Astronomical Prices Paid For Historical And Quality Pieces In Recent Asian Auctions Defies Global Economic Woes As More Chinese Collectors Get In The Game#

Hardly any industry has escaped the global economic slowdown unscathed, and art is no exception, but recent auction results indicate that the art market -- or at least pockets of the art market -- are coming back to life. As the Wall Street Journal reports today, in some recent auctions some pieces have sold for exponentially more than their estimates, surprising collectors and market analysts alike. The common bond shared by most of these pieces? They were Chinese -- or, if not Chinese, Asian:

Last week, the longest string of Asian art sales since the Zodiac clock dispute was held in the U.S.—and amid the most entrenched art-market recession in nearly two decades, the auction prices of many more than a handful of pieces went through the roof. At the Sotheby's sale of works from the collection of Arthur M. Sackler, for example, the auctioneer sang out fast-rising numbers, first in English, then Chinese, as if he were rising in the elevator of some fantastically tall Hong Kong skyscraper.

The emergence of the New Chinese Collector is a subject we've followed pretty much since our inception, and is a subject that is endlessly fascinating simply because it's such a new phenomenon. While, technically, Chinese people have collected art for a few thousand years -- with the exception of a few Mao-era decades where the practice was virtually nonexistent but for a few elite art lovers here and there -- the New Chinese Collector has only existed for around 20 years, and arguably even less than that. This collector base was out in full force in recent auctions of Chinese and other Asian art -- in New York, London and Hong Kong -- and the motivation, desire and intensity of the Chinese collector is becoming somewhat legendary right before our eyes.

In the Sotheby's sale of Chinese antiquities mentioned in the Wall Street Journal article, agreements set in the last few years factor into the decisions by collectors of Chinese art to purchase now and purchase even at high prices, since it has become much harder to procure artifacts that will not become embroiled in potential disputes. For the New Chinese Collector, however, the relative ease of purchase is less important than the value of the investment and cultural resonance of the pieces of Chinese art they are buying around the world:

China's economy remains strong relative to other nations, and there are impassioned movements in several Asian countries to reclaim national treasures and collect local art. So, at the auctions, rare works, those owned by prominent collectors, or those with comfortingly thorough and undisputed histories of export went for three, five, even 10 times their expected prices.

This fits with some of our previous posts, in which we posited that the continued rise of the New Chinese Collector as a global art collecting force would mirror China's economic growth and global presence. As this group becomes more influential, we can expect to see them trotting the globe even more, spending what they need to to "reclaim" (although that word has unfortunate political associations) works of Chinese art from antiquity to the present day. In the recent Sotheby's auction of works from the Sackler collection, this group didn't mess around, and was significantly more visible compared to a year ago:

While standard art auctions of all kinds have struggled in the past six months, virtually everything offered at the Sackler sales sold. Consider a 12th-century B.C. bronze vessel of the Western Zhou Dynasty. Estimated at about $25,000, it sold for $362,500 at Christie's. Tina Zonars, director of the firm's Chinese artworks division, said that the market was "surprisingly strong," with

70% of the buying done by Asian bidders, versus 50% a year ago

. "We haven't seen a noticeable impact of the recession."

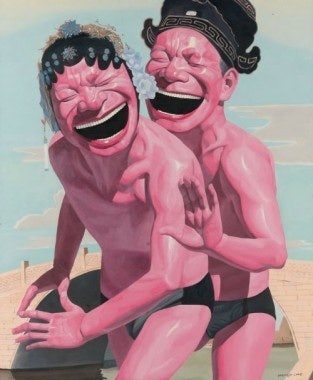

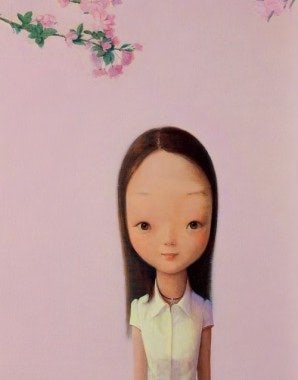

The article concludes by noting that there has been a major shift towards the East among auction houses like Sotheby's, where they can more easily reach emerging buyers in mainland China and East Asia, and points out that the New Chinese Collector base is developing varied, sophisticated tastes in everything from the "Recession Proof" antiquities and cultural relics to the newer generation of contemporary Chinese artists:

Chinese photography continues to climb in the wake of purchases by both the Museum of Modern Art and the J. Paul Getty Museum; they added works to their collections by such artists as Ai Weiwei and Hai Bo.

...

The star sector of so-called Asia Week...was classic Chinese art. "You have two things going on," says Larry Warsh, head of New York's AW Asia and a collector and trader in Chinese, Indian and U.S. contemporary art. "The Chinese, as a people, stopped collecting during the Cultural Revolution and have begun again; meanwhile, wealth and luxury spending there has grown to a degree we've never seen before."

Is it only the beginning in the nation's splurge? Consider this: Sotheby's raised more at a single sale of rare wine in Hong Kong this summer than at all of its London wine auctions combined all year.

I think these last few paragraphs really summarize the world of the New Chinese Collector -- many of them are flush with cash for the first time, and, having already put some of their money into traditional "hedges" like gold (a perennial favorite in China) and maybe real estate or luxury cars, they want to get into the cultural realm with things that resonate with them on a personal, patriotic and historical level. How best to do that? Buying the personal (fine wine, historical watches), the patriotic (Chinese contemporary art) and the historical (Chinese antiquities). As we've seen in recent auctions, the New Chinese Collector is equally motivated to get involved with all three and take as many of each group home as possible. It's good for the collector, it's good for the art market, and it adds a new and exciting dynamic to the art world, which remains plagued by the global economic doldrums.

Now we'll have to see what Chinese collectors do at big Asian auctions coming up in the next few months -- the first of which, Sotheby's Autumn Auction of Chinese and other Asian art, takes place on October 6 (during Golden Week -- when millions of cash-rich and shopping-mad mainlanders hit the city to celebrate and leave billions of yuan in the hands of HK merchants). Will the New Chinese Collector's march continue unhindered? Or will we be surprised by the old standby -- the seasoned Western collector? We'll have to wait and see.