This article was published earlier in our weekly newsletter. Sign up through our “Newsletter Sign Up” box on the right.

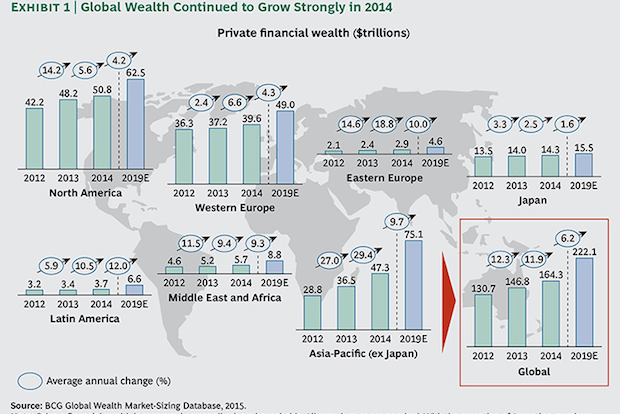

The growth of mainland China’s luxury market may be slowing, but potential Chinese luxury customers’ wealth certainly isn’t. This was the finding of Boston Consulting Group’s 2015 “Global Wealth Markets” study released this week, which found that China added one million new millionaires to its population last year.

In stark contrast to the fact that China’s luxury market growth slowed to negative 1 percent last year, according to Bain & Company, the number of Chinese millionaires skyrocketed from 3 million to 4 million, marking the world’s fastest growth rate and ranking second after the United States for the total number. China also ranks second in the world after the United States for ultra-high-net-worth individuals with a total of 1,037.

So why is the mainland luxury market slowing despite the influx of new wealth? In addition to the usual factors that are named—a shift in purchases abroad and the ongoing anti-corruption campaign—there’s also a growing “rationalization” of the market as China’s rich prioritize investment-oriented spending.

For example, the BCG study finds that the massive growth of private wealth in China was driven mainly by investments in local equities. China’s equity market saw 38 percent growth last year, according to the study, and wealth in the Asia-Pacific region excluding Japan saw its highest rise in wealth occur in private equities with a 48 percent growth rate (compared to 39 percent for bonds and 16 percent for cash deposits).

This emphasis on equities marks a shift for China’s wealthy, who have long been wary of China’s volatile stock market and put much of their wealth in hard assets such as real estate. Hard assets certainly aren’t dead, however—China’s rich are still on a global real estate buying spree, while they’re also spending growing amounts on art and collectibles at auction. In addition, investment in their children’s education is a spending priority—an elite foreign college education has long been considered the “ultimate luxury” for China’s rich.

This investment-oriented mindset doesn't mean that China’s wealthy won’t keep splurging on Chanel or Prada as well, but it does mean that they’re growing increasingly savvy and sophisticated as they focus on building their wealth in addition to showing it off.