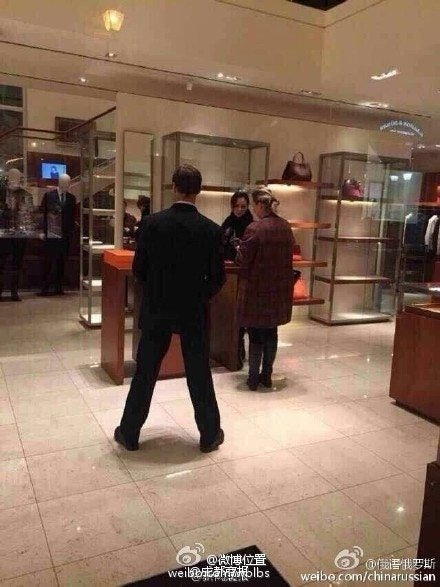

In a photo making the rounds on Weibo, a store window display stands empty at a Cartier store in Russia that was cleared out as Chinese daigou agents take advantage of cheap luxury prices.

Over the past week, Russia’s luxury boutiques have been flooded with shoppers who emptied store shelves of high-end handbags, watches, jewelry, and cosmetics. It wasn’t Russians buying Christmas gifts who were clearing the shops, however, but rather Chinese visitors taking advantage of the plunging ruble now that items such as Louis Vuitton handbags now cost just over half of their China prices.

While some of these Chinese shoppers are regular tourists on heavily discounted trips buying for themselves, family, or friends, many are on a special business mission: they’re daigou agents, or those who buy luxury items abroad, smuggle them into China to avoid tariffs, and then sell them for a much lower cost than they’re going for in mainland boutiques.

Translated roughly into “buying on behalf” in English, daigou is a popular “gray-market” way to purchase luxury items in China due to the fact that imported goods can sell for prices inflated by 30 to 80 percent thanks to tariffs and shipping costs. The practice may start winding down in China in 2015, however, as price-conscious Chinese shoppers become more international and are offered a variety of new ways to buy lower-priced goods.

While daigou generates massive short-term sales for luxury companies, many brands would rather do away with the practice due to the fact that their items are being distributed in mass quantities through unauthorized sellers, giving brands no control over the effects that this has on their image or post-sale service to the customer. Daigou is also often a matter of last resort for buyers as well, who would much rather have a relative or friend pick up items for them abroad than go through a sketchy third party—especially since authenticity is not always guaranteed when these transactions are made. As the number of Chinese travelers heading abroad rises dramatically, a growing number of consumers will have an alternative to daigou sales.

Luxury boutique shelves stand empty in Russia thanks to a plunging ruble and Chinese demand.

In addition, those who continue to shop in the country have a number of new opportunities for finding cheaper luxury goods at home. The opening of the world’s largest duty-free mall in Hainan this year now gives Chinese shoppers the option to buy cheaper goods within the mainland. Shanghai’s free trade zone may also create more opportunities in the coming year—American e-tailer Amazon has already set up a warehouse in the zone, allowing it to sell goods with lower shipping charges.

Middle-class Chinese consumers can also buy luxury goods at a discount through a growing number of platforms. Luxury outlet malls are quickly expanding in the country, as are many online platforms offering lower prices. For example, Chinese secondhand luxury e-tailer Secoo received a $100 million round of seed funding this year, marking the highest amount ever given to any Chinese luxury e-commerce site. The option for luxury goods rentals is also bursting on the scene as Rent the Runway-style site LuxTNT is expanding into Shanghai and Beijing. Flash sales sites such as Glamour Sales are also active in China.

The introduction of Alipay’s ePass in October opened Chinese customers up to a whole new set of international shopping options by allowing them to order directly from international sites. The Alibaba-run payment system takes care of logistics such as shipping and customs in China—common obstacles that originally prevented many companies from selling online in the Chinese market. While this option isn’t completely duty-free, Chinese consumers have the option to buy from a much wider selection of retailers than before, including discount and flash sales sites. Gap, Gilt, and Asos have already teamed up with Alipay for the program, while Bloomingdale’s, Macy’s Inc., Ann Inc., Saks Fifth Avenue, and Aéropostale Inc. access logistics service and marketing in China through global e-commerce platform and ePass partner Borderfree.

Despite all these factors working against daigou, the demand for these gray-market goods will remain as long as high tariffs exist and daigou agents have a platform on which to sell. It’s getting slightly harder for them to sell on their traditional favorites, Alibaba’s Taobao and Tmall. Although daigou and counterfeit goods sales are known for running rampant on the sites, Alibaba has vowed to crack down on the gray market with tough new policies as it works to improve its image abroad for its U.S. IPO. The company currently appears to be making the most effort to get rid of daigou goods for the few premium brands that have officially set up shop on Tmall, such as Burberry. Labels without Tmall shops have made other attempts to get Alibaba to step up its efforts—luxury conglomerate Kering filed a lawsuit against Alibaba this year to get gray-market goods taken down off its e-commerce sites. Although the two reached a settlement, it’s not hard to find gray-market items for brands such as Gucci on Taobao and Tmall.

Even if Alibaba is able to succeed in the challenging task of removing all gray-market goods from its site, sellers are already moving onto other platforms such as Weibo and WeChat to get in touch with customers. In fact, after the start of the Chinese shopping rush from Russia’s ruble slump, mentions of the term “Russian daigou” on Weibo surged to almost 10,000 this month. Chinese customs officials have also vowed to crack down on the practice, but the area has proven difficult to regulate.

More international shoppers, a greater variety of shopping options, and stricter policies to crack down on daigou will all help to chip away at the practice, but the only way it can completely “die” is if luxury prices in China come closer to those abroad on a widespread scale. Until then, currency fluctuations like the one in Russia will continue to see empty shelves thanks to luxury consumers' demand to beat the "China price."