When asked what gift they would consider for themselves or others, Chinese consumers chose travel at the highest rate out of all categories, followed by wine and spirits. (Ruder Finn)

As demand for luxury experiences continues to grow among China’s affluent, new survey results find that travel is now the top luxury category of choice for well-heeled consumers.

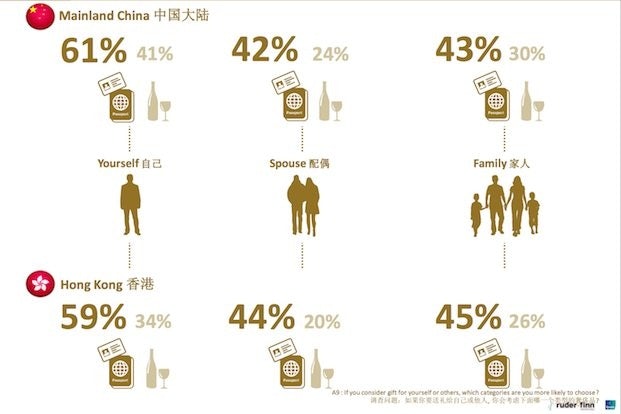

According to the findings of PR firm Ruder Finn’s annual China Luxury Forecast, consumers listed “travel” more than any other category when asked what type of luxury gift for themselves or others that they would be likely to choose. A total of 61 percent of mainland Chinese respondents said they would choose it for themselves, while 42 percent would choose travel for a spouse and 43 percent said they would for family. In addition, Chinese consumers are willing to spend more on travel in the coming year than on any other luxury category: 50 percent of mainlanders expect to be spending more, and 45 percent believe their spending will remain the same. The category was followed by wine & spirits, which was listed by 41 percent as a self-gift, 24 percent as a gift for a spouse, and 30 percent as a gift for family.

Conducted during the summer of 2014, the survey was answered by 1,933 Chinese consumers and covered a comprehensive list of questions on their luxury shopping habits. Respondents had an average household income of RMB774,876 (US$125,247) and hailed from 14 mainland cities and Hong Kong.

Although travel beat traditional luxury product categories, the report notes that luxury retailers should be optimistic about the results. Chinese consumers still love to shop when they head abroad: mainlanders’ number one preferred leisure travel activity is shopping for products with local characteristics, which is popular with 61 percent of consumers. They’re certainly making time for other shopping as well: shopping at luxury product destinations came in second at 54 percent, and shopping at luxury outlets was third at 47 percent. The survey results also indicated that Chinese consumers believe that luxury shops outside their home country offer better customer service and product selection.

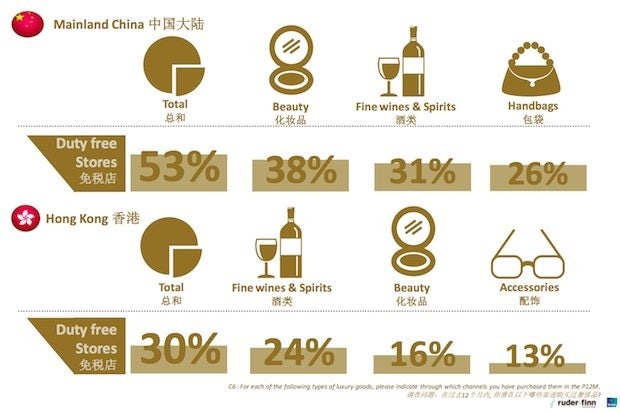

Chinese travelers also love shopping for luxury goods en route to avoid taxes. The survey found that duty-free shops commonly located in airports and major tourist locations are a leading distribution channel for luxury: 53 percent of mainland respondents shopped at a duty-free store in the past year.

Despite China’s ongoing luxury market slowdown, the survey finds that consumer confidence is generally unchanged across all luxury product categories, including watches, clothing, jewelry, shoes, handbags, accessories, beauty, cars, and wine and spirits. In all categories, the majority of mainland consumers expect to spend either the same or more on each of these types of items in the coming year.

Self-indulgence and gifts are both important reasons for Chinese luxury purchases, but shoppers are still buying slightly more for others than for themselves. The survey found that 48 percent of mainland luxury purchases are for oneself, while the additional 52 percent are gifts for spouses (22 percent), family (22 percent), friends (5 percent), and business partners (3 percent).

Online luxury shopping is expected to keep growing at a rapid pace as well. A total of 57 percent of mainland and 54 percent of Hong Kong respondents expressed more confidence in online retailers. Brick and mortar is still important: the majority said they prefer to see an item in a physical store before buying. Consumers are still wary about online shopping for luxury, with main concerns about lack for reliability (41 percent), getting an item in poor condition (37 percent), return hassles (31 percent), and an inability to see the physical product (31 percent).

Meanwhile, brick-and-mortar luxury retail shops in mainland China are offering lackluster service in the eyes of consumers. The survey found 36 percent of consumers said they’re dissatisfied with luxury retail service in mainland China, while only 19 percent said they are “very satisfied.” Their main complaints were of limited product selection, unknowledgeable staff, and too much emphasis on celebrities. Stores just across the border are doing a much better job of making them happy: 49 percent of mainlanders said they are “very satisfied” with luxury retail service in Hong Kong.

As a result of these shifting consumption patterns, the report notes that brands face several challenges and opportunities. According to the results, Chinese demand for luxury is still large, but expectations for unique experiences and top-tier service are high as well. With the majority of spending taking place abroad and duty-free on the rise, luxury labels need to take these trends into account and focus on maintaining brand loyalty for Chinese consumers on a global scale.