Xu Lei Joins Ranks Of Salvador Dali, Joan Miró, Georges Braque In Designing Mouton Rothschild Label#

A roundup of wine news coming out of the Greater China region this week, as the industry continues to reel from the recent $10 million Christie's wine auctions in Hong Kong:

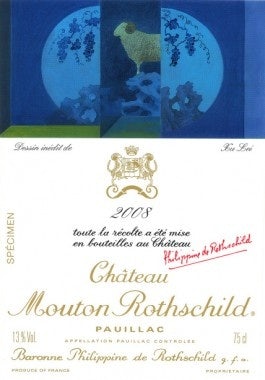

Xu Lei for Mouton Rothschild (Image: Decanter)

Beijing-Based Contemporary Artist Xu Lei Commissioned To Design Mouton Rothschild Label

As the Wall Street Journal reports today, Chinese artist Xu Lei is set to follow in the footsteps of artistic royalty like Salvador Dali and Joan Miró, as Xu has been named the latest artist commissioned to design a label for the top-flight Bordeaux wine producer Château Mouton Rothschild:

The winemaker has selected artists to design its label every year since 1945. For its 2008 vintage, Mr. Xu has drawn a ram, Mouton Rothschild’s emblem, perched on a rock, the winery revealed yesterday.

Mr. Xu is the second Chinese artist chosen by Mouton Rothschild — the 1996 label was designed by Gu Gan, who is best known for his calligraphic painting. This time around, the choice of Mr. Xu comes as the swelling ranks of wealthy Chinese wine buyers are imposing themselves on the global wine market. Hong Kong is now the largest wine auction center in the world by dollar sales, surpassing New York and London — and Mouton Rothschild’s move follows a similar recent announcement from one of its main Bordeaux-producing rivals.

The article goes on to revisit Chateau Lafite's recent announcement that bottles of its 2008 vintage would be imprinted with the Chinese character for "eight" -- an auspicious number in Chinese culture. Jing Daily recently covered Lafite's move, noting that the overt nature of the winemaker's nod to Chinese consumers (who are some of the most voracious buyers of Lafite, whether real or fake) was either a shrewd move or an uncharacteristic gimmick. From our article:

While this could be considered a gimmick, or another example of a European brand pandering to the Chinese market, the subtlety of the Chinese character, and the fact that Lafite doesn’t need to pander to the market – as its bottles are arguably the most coveted among Chinese wine drinkers, “gift” givers and collectors — make this move look far more sincere.

Apparently the demand for Mouton Rothschild's 2008 vintage -- even before the label by Xu Lei was confirmed -- is very much there, as futures for the wine (which will become available early next year) rose a stunning 34% between November 3 and November 15 on the fine wine exchange LivEx, according to the Journal. However, the obsession among a certain slice of China's wealthy with virtually any high-end wine from 2008 -- a highly significant year for China -- and specifically French Bordeaux means we'll never know how much of this demand boils down to Xu Lei's label. After all, it's not like Mouton Rothschild has been hurting for sales in the China market.

South African winemakers have increased exports to China in recent years, but Standard Bank thinks they need to do more to tap rising demand

Increase China Exports, Standard Bank Tells South African Winemakers

As Jing Daily recently pointed out, though France currently maintains its reputation among most Chinese wine enthusiasts as the preferred place of origin for high-end wines, Australian, Chilean, American, Canadian and South African producers are gradually chipping away at the Gallic giant's pedestal. Although rivals to the crown have been beset by China's uneven distribution infrastructure, low consumer education -- which often equates "not-French" with "cheap" -- and rampant counterfeiting, exports to China have grown steadily in recent years in tandem with demand from new demographics (emerging middle class, women, younger individuals).

Today, South Africa's Standard Bank Group issued a statement exhorting the country's winemakers to take greater advantage of the Chinese market, noting that China is on track to become the seventh largest consumer of wine by 2012. Currently, South Africa is the world's seventh-largest producer of wine and a major exporter, having shipped some 390 million liters of wine in 2009, 4 million liters of which were destined for China. As BusinessWeek writes today, however, South Africa's current focus on white wine may play against it in the red-wine-obsessed Chinese market:

South African wine producers aren’t planting enough new vines and those they are planting are mostly of the white grape variety, increasing risks to producers, [Willie Du Plessis, director of agricultural banking at Standard Bank] said.

Planting of vines decreased by more than 60 percent over the past 5 years, and of the vines being planted, 82 percent are white cultivars because of oversupply in the red wine market, Du Plessis said. This trend “increases the producer’s risk,” making it difficult to adapt to changing market demands.

By expanding into countries such as China, wine growers can “buffer against market shifts,” Du Plessis said.

Singapore is a popular destination for Chinese high-rollers, owing to Macau's more regulated environment (for government officials) (Image: Resorts World Sentosa)

Anticipating Demand From High-Rollers, Singapore Casino Spends $173,000 On A Single Case Of Burgundy

We already knew Singapore casino owners were going out of their way to entice Chinese high-rollers -- much to the chagrin of operators in Macau -- but this story is surprising nonetheless. This week, the owner of "a newly opened casino" in Singapore dropped $173,000 on a single case of "immaculate" vintage Burgundy. Purchased at a private sale, the case of Burgundy, which breaks down to a whopping $14,400 per bottle, eclipses the $67,000 spent on a case of 2009 vintage Bordeaux at a Hong Kong auction just four weeks ago.

As Gary Boom of wine merchants Bordeaux Index said this week, the skyrocketing prices for rare Burgundy is a direct result of demand outstripping supply. As Boom suggested, “One of the key factors with Burgundy is the scarcity of the product, and because of this, the market price is simply whatever someone’s willing to pay. There are literally only hundreds of cases of the best Burgundy produced every year compared to the tens of thousands of Bordeaux that come onto the market.”

So is the Singapore casino owner's (very expensive) move aimed towards guests from Hong Kong and mainland China? Considering guests from mainland China currently account for 14% of overseas tourists in Singapore, and Hong Kong adds another 3% -- making China the second-largest single market, after Indonesia (18%) -- and "the biggest [gamblers] in the region tend to be from China," according to Intercity Group CEO Ben Lee, it'd be surprising if these gamblers didn't factor at least somewhat in the purchase.