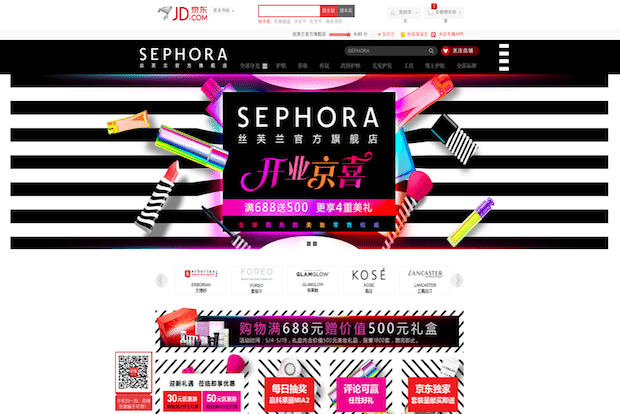

Sephora on JD.com.

This article was published earlier in our weekly newsletter. Sign up through our “Newsletter Sign Up” box on the right.

While Alibaba’s e-commerce platform Tmall has been on the path toward premiumization for quite some time now, enlisting major global players like Burberry and Calvin Klein, competitor JD.com is now getting in on the game. This week, JD (Jingdong) announced two major international brand partnerships that mark a serious sales coup for the platform: LVMH-owned cosmetics retailer Sephora and luxury eyewear conglomerate Luxottica.

However, these moves are unlikely to drown out concern among some luxury industry experts about luxury brands’ decisions to align with major Chinese platforms like Tmall and JD.com, which are known more for discount goods than premium brands. Many see the move as akin to setting up a luxury shop on Amazon in the United States, and believe that the decision could lead to brand dilution. However, there are several key advantages to setting up on one of these platforms in China, which has a unique e-commerce ecosystem. Below are some of the main reasons that Sephora and Luxottica likely decided to partner with JD.com.

Greater market reach.#

While Sephora has been serious about developing online sales in China with extensive social marketing and e-commerce loyalty programs, there’s just no way to beat the e-commerce market share of major platforms like JD.com. According to statistics from 2014, JD.com accounted for almost one-fourth of all B2C sales in China.

WeChat e-commerce capabilities.#

Although Tmall has a much higher B2C market share than JD.com in China—making up about half of all sales last year, JD.com has a major advantage over Alibaba: WeChat sales. That’s because WeChat owner Tencent is Alibaba’s main competitor, and has partnered with JD to allow in-app sales through the platform. Brands promoting their Tmall shops on WeChat are unable to do so, as WeChat banned links to Alibaba sites last year.

A robust logistics network.#

Logistics remain a challenge for brands looking to develop their e-commerce networks in China. Like Alibaba, JD.com has developed a robust logistics network with tens of thousands of delivery workers and thousands of delivery stations across the country, which Sephora and Luxottica can now leverage.

Protection against the gray market.#

China’s online gray market causes major headaches for global luxury brands. Sales of foreign goods bought abroad and smuggled in to avoid China’s high tariffs are rampant on the country’s e-commerce platforms. Even worse, counterfeit goods being passed off as the real thing are becoming a major problem on these sites. By signing up with a major e-commerce platform, brands are in a better position to get gray-market items and fakes removed.

Since Sephora and Luxottica both sell comparatively accessible luxury goods—cosmetics and sunglasses—it’s a no-brainer that they’d sign up for one of China’s major platforms. Most international cosmetics brands have fully embraced these mass-market websites to reach China’s middle-class shoppers. The key for both JD.com and Tmall in the near future will be convincing more major fashion brands like Burberry that their brand identities won't take a hit if they follow suit.