Bilibili, which was founded in 2009 and is known informally as B site, is a Chinese video-sharing website where users can submit and view “bullet” chats: real-time comments sent while users watch videos. Unlike other Chinese video-sharing platforms like Youku, iQiyi, and Tencent Video, Bilibili features professional, user-generated content (hence the platform usually being described as the Chinese version of YouTube).

Bilibili isn’t as well-known as other marketing and communications platforms like WeChat, Weibo, Douyin, or Little Red Book, yet, Bilibili is now tapping a wide range of fields such as fashion, lifestyle, beauty, music, and technology, in addition to its vertical market, which is anime, comics, and games (ACG).

When Bilibili first reached mainstream audiences over the last two years, it was poised to become another entertainment powerhouse in China. Because of live events like the New Year Countdown Gala (which is similar to China’s Spring Festival) at the end of last year to its recent “The Next Wave: Bilibili’s speech for the next generation” commercial, the site’s name has now gone viral across social media.

In fact, Bilibili became a household name among China’s digital natives ever since it started producing its own in-house content. During National May Fourth Youth Day, the platform’s “The Next Wave” video boosted the platform’s market cap by 480 million up to 9.5 billion in one day. By capturing the growing patriotic sentiment among young consumers after the COVID-19 pandemic, the video sparked an overwhelming amount of discussions on social media. While it was criticized for overtly capitalizing on patriotism, Bilibili said it significantly raised its recognition among different age groups.

This success has led to profiles on predominant media outlets, including local channels like CCTV and People’s Daily. Given this impressive online hype, Bilibili’s reach has now extended from its original ACG-based community to a more inclusive one with users that have a multitude of interests – no matter how niche.

As of last year's fourth quarter, Bilibili had 130 million active monthly users, 80 percent of whom were Gen Zers. Over the past year, each active daily user spent an average of 80 minutes per day on the website. The site's huge user base and visible in-built loyalty were enough to convince both Tencent and Alibaba to invest in Bilibili in late 2018 and early 2019, respectively. Now, the online giants hold 13 and 7 percent shares in the company, respectively.

Investment is pouring in from outside of China, too: Last month, the Japanese conglomerate Sony paid 400 million for 4.98 percent company shares. Tencent and Sony’s strength in games will further consolidate Bilibili’s roots in the ACG field, while Alibaba can support any entertainment and e-commerce plans. The strategic partnerships with these three tech giants reflect the strength of China’s mammoth video sector and indicate this platform’s growth potential.

According to Bilibili’s 2019 financial report, the site saw revenue growth of 64 percent year-on-year to 960 million (6.78 billion RMB). More importantly, the company presented a more balanced revenue composition that was less dependent on ACG and with a higher income from livestream and e-commerce — indicating that this former ACG giant is successfully diversifying its business and increasing its capacity to monetize.

The platform’s shift signals many potential collaborative opportunities for fashion and beauty companies that are looking to optimize their digital strategies in China’s market. Below, Jing Daily analyses the implications for fashion and beauty players and suggests how the platform can benefit your brand.

Implications for fashion and beauty brands#

Given the appetite for consuming and sharing video content in China, many brands launched Youtube channels in the past. Therefore, it’s logical to think that a lot of those businesses will look to open an official Bilibili account as yet another way to tap into China’s youth market. To date, C-Beauty brands like Perfect Diary and Marie Dalgar own official channels on the platform, and Dia Communications, which operates the multi-label showroom Tube, also has a dedicated channel, where it shares news and campaigns from local independent designers.

Additionally, brands can host virtual presentations and livestreams on the site. Beauty brand Shiseido rolled out an online launch event in April with a visually appealing livestream that featured its brand ambassadors. At its peak, the event had 1.34 million engagements and nearly 200,000 bullet chats — a more efficient and organic reach compared to typical offline launch events.

But Bilibili is a nuanced platform, and before launching on it, companies must understand the differences between this video sharing platform and its market competitors. As a Gen Z-focused, online community, the visuals and terminology of Bilibili’s content are shaped by its users and the platform collectively. According to Miro Li, founder of Double V., which is a consultancy that focuses on Chinese social platforms, brands need to understand Bilibili’s users and learn to speak a Gen-Z language, since this group is the key to unlocking China’s market. As Li explains, “try to communicate with them in a creative way.”

But being innovative and flexible is not only the privilege of the younger brands using Bilibili. Luxury houses like Louis Vuitton and Fendi have successfully pivoted on the platform as well. Last November, Louis Vuitton teamed up with the site to promote its collaboration with one of the world’s most popular video games League of Legends, which resonated considerably with young Chinese users.

