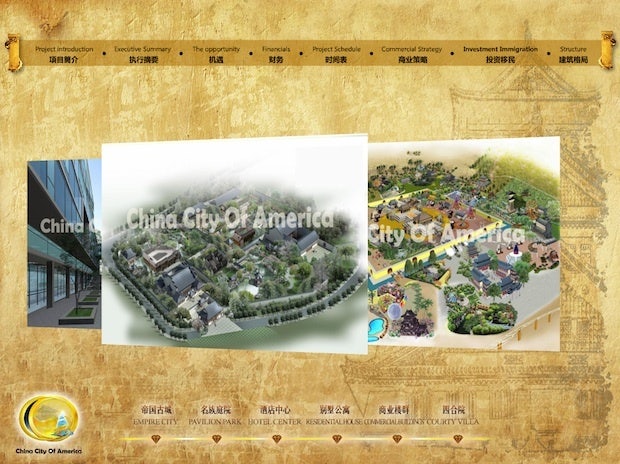

A mockup of the proposed "China City of America" from its official website.

A proposed business development in the Catskills referred to by some as “Chinatown on steroids” or “Chinese Disneyland” highlights the huge demand among Chinese investors for opportunities to participate in a U.S. investment immigration program.

On the 1990s-style website for the US$6 billion-dollar “China City of America” is an outline of plans for what looks like a mashup of Epcot, Las Vegas, a resort town, and a college town, featuring literally every money-generating aspect that can be crammed in: a hotel, a museum, a casino, a college, and condos, as well more “cultural” aspects such as a reproduction of the Temple of Heaven and an “ethnic pavilion” showcasing China’s ethnic minorities in a typical patronizing style. Hands down, the main highlight has to be the “center” of the whole complex, which is—what else?—a shopping mall shaped like the Forbidden City divided into themed sections based on the 12 zodiac animals. And of course, theme park rides.

A screenshot of the website for the proposal.

If you’re wondering why the Catskills were chosen for the location, look no further than the regulations of the U.S. EB-5 visa program that offers a green card to foreign nationals who invest at least US$1 million in the United States and create at least 10 jobs for U.S. citizens. Investment in a rural area defined as a “Targeted Employment Area” requires an investment of only half that amount, which is why this location is going to be a sizable trek from Manhattan. Furthermore, investment in a “Regional Center” means that the investor does not need to start his or her own new enterprise, which was a requirement of the original EB-5 program.

The “China City” plan may seem pretty outlandish, but it shouldn't be surprising that a Chinese “Regional Center” proposal has cropped up, considering the fact that 80 percent of EB-5 applications come from China. This proposal comes at a time when Chinese global investment is growing in everything from real estate to yacht companies, and the vast majority of China's wealthy wish to or have already emigrated. According to a report by China Merchants Bank and Bain & Company, “Among those mainland business owners who possess over 100 million RMB, 27% have already emigrated, while another 47% are considering emigrating.”

As with anything involving the possibility of foreigners coming to America in large numbers, the project has been a hotbed of U.S. conservative criticism. David North of the conservative-leaning, “low-immigration” U.S. think tank Center for Immigration Studies charges that the project’s financials and job creation claims are shaky and that Falun Gong practitioners in the United States are alleging it will be some kind of nefarious "stalking horse" for the Chinese government.

However, there are others who believe the area would be an economic benefit to the area. According to the South China Morning Post:

Others have taken a more positive view of China City, including Bill Liblick, a writer from New York’s Sullivan County – which encompasses land planned for use under the project.

“If China City works, it could place Sullivan County back on the map in a way like we have never seen before,” Liklick wrote. “This entirely new market could become a real economic generator for us.”

Wealthy Chinese investors shouldn't be transferring their funds just yet. According to Financial Times, this could all be one of several major scams that have tricked Chinese investors out of both their money and a green card this year:

In September, the SEC accused a South Texas company of fraudulently raising at least $5m from investors promising that their money would be invested as part of the EB-5 programme. The company allegedly diverted funds to other undisclosed businesses and for personal use of its owners.

And earlier this year the SEC filed a case against a Chicago developer who allegedly duped dozens of Chinese investors out of close to $150m by pretending to build a hotel and convention centre.

There are also major environmental concerns with developing such a large natural area, and if the project is indeed real, the question remains as to whether or not it could be financially successful. If it does get built, it could end up going the way of Florida's PRC-funded Splendid China theme park, a colossal financial flop that was closed in 2003, leaving behind creepy relics of fake Buddhas and its own deserted Forbidden City replica.