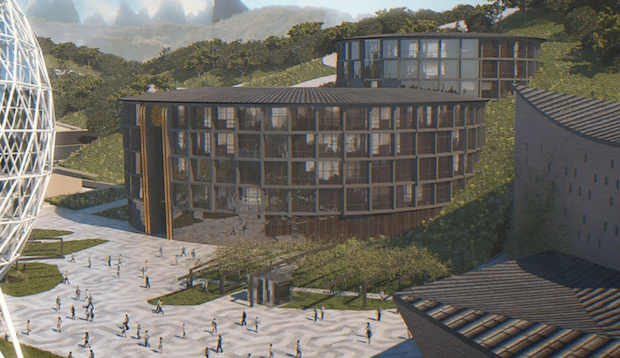

A rendering of Jihua Park's upcoming Chongqing location. (Courtesy Image)

With a plan to open 36 retail and entertainment complexes across mainland China, Italian-owned Jihua Park is forecasted to become one of the largest entertainment and tourism destinations in the country.

An immersive experience that's a mix of a fashion village, indoor sports center, gastronomy destination, and resort, Jihua Park hopes to cater to the fast-changing needs of the Chinese travel market. It will open its first location in Chongqing in September, and has started construction in Changchun and Yangzhong. Targeting China’s middle class, the park seeks to see annual visitation numbers from between 3-4 million visitors per location.

The size of its target middle-class demographic reached 50 million in 2010 and is forecasted to reach 400 million by 2020. Domestic tourism and consumption is also rapidly growing—leisure spending accounted for 73 percent of all domestic tourism in 2013, according to Bain.

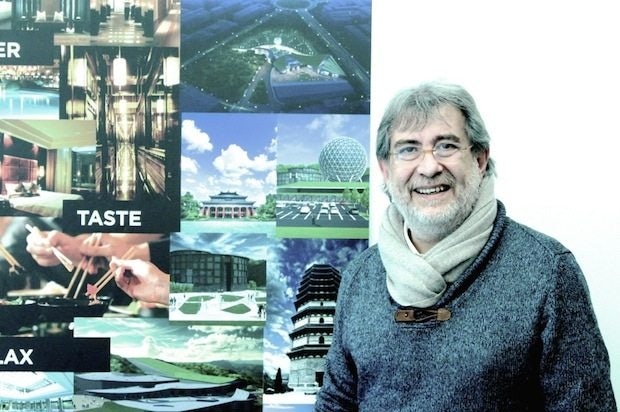

To gain more insights about the planning for this massive undertaking, we talked to the CEO of Jihua Park’s parent company ArcoRetail, Luca Bastagli Ferrari. Located in Milan, ArcoRetail designs, develops, and manages retail locations across Italy spanning from malls to retail outlets. In the interview, Ferrari gave us details about his strategies for Jihua’s market penetration, the growing purchasing power of the Chinese middle class, and why it's so important to provide experiential "retail-tainment" to Chinese shoppers.

ArcoRetail CEO Luca Bastagli Ferrari. (Marco Laganà)

Where did the idea of building Jihua Park come from and what makes it different from other outlets?#

We started with analysis of the Chinese market—what they need and what they want, not only now, but in the future on a long-term basis. China is changing a lot, we are going from basic functions and needs to something much bigger.

My Italian culture has also allowed me to understand China easily as these two cultures have a lot of similarities in terms of high values such as proudness in origins, family basics/values, love for their own food, as well as history and tradition. We are the oldest country in the West and China [is in] the East. Probably for these reasons, as well as the fact that I grew up in 1959—right in Italy’s economic boom—I can see a pattern with China’s current evolution. During Italy’s boom time, the numbers are really the same numbers/pattern that we currently see in China. The first thing Italians have done with their income is to buy a house; the Chinese are doing the same. The second is to buy a car and the third is to travel and see Italy.

Moreover, many more people are currently traveling within China compared to the people traveling outside of China. During China’s Golden Week holiday last year, more than 800 million people moved within China going to see family relatives, going from rural [areas] to the cities, as well as shopping and visiting touristic areas. For this reason, we understood that we needed to do a travel retail project where people can travel freely. This is Jihua Park. In conception of the Western analogy, a park is a place to enjoy yourself; it’s not a shopping mall, retail place, or outlet. It is a place where people can enjoy themselves and relax. They can enjoy via shopping, indoor sports, food, and gastronomy within architecture that is close to the Chinese traditions and modern at the same time. It’s a place where people can relax and enjoy and do whatever they want with their friends and family.

This is really a huge project. We’ve already selected 36 cities in China, we’ve already bought 12 lands in these cities, and we’ve started construction in three cities: Chongqing, Changchun, and Yangzhong. After this, we’re ready to start expanding in Dongguan, Chengdu, Xi’an, and Beijing. Our strategy is to enter in second- and third-tier cities first to boost and establish our brand awareness, and than enter the first-tier cities after at least eight or nine parks [have] already opened. This is due to the competition and nature of our business. However, we have already bought the land due to the increases in the current land prices.

A rendering of the planned Jihua Park recreation facilities. (Courtesy Image)

Will you be offering duty-free goods?#

We don’t have the duty-free concept; we are domestic travel retail. The price is a normal and correct price. The difference isn’t in the price but in the merchandising mix inside the shops. For example, when we go in an airport, the price of the Hermès goods in their airport boutique can range from 250-800 euros, however, if you go in their Paris flagship boutique, the average price is between 2,500 to 8,000 euros. Hence, the price of the brand is not only reduced due to the duty-free tax but also the quality and the particular product mix of the goods.

