Confidence Levels Have Come Back Strong Following Last Year's Economic Crisis, As Mainland Chinese Buyers Gain Ground#

This week, The Economist pointed out that China, following a never-before-seen surge in Mainland New Collectors, became the world's third largest art market last year, trailing only the United States and Britain. Although China makes up 7.7% of the world market, compared with 35.7% for the US and 34.5% for Britain, the key aspect is that the Chinese art market, unlike those of the US and Britain, is still new, with few individual collectors existing in the country until the 1980s and 1990s.

With American and British collectors of Chinese art having trouble competing with their New Chinese Collector counterparts over the last several months, we can expect that China's share of the art market should grow in 2009 and into 2010. This should be particularly true in the Chinese contemporary and Chinese traditional categories, as the dominance of Mainland Chinese collectors at recent auctions in Hong Kong and elsewhere have thrust this once-nonexistent collector base into the spotlight.

As a Bloomberg article this week observed, the emerging Chinese collectors have quickly gained a reputation for spending whatever it takes to get a piece they have set their sites on. As Le-Min Lim writes, New Collectors like Wang Wei, wife of a prominent investor, are collecting with specific objectives in mind; in the case of Wang, to open an independent museum of Contemporary Chinese art and "Red Classics," revolutionary-era pieces from the 1950s and 1960s:

At yesterday’s sale of Asian artworks, Wang frequently waved her paddle to offer an additional HK$1 million in pursuit of the pieces she wanted, often obliterating her opponents. Several times, she just held up her paddle regardless of rival offers until she won the lot.

Not in the last five years has the Hong Kong art-auction scene produced buyers of such confidence

...At this auction, Wang paid HK$7.2 million for a scarlet-and-pink acrylic-on-canvas by Chinese contemporary artist Liu Ye, titled “I Always Wanted to be a Sailor.”

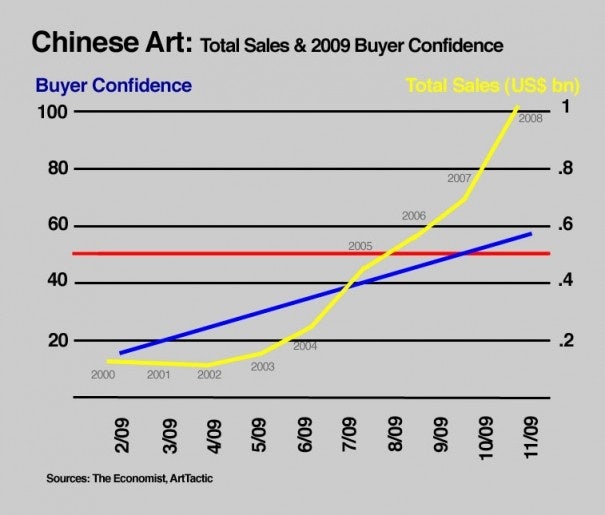

Confidence among Mainland collectors is one of their defining aspects, one that was validated this week with the release of ArtTactic's new Chinese Art Market Confidence Survey. Among the findings in the survey were the following:

The confidence in the Chinese contemporary art market has bounced back from its February low#

, and is now standing at 57, implying that there is more positive than negative sentiment in the market place.

2. The market remains concerned about the renewed risk of speculation, as the Chinese contemporary art market recovers.

3. A majority, 62% of the respondents, believe the market direction of the next 6 months will be ‘flat’, and only 10% believe the market will fall further.

4.

A large majority, 70% of the respondents, believe the market will recover within 2 years#

.

5. Lack of confidence in prices at the top-end of the market, but 62% feel positive towards the price bracket of $50,000 and below.

6.

Yang Fudong, Ai Weiwei and Xu Bing top both the Confidence Ranking (Short-term) and the Longevity Ranking (Long-term).#

As buyer confidence presumably continues to rise as more Mainland collectors appear on the scene, and as the resultant scarcity of works available by the top artists favored by Mainland collectors grows, we can expect that 2010 will see prices of contemporary art by China's top artists to approach pre-crisis levels. As the ArtTactic survey notes, most respondents believe prices will fully recover within two years; if more New Collectors on the level of Liu Yiqian and Wang Wei burst on the scene looking to get their hands on every Zhang Xiaogang, Wang Guangyi or Yang Fudong piece they can, however, we might see even faster price shifts occurring.