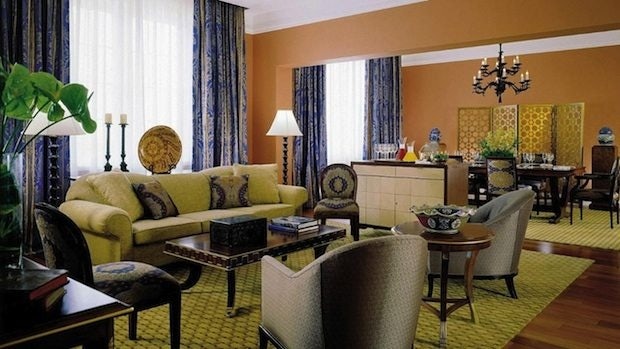

The St. Regis in Mexico City. (St. Regis)

At the St. Regis luxury hotel in downtown Mexico City, Alejandro Botti is busy putting his Mandarin lessons to use.

Guests from China are increasingly checking in, and the front-desk agent is the only employee here who can speak the language. The hotel’s management says it might eventually hire a Chinese interpreter to meet the growing need.

“You have no choice. You have to be ready,” Bernard de Villèle, general manager of St. Regis Mexico City, said in an interview at the hotel.

Last year, 60,500 Chinese nationals flew to Mexico, nearly 65 percent more than in 2011, according to the Mexican tourism ministry. That’s still a tiny fraction of Mexico’s overall airborne visitors—less than one percent—but it signals a rise in Chinese business interests in the country and reflects a major push by Mexican officials to lure Chinese vacationers to its beaches and cities.

It also points to the broader boom in Chinese travel. Worldwide, Chinese tourists spent $102 billion on foreign trips in 2012, more money than any other country, according to the United Nations World Tourism Organization. An estimated 100 million Chinese will travel abroad in 2015—a figure originally forecast for 2020—as disposable incomes rise, the middle class expands and government restrictions on foreign travel continue to ease.

How quickly Mexico City’s hospitality sector will respond to an influx of Chinese guests is an open question for analysts and observers.

Hotels have had little reason until now to cater to the Chinese, given the low number of visitors. Past political tensions with Mexico also hampered Chinese investment and business travel, though that is rapidly changing, said Benjamin Greenberg, who directs Deloitte Mexico’s real estate consulting office and spoke from Hong Kong.

Chinese direct investment in Mexico totaled $280.7 million from January to September 2013, and Greenberg said Deloitte is advising several Chinese companies that are each considering billion-dollar investments in Mexico.”They’ve never seen the opportunity to invest before … but are eager to start now,” he said.

“It’s only in the interest of the hotels and everyone that goes with it to start thinking about the magnitude of China’s investment.”

Hotel Snapshot#

The St. Regis brand, part of Starwood Hotel & Resorts, already has a comprehensive Chinese program in its 32 luxury hotels worldwide, including a second Mexico property in Punta Mita. When a Chinese guest books a night at a hotel, the room is stocked with traditional teas, biscuits, and noodles. The breakfast buffet offers congee rice porridge, dumplings, and spring rolls. All printed customer service materials come in Mandarin, and staff members are trained in certain cultural cues, such as using both hands to exchange business cards.

Javier Pérez Rubio, director of food and beverage at St. Regis Mexico City, said the hotel takes such lengths even if just one Chinese visitor is checked in, so that “he can spread through good word of mouth what we’re doing.” Chinese guests at the hotel accounted for 250 total room nights last year, up from 150 guests in 2012. Nearly all visitors were leisure travelers.

Four Seasons Hotel Mexico D.F., on the other hand, is “not doing anything out of the ordinary” for Chinese guests, though it does offer a submenu of a la carte Chinese fare at its restaurant, said Victoria Campos, the hotel’s director of sales and marketing. As most of the visitors are businesspeople who bring an interpreter or speak multiple languages, there is currently little need for Mandarin-speaking staff.

The Four Seasons in Mexico City. (Four Seasons)

Campos said the hotel has seen a “small but constant increase” in Chinese clientele in recent years, though she declined to give specific numbers. She credited recent political, energy and fiscal reforms in Mexico and Four Seasons' growing presence in China for boosting bookings. The company now has eight properties there, which “is really reinforcing our brand presence” among seasoned Chinese travelers.

Hilton Worldwide similarly does not have programs that cater specifically to the Chinese market in Mexico. The Hilton Mexico City Reforma hotel, however, is expanding its partnerships with local tour operators that bring in Chinese groups, who receive competitive rates and targeted benefits, such as rooms on preferable floors and welcome letters in Mandarin, said Vilma Campos, Hilton’s area director of sales in Mexico.

She said the number of Chinese guests at the hotel, including families and businesspeople, has risen in the last three years, thanks not only to the tour operators but also to the Mexico City government’s $11.6 million “Live It to Believe It” campaign to promote the capital city abroad.

While Chinese leisure travelers in Mexico typically spend their visit in sunny Cancun, Hilton’s Campos and the other hotel representatives said that more families are opting to divide their trips between the beach and Mexico City—where they explore its museums, taco stands, shopping malls and archeological sites—as they learn more about Mexico’s interior.

Business travelers, however, will likely dominate the new tourism in Mexico City, said Greenberg of Deloitte Mexico.

Strengthening Mexico-China diplomatic ties are softening a longstanding rivalry between the countries as major global manufacturing hubs. ”They’ve realized what each other’s strengths are,” he said. Mexico’s labor, electricity and gas costs are falling compared to China’s, which makes it attractive for infrastructure and construction projects, clean energy development and automotive manufacturing.Chinese oil companies are also eyeing Mexico in the wake of energy industry reforms adopted late last year.

Providing investors with a safe, comfortable visit in Mexico City is critical to sustaining business tourism in the country, Greenberg added. ”The experience they have while in Mexico plays a large role in the success of them closing a deal here.”