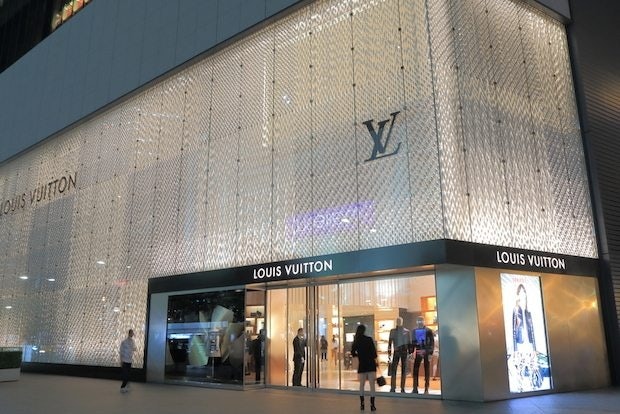

The Louis Vuitton store in Nagoya, Japan. Japan is an increasingly popular destination for Chinese shoppers. (Shutterstock)

Most Chinese luxury shoppers traveling abroad have done an extensive amount of research on what to purchase before they even left home, according to new data highlighting the vital importance of Chinese digital marketing for luxury brands.

According to Nielsen’s Mainland Chinese Luxury Shopper survey that polled 1,005 internet respondents from four regions, 90 percent of Chinese travelers plan their luxury goods purchases prior to travel, while 38 percent know exactly which products they will be buying. Unsurprisingly, they’re doing their research online, with 50 percent heading to luxury brands’ official sites and 49 percent to social media pages for their primary source of information.

“Among those mainland luxury shoppers with high engagement on online platforms, there is an opportunity for marketers to create targeted brand awareness programs by advertising on blogs and forums to maximize the reach to their potential consumers,” said Managing Director of Nielsen Hong Kong and Macau Eva Leung. “Apart from this, a better understanding on Chinese travelers’ luxury perceptions, purchase plan preparation, and key source of information besides digital is a critical asset for any organizations nowadays targeting Asian markets.”

Shopping is still a key reason for travel: it was cited as a main purpose for 97 percent of respondents, compared to 84 percent who listed sightseeing and 72 percent who listed attractions. The most popular categories for purchases were accessories (71 percent), and high-end cosmetics and skincare (70 percent) while other categories also did well: 63 percent bought watches and jewelry, 62 percent picked up clothes, and 52 percent purchased wine or fine liquor on their trips.

“Quality” was the most important deciding factor for purchases, with 45 percent of respondents listing it as a key reason for purchase and 56 percent saying that it’s the term they most associate with luxury goods (in addition, 46 percent listed “fine design” and 40 percent named “established heritage” for this category). Meanwhile, 42 percent of respondents bought items for a sense of taste and differentiation, while 42 percent bought them to “reward themselves.”

Airport duty-free stores were almost on par with brand boutiques for purchase channels, with 24 percent buying at the former and 26 percent the latter.

Countries known for their duty-free shopping naturally emerged as top spots to visit. Despite Hong Kong’s ongoing sales slump, the city was listed as the number one destination among respondents, followed by South Korea, Macau, and Japan. Respondents form northern China chose South Korea and Japan as their top two destinations, while those from the south picked Hong Kong and Macau. In addition, the southwestern city of Chengdu saw a signifiant number of visitors to Thailand.

All of their online browsing also contributed to the growth of another hard-to-ignore purchase channel: e-commerce. A total of 90 percent of respondents who have already bought luxury online said they will buy more in the next 12 months, while 77 percent of all respondents know of websites selling luxury goods. Forty-five percent of them have already bought goods online, while 48 percent are considering it. Unlike the high role of duty-free shopping for those traveling abroad, convenience (75 percent) and ease (59 percent) were the top reasons given for buying luxury online.