Age, it seems, plays a vital role in the effectiveness of celebrity endorsements in China, according to a new report released on August 27 by the New York-based data intelligence firm Gartner L2 titled “Luxury China: Influencers.”

The study reveals that three boy celebrities with an average age of 18 are the most effective celebrity spokesmen for luxury brands and that older Chinese celebrities like Angelababy and Chris Lee—despite being more high-profile—have lost some appeal.

Over the past year, luxury brands have continued to bet big on celebrity influencers and their unprecedented reach to consumers in the hot China luxury market by announcing ambassador-launched campaigns and key opinion leader (KOL) collaborations on trendy new platforms like Redbook and Douyin.

But do these celebrity investments pay off equally on different platforms and what difference does the influencer make? Gartner L2’s new report offers a surprising wealth of measurables and insights into this quickly evolving arena. Here are the three most important takeaways from Jing Daily:

Online engagement generated by celebrity endorsements is hard to match#

Ultimately, the report concluded that celebrity endorsements remain the most effective way for luxury brands to create online engagement with users. Over 95 percent of surveyed luxury fashion brands said they relied on celebrities to engage with users of China’s Twitter-like social media platform Sina Weibo during Gartner L2’s observation period (from May 2017 to April 2018).

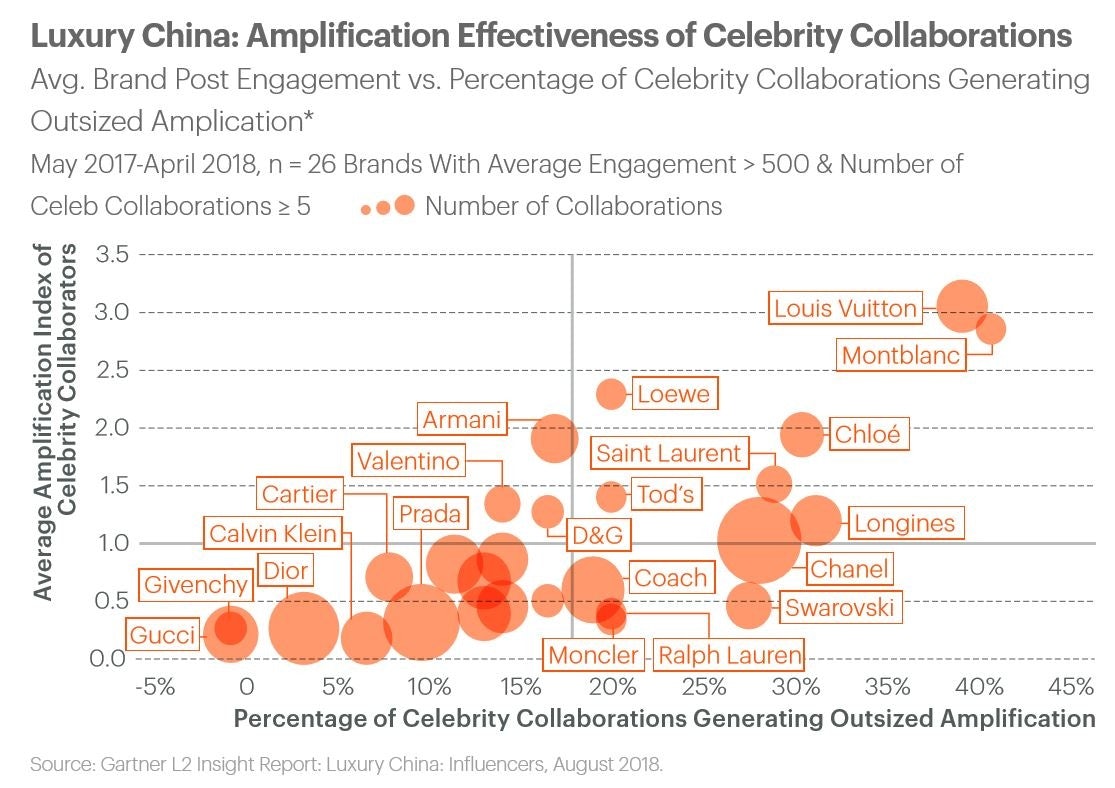

However, depending on the goals of these celebrity collaborations, the report revealed that only 18 percent of celebrity endorsements generated “outsized” engagement—meaning media engagement that surpasses the estimated average for brands of equal size. Louis Vuitton, working with Fan Bingbing, Tang Yan, Wang Yuan, and Xu Weizhou, and Montblanc, working with Yang Yang, have had exceptional performances from their influencers, garnering outsized engagements from 40 percent of their celebrity-initiated posts about the brand. The luxury brands Chloe, Longines, Saint Laurent, and Chanel, meanwhile, all came up short of that number.

On the other end, French luxury powerhouse Christian Dior received some of the worst value from its influencers during the course of this study. Only one of its 26 celebrity collaborators, the actor Huang Jingyu, was able to generate outsized engagement for the company. Dior’s brand ambassador, Angelababy, despite collecting 86 million followers on Weibo, did not deliver much value, according to the study. Gucci and Givenchy’s collaborators were even less effective at offering outsized engagements.

As the cost of working with Chinese celebrities is high today, L2 suggests that brands need to make wiser celebrity selections to represent their products. As a benchmark, the report said celebrities with 40-60 million followers represent a “sweet spot” for consistently delivering outsized engagement to their brand partners.

Members of TFBoys are most effective in generating outsized engagement, but do their fans hold purchasing power?#

The report pointed to the TFBoys—a Chinese boyband consisting of three members: Karry Wang (or Wang Junkai), Roy Wang (or Wang Yuan) and Yi Yangqianxi (or Jackson Yee)—as the Chinese celebrities who best generate outsized engagement.

Luxury brands like Louis Vuitton, Dior, Chopard, and Givenchy are seemingly aware of the boys’ social media influence. During the observation period, 41 percent of the observed brands mentioned at least one of the TFBoys in their Weibo posts, accounting for 28 percent of overall engagement directed from celebrity-oriented posts, the report said.

Some brands have now made their relationship with TFBoys official. Dolce & Gabbana appointed Karry Wang as its official Chinese brand ambassador in February 2018, while Chopard chose Roy Wang in May. Bottega Veneta hired Jackson Yee under the same title in August.

However, there is still a lack of solid evidence that Chinese Gen-Z's infatuation with the TFBoys is transferable to sales. After Jackson Yee’s announced partnership with Bottega hit social media, Yee’s fans were generous in showing their support for him, but some stated that they couldn’t afford the new products their idol was endorsing.

Brands are missing out on opportunities to monetize organic mentions on Redbook#

Aside from Weibo and WeChat, influencer marketing on alternative platforms in China has been on the rise, with one of them being the social commerce app Redbook. The platform—which received a 300 million investment from Alibaba, Tencent, and K11—is becoming the hottest place for marketing beauty and fashion items.

According to the L2 report, Chanel, followed by Gucci and Hermes, were the most widely discussed index fashion brands by KOLs on the company’s RED app, with those posts generating the most brand engagement. However, luxury brands tend to waste these organic mentions, having yet to tap into Redbook’s commercial potential.

Due to luxury brands’ limited adoption of RED shops, less than three percent of Redbook KOL posts with luxury brands link to commerce pages. But, the report noted that 99 percent of posts that do link to commerce, do so through a third-party seller on the platform.