In just five years, the share of beauty and personal care products sold online in China has increased nearly sixfold. Today, 15 percent of the industry’s sales are now generated online—three times the penetration observed in other major markets. Online competence is no longer a differentiator for brands operating in the market, but table stakes.

Mobile, however, is the real competition arena for personal care brands. Close to half of online personal care purchases are expected to occur on a mobile phone this year, up from a third in 2014. And by 2016, mobile spending in China is expected to surpass desktop.

According to a recent report by market research firm L2 called “Digital IQ Index®: Personal Care: China,” which assesses the digital competence of 75 global and local personal care brands operating in China, the most successful global brands tailor their strategy to the Chinese market rather than exporting what what works in the United States or Europe.

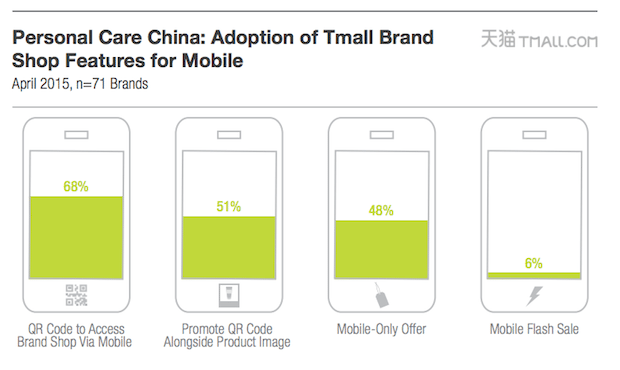

For example, QR codes—which never took off in the United States or Western Europe—are an important component of a China mobile strategy. Forty-two percent of China’s mobile internet users have used QR codes, according to iResearch, and two thirds of personal care brands on Tmall enable QR codes for shopping the brands online. QR codes also enable brands to participate in special contests and offers. Earlier this year, Taobao invited consumers to scan barcodes on select products at offline retailers via Taobao’s mobile app to receive special discounts. Forty percent of brands in the L2 study participated in the O2O campaign to boost sales.

Mobile-only discounting is another strategy to nudge consumers to complete the transactions on the spot, one that many brands in the study have employed. Almost half of brands offer mobile-only discounts or mobile coupons, and 6 percent are experimenting with mobile-exclusive flash sales.

Development of mobile sites—key for reaching consumers in the United States and Western Europe—is an area of underinvestment in China. It is the one area of mobile where local brands fall short and global brands excel; 90 percent of all mobile brand sites in the study belonged to a global brand.

All signs point to the need for a customized and strong mobile strategy in China. As of now, local brands have a competitive advantage and global brands should alter their investments to reach Chinese consumers on the digital channels they use.

Danielle Bailey is a research director at L2 Inc.