Distiller Looks To Nightclub Crowd As Luxury Crackdown Hits High-End Clientele#

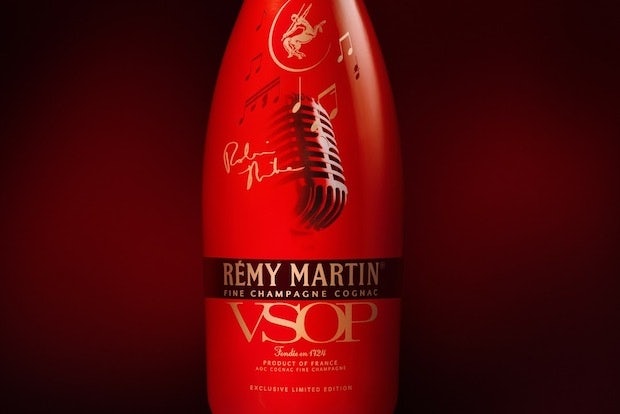

Rémy VSOP is being heavily marketed toward young Chinese clubgoers.

On Tuesday, a Financial Times report stated that French cognac distiller Rémy Cointreau joined its rivals Pernod and Diageo in announcing a prediction of reduced sales growth for the first part of 2013. While cognac makers have higher hopes for the second half of the year and beyond--China is, after all, still projected to be on its way toward becoming the world's largest cognac consumer--distillers of the French brandy hope that in the short term, younger consumers will lighten the current dip.

Although Rémy has reported a 40 percent rise in China sales growth for the fiscal year, it expects the first half of 2013 to slow, and then pick up again in the second half. Pernod Ricard, France's largest distiller and maker of Martell Cognac, also predicted a slowdown last month and said it expects "high single-digit" growth in China for the financial year. Diageo announced in April that its sales growth had slowed in the Asia-Pacific region to 4 percent in the nine months ending on March 31 from 10 percent of the earlier year.

Companies have attributed slower cognac growth to the government's crackdown on lavish luxury banquets and gifting of high-end bottles among older, wealthier consumers. Rémy's chief executive, Jean-Marie Laborde, told Financial Times that

"…there had been a sharp slowdown in Chinese demand over the past six months in restaurants and bars for its most prestigious cognacs, including Louis XIII, which retails from about $2,500 a bottle and is often consumed by high-ranking Chinese officials."

Other major cognac labels have been echoing this type of development. Pernod's chief financial officer Gilles Bogaert told investors in April that sales had been dampened by the crackdown, and Diageo's Asia-Pacific president Gilbert Ghostine stated on an investor call that because drink categories frequently gifted to Chinese officials are "baijiu and high-end cognac," they were more affected than scotch by the anti-extravagance campaign.

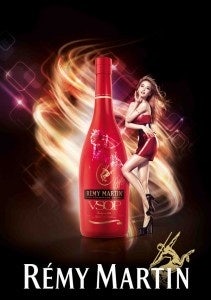

A Rémy VSOP ad featuring celebrity Jolin Tsai.

However, according to Laborde, demand from younger Chinese drinkers, who consume less expensive bottles, "remained robust." As a response, Rémy has continued its ongoing efforts to court a younger, trendier generation through a variety of marketing efforts. The brand has been targeting young consumers for a while now, with campaigns such as a limited edition very superior old pale (VSOP) bottle endorsed by Taiwanese pop star Jolin Tsai, nightclub events, and sponsored "Remy Dance" competitions. These ongoing efforts can be seen on the brand's VSOP Weibo account and Chinese website, which specifically promote VSOP as a choice drink for nights out at the club. These efforts at targeting younger drinkers have been part of the company's two-tier China marketing plan which tailors a dual set of strategies each aimed at different age groups. Both of these efforts can be seen on the company's main Chinese website, which features flashy VSOP campaigns alongside more toned-down ads showcasing the quality of the company's distilleries.

Other cognac distillers have taken note of younger consumers as well. “There seems to be some expectation for something else other than baijiu for the young generation," said Thierry Billot, Pernod's company's brands unit managing director. In February, president of Camus Cognac Group, the world's fifth-largest cognac house, stated that in China, his company has seen the emergence of a "younger consumer who will drink cognac also for status but in a different environment, more in the bars, nightclubs and sometimes as a cocktail or on the rocks."

Targeting youth certainly isn't the only course of action for cognac makers. Pernod has expressed interest in steering beer drinkers and female consumers toward its drinks, while Diageo is banking on rising demand for scotch, another import popular with young Chinese drinkers, to make up for lagging cognac growth. Meanwhile, Hennessy is active on the higher end in Hong Kong with the introduction of a special edition collection of its extra-old (XO) cognac that will be sold exclusively at Lane Crawford.