Price Tag May Further Boost Prices For Chinese Art#

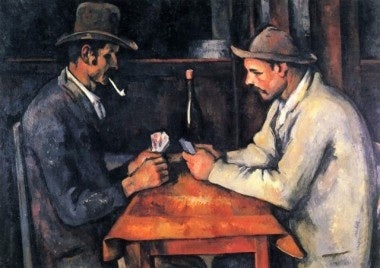

Last week, the global art market was shaken to the core by the news that a Paul Cézanne painting, The Card Players, was sold to the Middle Eastern nation of Qatar for over US$250 million. The highest price ever paid for a piece of artwork, this sale sent shockwaves throughout the modern art market and reflected the new multipolarity and shifting power structure of the art world, where emerging players like China and India are producing new, cash-flush collectors with an appetite for top-quality artwork and, more importantly, are willing to pay dearly for it.

As Vanity Fair wrote of the sale last week, part of Qatar's motivation for the purchase was led by a desire to become an arts and culture hub in the Middle East, a goal that has seen the tiny country become a "new destination on the art-world grand tour." Currently, Qatar is hosting exhibitions including an 80-foot-high Richard Serra and a Louise Bourgeois retrospective, and next month it will hold a Global Art Forum expected to attract artists and curators from museum groups around the world. From Vanity Fair:

The most paid for a painting at auction is the $106 million, paid last year at Christie’s for a lush portrait of Picasso’s curvy mistress Marie-Thérèse. Privately, works by Picasso, Pollock, Klimt, and de Kooning have changed hands in the $125 million-to-$150 million range, traded to and from by Ronald Lauder, Wynn, David Geffen, and the like. But no price has come close to this one. And Qatar is also buying 20th-century art: The Art Newspaper, with has chronicled Qatar’s buying sprees with care and ferocity, earlier this year crowned the nation the biggest single contemporary-art buyer in the world.

The money is there: the United Arab Emirates region (which, loosely defined, includes Dubai, Bahrain, and Abu Dhabi) is home to nearly 10 percent of all the world’s oil reserve, nearly four million people, and, until recently, the planet’s largest-ever construction boom. Qatar’s neighbor (and rival) Abu Dhabi started, stopped, and now has started again ambitious plans to build outposts of the Louvre and the Guggenheim museums on its Saadiyat Island.

So what does this record-breaking Cézanne sale have to do with China? It shows, as have other sales in mainland China and Hong Kong in recent years, that the boundaries of prices for artwork will continue to rise, driven by the bidding habits of motivated buyers and collectors. Over the past year in particular, we've watched as Chinese collectors and investors have sent prices for Chinese modernist painters through the roof, pushing domestic Chinese auction houses further up the global rankings -- where two, Beijing Poly and China Guardian, now trail only Christie's in Sotheby's in sales turnover. In record time, both auction houses have dominated the Chinese contemporary and traditional art segments, with China Guardian taking in US$606 million at its autumn auctions in Beijing last November alone.

International auction houses like Christie's have benefited from the emergence of Chinese collectors on the scene in recent years, with the London-based company recording record sales of US$5.7 billion in 2011, helped by a 13 percent rise in the Asian art segment, which totaled $874.4 million. As Bloomberg pointed out last month, China's growing clout in the global art market has become starkly apparent in recent years, with the country accounting for 39 percent of the approximately $11 billion total world revenue for fine art in 2011, up from 33 percent in 2010 and ahead of the US, which accounted for 25 percent.

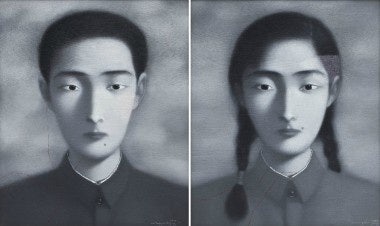

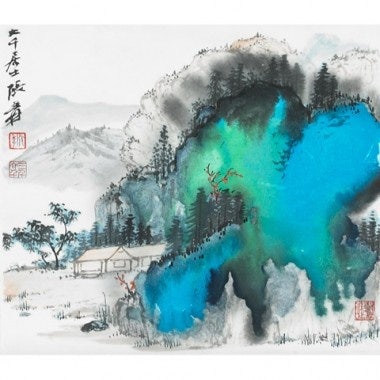

For their part, Chinese collectors have shown a willingness to go far above pre-sale estimates for particularly important or desirable pieces of art. Last year, owing to frenzied buying by China's new generation of art collectors and investors, three Chinese artists were among the world's top five in terms of sales volume. Unseating long-time leader Pablo Picasso, in 2011 the Chinese artist Zhang Daqian (1899-1983) was the top auction earner of the year, with Zhang’s works pulling in a total of US$506.7 million. Coming in at second and handily beating third-ranked Andy Warhol, works by another Chinese artist, Qi Baishi (1864-1957) made a combined $445.1 million, and Xu Beihong (1895-1953) paintings sold for a total of $212.9 million. Altogether, works by these three artists -- who are rarely collected by Western buyers -- sold for $1.16 billion. Aside from modernist artwork, Chinese buyers have pushed the boundaries of pricing in the contemporary art market as well, leading prices for the best works by top Chinese contemporary artists to pre-global economic crisis levels.

As Jing Daily recently noted, the fundamental motivations of Chinese collectors are an instrumental factor in the relative strength of the Chinese art market, compared to Europe or the US:

The most pronounced trend recently taking shape among Chinese collectors — both new and established — is bidding for the best works by blue-chip Chinese contemporary artists, while remaining cool towards sub-par works. Much of this comes down to the buying priorities of Chinese collectors. Though many see collecting as a form of cultural preservation and others see it as a means to eventually opening private museums, others view collecting as a highly pragmatic activity, a bulwark against inflation, diminishing returns from cash holdings, and uncertain real estate and stock markets. As such, Chinese buyers will continue to make up an important contingent at auctions in Hong Kong, Paris, London and elsewhere as long as there is top-quality Chinese art (whether traditional or contemporary) up for grabs — regardless of the global economic climate.

As we see from the example of Qatar's $250 million Cézanne purchase, the boundaries of how high a work of art can sell for are becoming arbitrary. If a work by Cézanne can sell for this much, there's no reason Chinese buyers -- itching to diversify away from cash holdings amid rising inflation and low interest rates and establish themselves as credible art collectors -- won't bid over $100 million for a piece of Chinese art.

In only a few short years, the particular motivations and highly pragmatic bidding habits of Chinese collectors have reshaped the market, with artists sometimes unknown outside of China selling for millions on a consistent basis. Last year, works by Huang Binhong (1865-1955) sold for a combined total of US$86.79 million, more than double his 2010 total of $41.8 million, the renowned artist Zao Wou-Ki nearly doubling his 2010 total with sales of $90 million, and works by Wu Guanzhong (1919-2010) making a whopping $212.62 million, over 2010 revenue of $72.77 million. Given the right motivation, for Chinese collectors, clearly the sky -- rather than a pre-sale estimate -- is the limit.