Top Chinese Sportswear Maker Set To Open First US Store Next Month; Will It Someday Compete With Nike And Adidas?#

Li Ning, the sportswear brand founded by one of China's most famous athletes, has set out to become one of the world's top five sports brands within the next decade. Although the brand's dream of joining the upper echelon of global sports brands may seem like a pipe dream to many observers, the rapid growth of Li Ning since 1990 has astonished others. Currently, the brand operates over 6,000 stores in mainland China, with plans to build 3,000 more within the next four years, and takes in nearly a billion dollars each year from their China operations alone.

As Li Ning's status as China's top sportswear brand has been cemented in the last few years -- with a particular boost in the aftermath of the Beijing Olympics, when Li Ning stock jumped more than 3% after the company's founder lit the Olympic torch -- the company has set its eyes on expanding into lucrative global markets, particularly the United States.

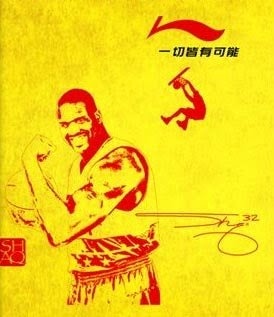

Li Ning's strategy for entering the US has, so far, been limited to sponsorship deals with a handful of NBA players, most notably Shaquille O'Neal, who Li Ning signed in 2006, though O'Neal only promotes the brand in the China market. Moving ahead, the company appears to be shifting its focus away from relying on the NBA and toward driving perceptions of Li Ning as a high-quality, global brand, able to compete with dominant brands like Adidas and Nike. A 2008 BusinessWeek profile of the company hinted at Li Ning's new international focus:

To compete with the big names either at home or abroad, Li Ning may need to decide what it wants to be. Today, it's difficult to say whether it's a trendy brand for urban teenagers or a bona fide performance shoemaker, and simply creating an image of global reach won't clear that up, says Tom Doctoroff, chief executive officer for China at ad agency JWT. While Nike may now be both, it established its name as a maker of serious athletic footwear before it was ever cool. "The challenge is to link to a brand idea that is the basis for enduring loyalty," Doctoroff says. Li Ning's "helter-skelter messaging is probably not an effective way of establishing that."

Over the past year-and-a-half, Li Ning appears to have taken this message to heart, trying to consolidate its brand image and taking a more direct, proactive approach to its global strategy. In Asia, Li Ning has opened outlets in Hong Kong and Singapore, and plans to open up to 100 badminton specialty stores in Southeast Asia before the end of next year. In China, the company has been working with the Portland, Oregon-based consultancy Ziba Design to remake and rebrand itself to tighen up its image domestically and eventually appeal to a global (e.g. American) audience.

As a recent Fast Company article suggests, Ziba's prior success helping design products like HP's first flat-panel PC monitor and Microsoft's first ergonomic keyboard -- and its obviously deep knowledge of the American market -- could help Li Ning avoid the same pitfalls that have caused other Chinese companies to wallow in obscurity outside their home country:

Everything from the company's product line and store interiors to its visual identity and even its logo are going under the knife. But Ziba is also helping Li Ning learn to think of itself as a global company, which is no small thing for an operation that's been almost exclusively focused on the domestic market. "Defining the problem is more important than solving the problem," says Ziba founder Sohrab Vossoughi. And for Li Ning, "The problem, and goal, was to create a world-class design competency."

...

Li Ning wanted to avoid repeating the mistakes of [other Chinese brands] by not expanding abroad too hastily. More important, before it could become a global player, it had to reclaim its home turf: In 2002, despite Li Ning's double-digit growth, both Nike and Adidas surpassed the company in Chinese market share. And they've been gaining since. "When that happened," says Zhang Zhiyong, Li Ning's youthful 41-year-old CEO, "we realized that revenue is not the most important thing for a company. It's product and brand innovation -- a design strategy, not just designs."

Although Li Ning's American makeover may not yet be complete, the company is set to open its first US retail location next month in Portland, although -- as a commenter helpfully points out -- this location and its focus will not be connected to the company's domestic rebranding strategy (which involved Ziba Design). Though the Portland store's stated aim is simply to "test the waters," if it's successful it might not be a stretch to project Li Ning could develop a respectable foothold in the American Northwest and perhaps into California -- where brand recognition and the company's Chinese heritage could appeal to crucial demographics -- within a few years.

How this could happen, and what products the company feels would appeal most to American consumers, remains to be seen. But according to a recent Reuters interview, Li Ning chief executive Zhang Zhiyong hinted that the company's American image would rely heavily on products and designs with an "oriental element":

[Li Ning], which makes basketball, badminton and rtable tennis-related sports gear, aims to accelerate growth and gain a stronger foothold in overseas markets by developing its own products and or through acquisitions.

"Both ways are possible. It will involve some risk if (we do it) by way of a merger or acquisition, but it will be much faster," Zhang said. "We see a lot of opportunities in the (sports) equipment market."

Zhang did not elaborate on what sort of sports equipment assets the company was looking to buy, but said sports fashion with an "oriental element" would be among the first batch of products it would test in the U.S. market under a "Tai Chi" theme, the name of a popular Chinese martial art.

* UPDATE#

: As a reader has kindly pointed out in the comment section, Tom Doctoroff’s comments in the BusinessWeek article may constitute a conflict of interest, as Doctoroff's agency handles advertising for Anta Sports -- one of Li Ning's primary domestic rivals in the China market.