We can say that we’re not duty-free, however, more than 35 percent of the brands that we have are from Italian and French brands in exclusivity for China without the cost of a distributor as we operate directly; we organize a platform from Italy where the goods arrive in China and we directly manage the shops for the brands.

For example, a wallet from Fedon (a brand we will have at Jihua) can be bought for 55 euros in Italy, while in China, due to the tax and the importer company fees, the retail price is 150 euros. In our shopping hub, it would be 75 euros (we only have the duty cost as it’s direct). This means that the prices become affordable—not duty-free—but affordable. We believe that the new Chinese consumers can understand this. We don’t want in terms of shopping to go close to “high luxury”; we just want to give people what they want. We’re planning to have at least two or three bicycle shops, as the new consumer is no longer willing to spend 2,500 euros on bags, but they would spend more than 5,000 euros to buy a specialized bike.

The market is really changing in China and we believe that it’s important to give the consumer what they want at the correct and right price. No one currently in China has made a real price strategy. Most just bring goods in China and sell at a markup, which is for me not the correct way. A price choice in terms of quality, brands, and fashion is important. This is what Jihua is able to warranty for the Chinese consumers.

We’re bringing in exclusivity all of the best top quality sports and entertainment attractions at Jihua; indoor parachuting, surfing indoors, indoor climbing, indoor snow parks, and one of the biggest water parks in the world along with international management for quality control and coherence. This is completely in line with China’s philosophy of sports becoming more and more important. In 2022, the Olympic games will [likely] officially be held in Beijing. Given that there is no snow in Beijing ,they will have to use artificial snow, so we’re really in alignment with the future trends and opportunities to grow in the market.

A rendering the future Jihua Park. (Courtesy Image)

Has China’s economic slowdown affected this year’s sales to Chinese visitors at ArcoreRetail locations?#

No, definitely not. It’s changing the way their spending money, but not that they’re spending less. Of course, China has not grown as [much as] two years ago, but the people who had this spending money then [were half as many as those] of today. As per capita it may be less, but in totality, we will see an increase in purchasing power and consumption until we will reach the year 2020, when we arrive at the middle class that has reached 400-450 million. We may at this moment see a decrease in terms of sales.

Purchasing power is highly related to age. Currently, the people in middle age stop spending the [same] amount of money as they spent before. If we talk about China 10 years ago, the people who spent money were people who go to university, find jobs, and spend 70 percent of the salary on themselves and 30 percent on their family. In the beginning, they sent money to the rural areas, and after, they started bringing their family into the cities, exactly like in Italy. This is why, for me, this type of trend is easy to understand.

A rendering of the planned architecture at Jihua Park. (Courtesy Image)

What is Jihua’s t#

arget market and how do you tailor your marketing strategy to reach it?#

According to Bain’s latest research in China, we’re really seeing a significant difference between now and only one year and a half ago. Japanese and Korean brands are becoming stronger, online is taking the place of outlets, and luxury brands are decreasing while the affordable luxury trend is starting to increase in power substantially.

According to these trends and our future analysis, we’ve focused on four key age groups, which we’ve called “Flash” (15-19 years old), “Freedom” (20-24 years old), “Friends” (25-29 years old), and “Family” (30-44 years old). The Flash group is the segment that is extremely important for Jihua as the Family is ready to spend a significantly large amount of money for their children. The internet and online social media environment have become a part of themselves. They have also become trend creators in fashion, music and style.

The Freedom group is pampered by parents and grandparents. They are creating online visual content, while the Friends group is trying to ignore the financial pressure and is living in the now. Lastly, the Family group has high spending with great financial pressure from the parents, spouses, and children.

A rendering of the planned Jihua Park. (Courtesy Image)

How did you develop your pricing strategy?#

According to the target market we want to attract, we’ve made a highly competitive pricing strategy. For example, if we look at our costs—indoor snow is 180 RMB for two hours, the snow play is 80 RMB for two hours, and rental of equipment is free. When we're talking about affordable prices, they are really affordable prices. Jihua wants this to be a hub where everyone can participate.

What are your next logistical steps moving forward?#

Apple invests more than 15 percent in R&A. Brands usually invest between 3 and 4 percent. Jihua also invests more than 15 percent in analysis and research. We have people from all over the world who are researching the latest trends in sports, technology, gastronomy, automobile, aviation, fashion, hospitality, and more.

For our leasing activity, we currently have more brands who want to enter Jihua than the brands we’re selecting. We’re only selecting brands who have the aligned spirit with Jihua group in order be completely consistent throughout the 250 shops we’ll be hosting. Every shop needs to understand the strategy, collection, and product mix we want to showcase as philosophy.

For management, we’ve started with Jihua Academy, where we’re bringing young talented Chinese staff to Italy to do corporate training. In this way, our staff will be ready for the opening of Chongqing in September. Starting from next year, we’ll have a Jihua Academy located in Shanghai and Beijing where students will be able to do an internship and master’s. We’re already in touch with two main universities for this project.

This interview was edited and condensed.

Yanie Durocher is a lifestyle and fashion blogger at The Marginalist.