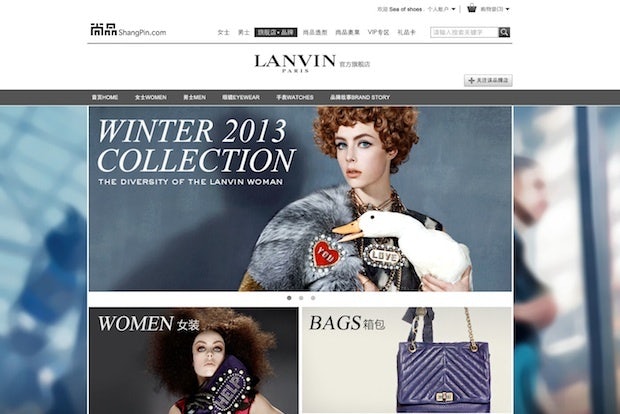

ShangPin's new Lanvin e-flagship store. (ShangPin)

Alibaba may be China’s clear market leader when it comes to mass consumer goods, but in China’s online luxury sphere, the market still remains fiercely competitive. With the launch of a new e-flagship platform and several other key marketing strategies, luxury e-tailer ShangPin aims to gain an edge in attracting and retaining savvy Chinese shoppers.

The three-year-old site just announced the rollout of its new online “shopping mall” business platform with the launch of an e-flagship store with partner Lanvin, which was revealed on November 18. The independent store hosted on ShangPin will feature men’s and women’s clothing, bags, accessories, and shoes. In addition to Lanvin, ShangPin is in talks with several other luxury brands to join the service, which marks a major development for the company.

“This new service was launched to meet the demands of brands who prefer to market and sell their collections in their own branded environment,” said ShangPin Founder and CEO David Zhao, who believes this new format is aptly suited for Chinese consumers. “Chinese online consumers prefer to shop on ‘platforms’ with multiple brands and a large selection of merchandise. This is why so many fashion mono-brand sites powered by third parties have failed in China.”

This service is directly related to Chinese consumers’ growing sophistication and individualism, according to ShangPin Vice President of Global Business Development Claire Chung. “We are adding the new ‘flagship’ model in order to offer a wider mix of brands from fast fashion to luxury,” she said. “We need to present the e-consumer a diverse brand offering as consumers evolve quickly and ‘buy up.’'

In addition to the new platform, several other aspects of ShangPin’s business strategy are advantageous in the China market, including a focus on high-quality service, efforts to attract customers from smaller cities, and the incorporation of editorial features in the site.

ShangPin’s emphasis on service includes offering VIP services to its customers as well as detailed attention to logistics issues that can cause headaches when it comes to e-commerce in China. In order to give customers a VIP experience, the site emphasizes special after-sales service, styling advice, and reliable delivery. “In order to sell full-price online, you really have to excel in customer service,” said Chung, who noted that the brand provides free delivery service, as well as courier service in first tier-cities that waits for the customer to try the items on. In addition, the site features a styling team to provide suggestions to clients.

Logistics are a tricky part of providing this level of quality of service in China, but Chung says that ShangPin has several advantages. “We have exceptional logistics and service. We’ve been doing this since 2004,” she says, referring to ShangPin’s previous role as an exclusive VIP shopping site for platinum credit card holders, which helped give the website a major head start and access to a strong customer base as it transitioned to its current model. In order to make logistics run smoother, the e-tailer runs all its own warehouses, provides extensive training to its customer service representatives, and works with its three bank partners for help on payment issues.

This service extends to customers in lower-tier cities, which are an important part of ShangPin’s customer base. Hailing from a range of 400 different Chinese cities, many of these customers rely on e-tail because there may not be brick-and-mortar stores in their city. According to Lanvin China General Manager Lily Liu, the partnership with ShangPin offers a valuable opportunity “to reach affluent customers in Tier 3 and Tier 4 cities where we still not have opened stores.” Chung notes that lower-tier cities are “where a lot of new wealth is coming from.” As a part of its tailored service approach, the site has offered mail-in dry-cleaning services for clients in smaller cities without reliable access to care for designer materials.

Like counterparts such as Net-a-Porter and Shopbop in the West, ShangPin is also dedicated to providing editorial content to consumers. The site has partnerships with Bazaar China and OK China to create looks from items offered on ShangPin, which feature a QR code providing a link to purchase the entire outfit via mobile phone. According to Chung, this strategy has been successful in bringing the average mobile transaction rate of the site up to 3,000 RMB, compared to 2,000 via computer. In addition, the company works with fashion bloggers and celebrity brand ambassador to promote its looks, especially niche brands.

Chung emphasizes the fact that China’s luxury e-commerce market is “one of the most competitive markets in the world,” but notes that ShangPin sees a 70 percent return in repeat customers. This competition stems from the diversity of brands in the China market. “What’s really exciting about China is that nowhere else on earth you have every single leading brand coming in,“ she says. “Everyone wants to have a stake in China.”