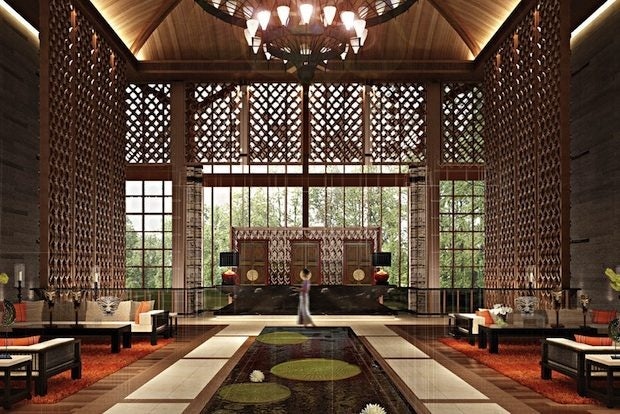

The new Anantara Emei Resort & Spa in Sichuan. (Anantara)

From the Maldives to Hawaii, resort vacation locales across the world are working hard to attract a gigantic and growing number of Chinese tourists. In the next several years, however, they’re going to be facing a lot more domestic competition as the country’s resort construction market takes off on the beach and beyond.

The leisure landscape in China is set to change dramatically over the next decade with a host of major new resorts aimed at the country’s growing upper-middle class. China’s domestic travelers will have an enormous range of options for inclusive vacations with resorts centered around virtually all of the main leisure themes that can be found in other countries, including beaches, skiing, family entertainment, or natural scenery.

Demand for leisure activities is rising on all fronts in China as incomes rapidly grow. According to an estimate by McKinsey, China’s upper-middle class will expand from 14 percent to 54 percent of total urban households by 2022, and these newly affluent are increasingly spending their money on travel and entertainment. In 2011 and 2012, the Chinese government created a series of policies to promote the expanding domestic leisure industry. Domestic tourism spending is projected to reach 6.3 trillion yuan (US$984 billion) by 2016, according to the World Travel and Tourism Council. The increasing Chinese demand for leisure is being seen on many industry fronts, including film, entertainment, cruises, and gambling.

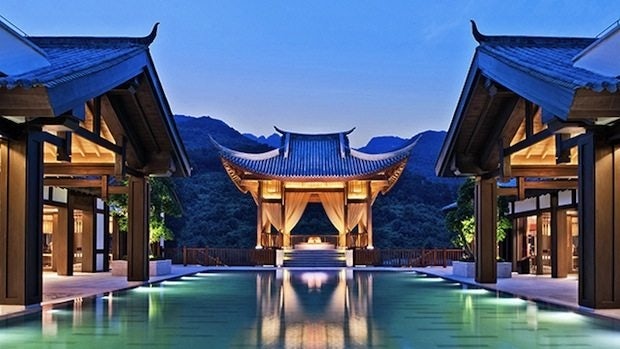

A rendering of Kerzner's One&Only resort in Sanya, Hainan which just began construction this month. (One&Only)

The massive number of leisure resorts popping up all over the mainland is one of the most distinguished examples of this trend. With lush beaches and major development efforts by the Chinese government, the tropical island locale Hainan has long been at the vanguard of China’s resort boom. Ever since Hainan was designated a special economic zone by the Chinese government in 1988 to promote tourism, global hospitality giants have been lining its beaches with resorts en masse—Shangri-La, Sheraton, St. Regis, Ritz-Carlton, and Mandarin Oriental are just a few of the big international names that have set up shop there. New resorts by global companies are still rushing in. This year, Kerzner International's One&Only just began construction in Sanya, and Westin has a Hainan resort opening in June, which will be followed by six additional Starwood resort properties in the next six years.

However, Hainan is only the start for many of these companies, which are building resorts near China’s major cities and in the country’s many natural scenic areas. Caesers Entertainment Group has been at work in Hainan on its first non-gambling resort in Asia, which is only the jumping-off point for an additional 25 similar projects throughout the country in the next five years. Thai resort company Anantara also got its start in China with a Hainan resort, and last week opened its third luxury resort in China in the foothills of the sacred Buddhist Emei Mountain in Sichuan.

Anantara’s Sichuan resort points to a boom in the number of nature-focused resorts being constructed far beyond China’s beaches. Residents of China’s smog-choked cities looking for an escape are gaining a growing range of domestic nature resort getaway options, with an especially heavy concentration in Yunnan. Other recently opened resorts include Club Med in Guilin, the Sheraton Huzhou Hot Springs Resort, and Banyan Tree’s Chongqing Beibei Hot Springs Resort.

The Banyan Tree Chongqing Beibei Hot Springs Resort. (Banyan Tree)

In the next few years, visitors will be able to head to notable new resort locations like a massive InterContinental resort being built in an abandoned quarry, a Dusit hot springs resort in Guangzhou, or 13 different Starwood resorts across many different provinces, including Sichuan, Yunnan, and Zhejiang—just to name a few.

Entertainment and sporting activities are also a growing feature of resorts as China’s middle class searches for family-friendly options. Currently, Disney and DreamWorks are both setting up massive amusement park resorts outside Shanghai, with Chinese competitor Dalian Wanda developing a theme park resort in Anhui to compete with them.

Many ski resorts are also being constructed in hopes of attracting China’s growing number of fans of winter sports. Western brands have been moving in to compete with Chinese company-owned ski resorts, such as Yabuli Sun Mountain near Harbin. French resort company Club Med, which was acquired by Chinese company Fosun, has a ski resort in Heilongjiang, while Westin and Sheraton created a “dual-branded” ski resort for Changbaishan. Some are opting for a combined ski resort and water park experience, such as the Dawang Mountain Resort under construction in Hunan and the massive “castle”-style Dusit Thani Castle Fushun planned for Liaoning.

Whether China's travelers will opt for sun, skiing, or hot springs, the world's top resort companies are making major long-term investments in China's growing middle class—and their growing need to take a vacation.