China Art Auction Market Multifaceted, Complex And Global#

This week, a great deal of online and Twitter chatter has centered around questioning the legitimacy of China's art market as reflected by activity at its domestic auction houses. While the main article in question raises some interesting and important points -- some of which (such as non-payment of winning lots, buying with the aim of so-called "gift-giving" and the occasional appearance of forgeries at auction) we have brought up in previous posts -- the overall conclusion misses several distinctions that must be made about the art auction market in mainland China as well as Hong Kong. Here are a few of the "big misses" we noticed:

1.) The article focuses its chief criticism on Poly yet lumps together all Chinese auction houses#

Though Beijing Poly -- part of the massive state-owned China Poly Group -- is the largest player in the domestic Chinese auction market, it is not the only player. In an article that looks to expose shady practices by Poly, it seems misguided to drag other mainland auction houses like China Guardian into the mix because: A.) Poly and Guardian are direct competitors with distinct business aims, and B.) five of the top 10 auction houses in the world are now Chinese. Poly is big, but it is not the entirety of the massive Chinese art market. Going after Poly, with backed-up research and statistics, is one thing. Tossing others into the same pot without similar attribution is another altogether.

2.) The article couples the Hong Kong and mainland China auction markets together#

Another major distinction that this article did not make is that of adequately separating the mainland China and Hong Kong art markets. That mainland Chinese auction houses -- which are far younger than their counterparts in the West -- are less thorough with authentication, and have issues with non-payment and bidders inflating prices, is not news to anybody who has followed the Asian art market for any length of time. But to lump together the issues surrounding auction houses like Beijing Poly -- the main focus of the article -- with the activities of, say, Christie's and Sotheby's, which are unable to operate in mainland China and conduct their China business through Hong Kong, simply doesn't reflect the reality of the situation.

3.) The article never addresses the headline figure of $13 billion#

A flashy and compelling headline is never substantiated with corresponding numbers in the article.

4.) Beijing Poly is not the only large-scale Asian company with ties to both art and the defense industry#

Again, going after Poly is fair game. But to think it's the only arm of a massive conglomerate with ties to weapons-making and the defense industry is a bit short-sighted. In addition to their more readily identifiable industries, Samsung and Mitsubishi among others too are involved in weapons-making. Like Poly, Samsung is also heavily involved in the arts, with its Samsung Museum of Art and Samsung Foundation.

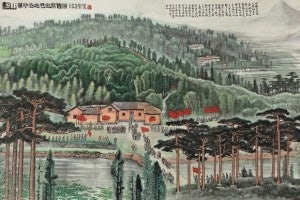

5.) The article fails to examine "Chinese art" as what it really is: many discrete segments#

One core criticism raised by the article about Poly (and, by extension, the whole Chinese art market) is that works purchased by bidders there can be used for bribery. This is not a new argument, yet is one that has been raised many times before, specifically about the traditional ink-and-paper auction market in China. However, the article fails to distinguish between art segments and note that the problems plaguing, say, auction houses in mainland China do not necessarily have an impact on similar segments in more regulated markets like Hong Kong or New York -- where a great deal of these works still go under the hammer.

6.) The link between the criticism of Poly and the ultimate impact on global collectors is weak#

The ultimate aim of the article is to convince readers that there is a massive global impact on pricing due to market manipulation and other unsavory actions by Beijing Poly. However, this presupposes that buyers outside of China are continuing to collect Chinese art segments like traditional ink-and-paper paintings, calligraphy and antiques -- segments in which Poly is heavily involved. However, in these segments Western collectors are more likely to be seen selling to Poly rather than buying from them. Recent sourcing events in Australia and the US affirm that Poly is on a global hunt for items to sell back home to a receptive collector base, which now dominates these auction segments. (Whether the buyers ultimately pay up is another issue.) When buyers outside of mainland China do look to buy Chinese art or antiques, they're not doing it at Poly. They're going to the likes of Sotheby's, Christie's or Bonhams in Hong Kong, London or New York.

Also, claiming that sales in China have a strong impact on pre-sale estimates in Hong Kong or New York by auction houses like Christie's or Sotheby's contradicts other articles that have claimed that these auction houses are setting estimates too low in order to make final sale prices look even more dazzling. Again, the article appears to be gunning for a scandal in the wrong place.

7.) "Caveat emptor" is always the name of the game in the art world#

Making the case that the issues highlighted in the article only exist in China, and that what may or may not happen at Beijing Poly is emblematic of the entirety of the Chinese art market, is somewhat thin. For a collector, whether they're buying Chinese contemporary art, modern art, traditional ink paintings or antiques, just like anything at auction it's "buyer beware." Whether you're an art buyer or an observer of the art world, it's always important to do your research.