Corporate entertainment has gone way down since the government's corruption crackdown kicked in, and a new report now has tangible evidence linking the two.

According to a China-based market research firm's new report on Chinese corporate entertainment, a substantial number of corporations have admitted that the government’s anti-extravagance policies have directly contributed to a significant drop in corporate spending on “entertainment”—or, in other words, fancy banquets where Chinese businessmen and officials gather to gorge on delicacies such as shark fin soup and down inhumanly massive amounts of alcohol.

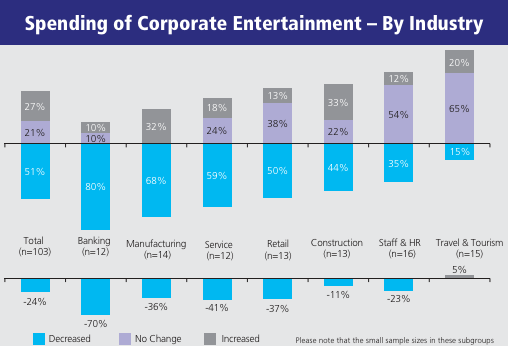

Shanghai-based market research company Data Driven Marketing Asia (DDMA) came to this conclusion after surveying 100 medium to large Chinese companies. While the report didn’t reveal the names of the companies or whether or not they were state-owned enterprises, their frequency of and spending on corporate entertainment has certainly taken a dive. According to the report, 46 percent of Chinese companies have reduced the frequency of corporate entertainment, and 51 percent have reduced the amount spent on it.

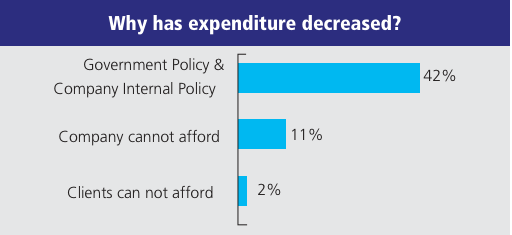

Moreover, in some of the most tangible evidence of causation rather than simply correlation between the government’s crackdown on luxury spending and the loss of revenue that's been hitting high-end banquet-related industries, 42 percent of the companies surveyed admitted that this sharp decline in expenditures was a direct result of the new government policies. The economic slowdown is also affecting these expenditures, but to a much lower extent—only 11 percent of those surveyed said that cuts were due to budget issues. Unsurprisingly, in addition to taking out clients, “entertainment of local, regional and central government officials has been reduced the most,” says the report.

In another equally unsurprising finding, the greatest specific spending cuts have been to alcohol, and baijiu has been hardest hit. One fourth of the Chinese companies surveyed said they are spending less money on super premium baijiu. Interestingly enough, wine and international spirits fared much better: companies only made a four percent cut to their expenditures on premium wine and a one percent reduction on other spirits.

So, why are wine and other spirits faring so much better? The reason is open to speculation—one issue could just be the fact that baijiu made up a vast majority of companies' alcohol purchases in the first place, while another explanation could be the fact that baijiu tends to be the drink of choice for older bureaucrats, who, as the report stated, are the ones steering clear of being wined and dined at the moment.

Since the report finds that “70 percent of all baijiu profits are generated from corporate entertainment and gifting,” it’s no surprise that baijiu companies are eagerly pursuing overseas markets to make up for losses at home. Diageo, which is one of the clients of DDMA, is certain to continue these efforts after its announcement yesterday of its full acquisition of 600-year-old baijiubrand Shui Jing Fang.