In case you missed them the first time around, here are some of Jing Daily’s top posts for the week of September 24-28:

New Collectors At Sotheby's: What To Watch At Upcoming Auctions#

On October 7, Sotheby’s will hold its Contemporary Asian Art auction in Hong Kong, a sale packed with dozens of works by the region’s top artists, among them increasingly hard-to-find lots by leading Chinese sculptors, photographers and painters. Despite the fact that many of the rarest and most historical works at the auction are expected to sell for millions of dollars, you don’t have to be a “super-collector” to take home blue-chip Chinese art. For new bidders just now looking to get involved in China’s art market and historical Chinese artists, or seasoned buyers looking to build up their collections with proven, affordable works of art that sell internationally, following up our list of “Top Lots to Watch,” here are Jing Daily’s “Top Lots for New Collectors.”

J. Crew's China Adventure Set To Kick Off In Hong Kong#

After months of planning and anticipation, American retailer J. Crew’s long-awaited Autumn/Winter 2012 expansion in partnership with Hong Kong’s Lane Crawford is finally set to launch. Appearing first at Lane Crawford Canton Road and online at lanecrawford.com on September 26, followed by Lane Crawford ifc mall on September 28, J.Crew will offer customers in Asia special access to curated women’s and men’s ready-to-wear collections, including shoes and accessories. This two-pronged on- and offline approach will give customers throughout Hong Kong and mainland China the ability to shop in-person at J. Crew outside of North America for the first time.

For Luxury Brands, Is Weibo Still Worth It?#

For luxury brands hoping to capture the hearts and minds of younger Chinese consumers, newer social media platforms like WeChat (weixin) might be the talk of the town at the moment, but for the last 18 months, three-year-old Sina Weibo (often, and mostly inaccurately, described as “China’s Twitter) has been the focus of most major brands’ online PR efforts in mainland China. Since Weibo burst onto the luxury scene, led by relative “early adopters” like Louis Vuitton and Burberry that launched official pages in early 2011, the most successful luxury brands adopting the platform have either gained a strong following via rich features (Bentley), giveaways and promotions, live-streaming events (Dior, Hugo Boss, Coach) or via a strong and compelling personality (Marc Jacobs, Diane von Furstenberg).

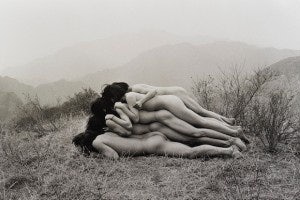

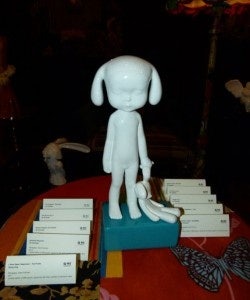

Interview: For Beijing Duo X + Q, Home Is Where The Art Is#

Prominent Chinese sculpture artist Qu Guangci, whose high-profile fans include Cartier, Elton John and Lane Crawford, came to London last week to showcase his latest business venture X + Q (稀奇). Over his career, Qu’s solo work has sold for jaw-dropping amounts at auction, yet for X + Q the artist has taken the brave step to work with his wife on a collective design project. Going against the ever-increasing prices for works of contemporary Chinese art, the stated aim of X + Q is to create handcrafted limited-edition pieces available to everyone — without the need to get a second mortgage on their house.

“Art should be a gift that people can share,” Qu says. “You don’t need an auction house to buy these pieces, just a home in which to display them.”

Estée Lauder’s Osiao May Send Chinese Shoppers Mixed Signals#

Streamlined to mainly focus on skincare, Osiao (which has been under wraps for four years) is specifically developed with the Chinese consumer in mind. Now the third largest regional market for the Estée Lauder group, having recently surpassed Japan, group chief executive Fabrizio Freda recently called China Estée Lauder’s “second home market.” After an 8 percent decrease in total compensation from 2011 to 2012 and a decrease in international air passenger traffic this summer — a damper on the 20 percent of operating earnings the group derives from duty-free shops — Osiao has the potential to buoy Estée Lauder’s fiscal year 2013 earnings.