Prices For Art Continue To Expand Worldwide, Pushing Chinese Art Upward#

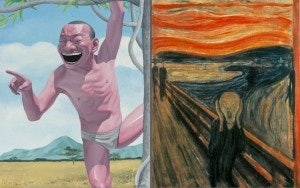

Last night in New York, following a prolonged battle between two phone bidders, Sotheby's set a new world record with the US$119.9 million sale of Edvard Munch's iconic work "The Scream." Packed with dozens of top-quality historical works, the Sotheby's Impressionist & Modern Art Evening Sale eventually totaled $330.6 million, a new auction house record for a sale of Impressionist and Modern art, and the second-highest total for any category at Sotheby's. According to David Norman, Co-Chairman of Sotheby’s Impressionist & Modern Art Department, “I have been at Sotheby’s for three decades, and the sale of The Scream in tonight’s auction is the most exciting moment I have experienced here. In 2004, Sotheby’s sold the first $100 million picture, and to shatter the world auction record again for such an iconic and rare work of art this evening was nothing less than historic.”

Though some speculated the 12-minute-long bidding phone bidding match for "The Scream" was finally won by a Chinese bidder, Jing Daily has previously noted that Chinese art collectors remain primarily (if not completely) fixated on Chinese art and antiques. The lower baseline interest in and experience with Western art, even classics like "The Scream" means the likelihood that Munch's work will soon have a new home in China is virtually nil. But this doesn't mean the record-setting sale won't have an effect on China or on the prices for Chinese art. In recent years, we've watched as prices for top works of Chinese traditional, modern and contemporary art have rebounded from the global financial crisis, sending artists like Zhang Daqian and Qi Baishi to the list of the world’s top five in terms of sales volume at auction last year. In recent years, Chinese buyers have essentially been “redrawing the maps,” with Artprice recently announcing that the volume of fine art sales at public auctions in mainland China accounted for 41 percent of the global market in 2011, making it — as Jing Daily wrote last month — the largest art market in the world.

So, if it wasn't a Chinese buyer who won the battle for "The Scream" at Sotheby's this week, what does its record-breaking sale have to do with China? It shows, as have other sales in mainland China and Hong Kong in recent years, that the boundaries of prices for artwork will continue to rise, driven by the bidding habits of motivated buyers and collectors. Over the past year in particular, we’ve watched as Chinese collectors and investors have sent prices for Chinese modernist painters through the roof, pushing domestic Chinese auction houses further up the global rankings — where two, Beijing Poly and China Guardian, now trail only Christie’s in Sotheby’s in sales turnover. In record time, both auction houses have dominated the Chinese contemporary and traditional art segments, with China Guardian taking in US$606 million at its autumn auctions in Beijing last November alone.

Aside from baseline prices for modernist Chinese painters like Zhang Daqian and Qi Baishi, Chinese buyers have pushed the boundaries of pricing in the contemporary art market as well, leading prices for the best works by top Chinese contemporary artists to pre-global economic crisis levels. As top Western contemporary artists like Warhol, Rothko, Still, Lichtenstein, Bacon and Basquiat all sit firmly in the US$5-50 million range at auction, as time goes by we should see auction prices for multi-million-dollar living contemporary Chinese artists like Zhang Xiaogang (whose works broke the $10 million mark in 2011), Zeng Fanzhi (who reached $9.7 million in 2008), and others continue to climb in tandem with the broader global auction market and gradually close the gap with their Western counterparts.

As we see from the $120 million price tag of "The Scream," the boundaries of how high a work of art can sell for are becoming arbitrary. If a work by Munch can sell for this much, there’s no reason Chinese buyers — itching to diversify away from cash holdings amid rising inflation and low interest rates and establish themselves as credible art collectors — won’t bid over $100 million for a piece of Chinese art.

In only a few short years, the particular motivations and highly pragmatic bidding habits of Chinese collectors have reshaped the market, with artists sometimes unknown outside of China selling for millions on a consistent basis. Last year, works by Huang Binhong (1865-1955) sold for a combined total of US$86.79 million, more than double his 2010 total of $41.8 million, the renowned artist Zao Wou-Ki nearly doubling his 2010 total with sales of $90 million, and works by Wu Guanzhong (1919-2010) making a whopping $212.62 million, over 2010 revenue of $72.77 million. Given the right motivation, for Chinese collectors, clearly the sky — rather than a pre-sale estimate — is the limit.