgeable about luxury brands.

8. Luxury consumers get majority of information from print media and Internet#

Respondents were broadly media-savvy, with 99.8 percent getting most of their brand information from print media and 99.6 percent getting it from the Internet. Huicong found in its research that fewer respondents relied upon radio or television for brand information. The importance of the Internet for brand awareness and high-end consumer education has increased over the past year, driven by the rising popularity of microblogging platforms like Sina Weibo.

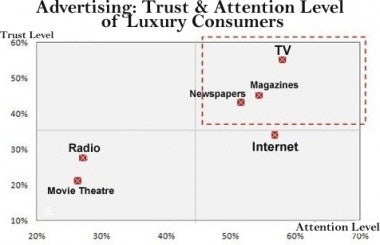

Data & Chart: Huicong Market Research (click for full-size)

9. Luxury consumers trust television commercials, print media and the Internet more than radio

The chart at left shows Huicong's findings about the trust and attention level of luxury consumers towards different advertising media. According to Huicong's research, Chinese luxury consumers trust television commercials and print media far more than radio or movie theatre marketing. While the Internet does not have the same trust or attention level as television, it is becoming increasingly important for consumers as well as advertisers.

Huicong cites the recent "Guo Meimei" scandal as an example of the Internet's attention-raising power. When the scandal broke, Chinese netizens targeted much of their ire on Guo's super-luxury Maserati car. Although the scandal had negative effects on the Red Cross Society of China, where Guo initially claimed to work, it raised Maserati's brand visibility in China to new highs. Still, respondents said they still find print media and television advertisements the most trustworthy sources of information.

10. Print media ranks first in terms of cosmetics information among luxury consumers#

The last finding of Huicong's study is that print media remains the top choice for promotional investment among cosmetic brands. According to the firm's survey, Estee Lauder, Dior, Opera (Shiseido subsidiary) and Chanel spent more than 300 million yuan (US$47 million) in 2010.

As always, it pays to take Huicong's findings with a grain of salt, as we have no sense of their research methodology or sample size. However, as Jing Daily has previously highlighted some of this survey's findings -- such as the growing demand for online shopping among luxury consumers (and inadequate supply of trustworthy retailers) and strong influence of print media in China -- it seems that Huicong's report shouldn't be dismissed out of hand. While not all of Zhai Shuqing's observations may be "things we don't know" about the Chinese luxury market, they're definitely worth keeping an eye on.