As the luxury retail industry in China goes up against a slowing economy and another year of the anti-graft campaign, Greater China's department stores and shopping malls are continuing to feel the effects of a consumer base increasingly reliant on e-commerce, according to a new CBRE report. The developers and landlords that have made it this far are finding they need to shift their strategy to keep their stores open and tenants happy. Meanwhile, all across the mainland, new shopping malls are being built. And that supply keeps rising.

For example, commercial real estate giant Dalian Wanda recently announced it will continue to push forward with mall expansion this year, even in third- and fourth-tier cities where the developer is halting new construction of offices and residences. The company plans to have nine times as many malls as it does now in the next 10 years, with a likely focus on tourist destinations and theme parks.

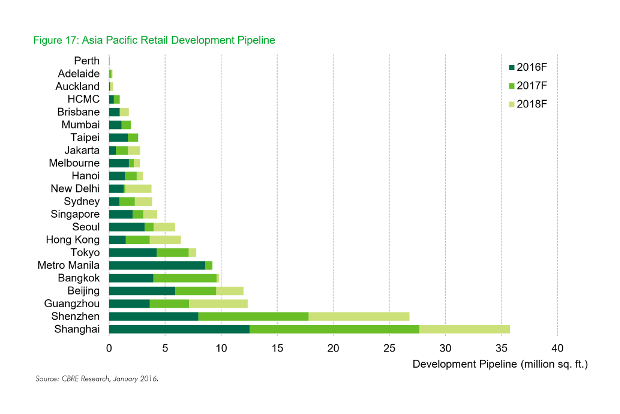

However, across the mainland, most of shopping mall supply growth is targeted in suburban areas in first and second-tier cities and in Shanghai and Shenzhen's urban sprawls, according to CBRE's Asia Pacific Real Estate Market Outlook 2016. In fact, shopping mall supply will be 45.2 percent higher compared to 2015 in all of Asia, and a large chunk of that excess space is in China.

Developments in Shanghai and Shenzhen lead the growth. Approximately 27 million square feet and 17 million square feet of mall space respectively will be built there over the next two years, four times what it was in 2015. Beijing comes in fourth on the chart, with significantly less supply being built. Next year, new supply growth in China's capital will be about half of what it is now.

But just because the supply exists doesn't mean that landlords are going with the same floor plans they have used in the past—at least if they're playing it smart. According to CBRE, in-store retail sales value growth in China is expected to drop as it faces competition from the thriving and growing mobile e-commerce sector, and oversupply of space may even prompt developers to delay construction time to avoid empty spaces or filling up with low-quality retailers.

Analysts are suggesting landlords and developers need to change their strategies to bring shoppers into the malls, and one way of doing this is finding alternatives for providing entertainment. Many developers are shifting a large portion of their brick-and-mortar supply to this aspect. In some cases, the tenants are proactive in creating an interactive element for the shopping center, as in the case of a Printemps Department Store in Shanghai, which had a five-story slide installed in its shop earlier this year.

Aside from entertainment, CBRE says affordable and niche luxury brands, as well as fast fashion, will do increasingly well in malls, and restaurants will be in such high supply that analysts warn landlords against overdoing it. Malls in Beijing already show signs of doing this, with long-established shopping centers like The Grand Summit now renting much of its space out to independent, local brands, as well as multi-brand shops with a large online presence, while the busy Taikoo Li increasingly fills up with fast-fashion and more niche international high-end brands.