Luxury Brands Looking Into Innovative Branding And Marketing Techniques To Cement Customer Loyalty In Mainland#

As anyone who's recently been to one of China's newer luxury malls can attest, middle- and upper-middle class shoppers are constantly inundated with advertising, for everything from jewelry to fashion and on to luxury cars and condos. Despite the massive cost inherent in this blanket advertising, major luxury retailers must still contend with relatively low customer loyalty in Mainland China, as Chinese luxury buyers have quickly developed a reputation for mixing and matching conspicuous brands rather than sticking with one.

Perhaps to combat customer fickleness in China, several high-end brands have entered the digital realm, starting online-only advertising and marketing campaigns designed to directly target key audiences. This year alone, both Cartier and Coach began large-scale Chinese-language online campaigns, and now Tiffany & Co. has joined its rivals in launching a digital campaign to promote its Tiffany Keys collection in Mainland China. To localize this campaign for the China market, Tiffany has incorporated many of the online "characteristics" that appeal to young (primarily female) Chinese netizens: BBS, blogging, and social media.

As Media Asia notes, print to digital shifts (or at least increased digital marketing allocation) is rapidly becoming an important trend among major luxury brands in China, as they jockey for the largest share of China's fast-growing middle class luxury customer segment:

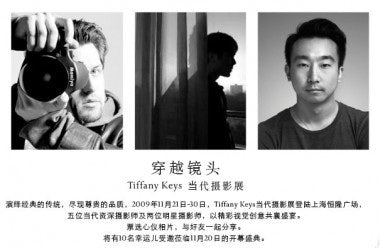

This week, Tiffany unveiled its ’Journey behind the door’ online campaign, developed by Proximity Live and BBDO, in conjunction with a photography exhibition featuring mainland celebrities. The digital site, at TiffanyKeysPhotos.com, features a sample of the photographers’ works and includes community features, encouraging audiences to share their interpretations of the theme 'Journey behind the door' via BBS posts and photographs.

Tiffany will reward the contributors who gain most views with an invitation to the exhibition’s opening next month in Shanghai and with Tiffany Keys products.

According to Jude Robert, managing partner of Proximity Live, the campaign launched to create a more “holistic approach” to reaching audiences. “Having the Tiffany brand and product seamlessly integrated with a creative campaign without it being deemed ‘commercial’ was a challenge, but that was clearly delivered and the consumers share of voice on social media simply echoes that,” he added.

As more brands look to the digital space to target specific potential buyers in China, it would make sense that exclusive marketing and branding initiatives, carried out through social media, microblogging and BBS could become the rule, rather than the exception. Instead of diluting a brand's equity in the Chinese market, large-scale online campaigns would probably create brand equity and loyalty in China among a younger group of potential buyers.

Since the wealthiest percentile of potential buyers (who are typically middle aged, anyway) tends to prefer buying their luxury goods on overseas excursions or short jaunts to Hong Kong, homing in on a younger crowd will probably pay dividends for luxury brands looking to cement their position and build their market share in China. As the Media Asia piece concludes, online marketing is likely the future of luxury outreach, not only in China but elsewhere:

“For luxury specifically, a lot of this focus reflects the general shift of people to using online on a daily basis, and that means affluent individuals who incorporate online activities at home and in the office,” said Eugene Chew, general manager of Agency.com. “This is combined with less being spent on print and money being shifted to an online environment. For luxury, even mature, traditional print publishers like Vogue and Elle invest more in their online side. Conde Nast has a business unit called Conde Net responsible for taking a lot of print work and moving it online.”