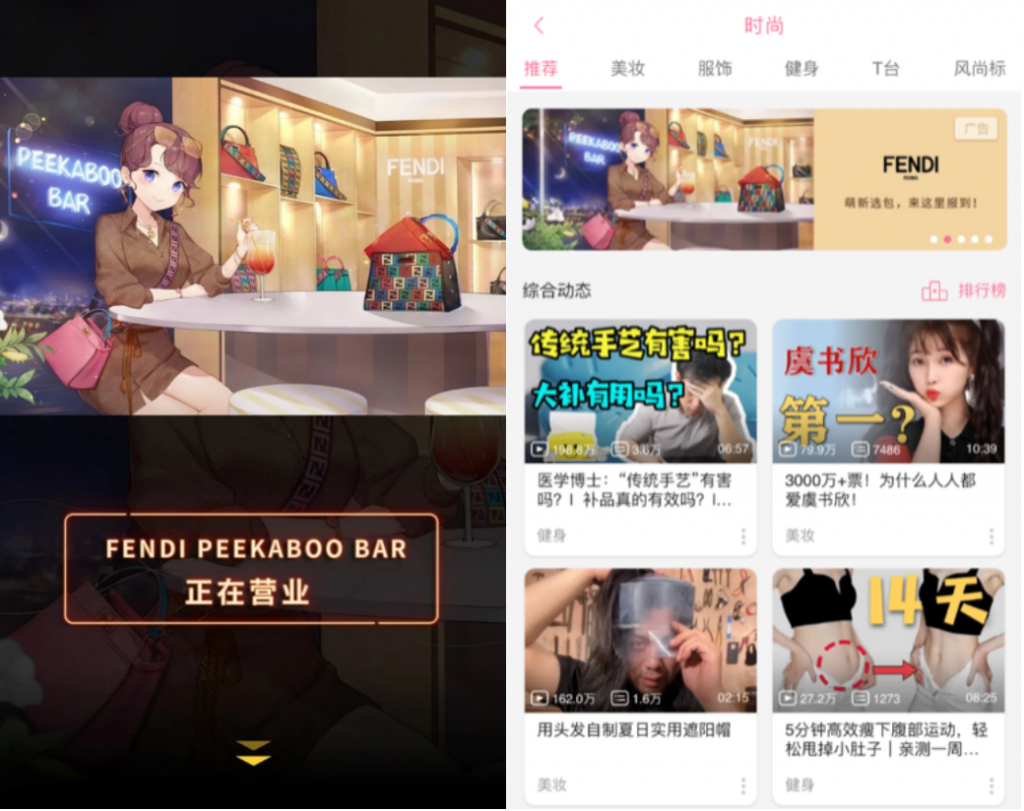

Similarly, Fendi launched a banner advertisement last month to introduce its “Peekaboo Bar” campaign, which allows consumers to customize the brand’s well-known Peekaboo handbag. To reach the Gen-Z community, the campaign featured a comic-influenced illustration that was created by Bilibili’s in-house design team. The ad was well-received and sparked many consumer comments on the novel idea.

Both examples prove that to maximize a campaign’s performance, brands should tailor strategies to specific platforms, especially when it comes to one with a unique personality like Bilibili. “Merely copying the same content from WeChat or Weibo will not work well here,” Li states. But having grown out of ACG industries, Bilibili is an ideal partner for hooking into relevant customers from the Chinese youth culture community.

However, given the investment required for such undertakings, brands that aren’t familiar with Bilibili’s cyberculture should collaborate with “uploaders” as original content creators. These uploaders are insiders who know the young targeted audience well and can speak to them in their language.

Similarly, sponsored content is an efficient way to connect brands with Bilibili’s users. Beauty players are again leading the way among brands that are leveraging influencer marketing on the platform. Lancôme’s recent “Aurora Essence” campaign exemplifies how site-specific sponsored videos can increase a product’s awareness among young consumers and drive organic reach.

How Bilibili can benefit your brand#

Gen Zers make up 70 percent of Bilibili contributors in the fashion & beauty category, and few trends get past them. Despite coming under the same category, their interests and specialties vary greatly. Besides regular product reviews and tutorials, they also follow niche topics such as character-inspired makeup and traditional Chinese fashion (known as “Hanfu” in Chinese). Therefore, collaborating with Bilibili shouldn’t just engage young generations who may become prospective clients but also niche markets that are rarely mined by other platforms.

Due to its interactive design, Bilibili manages to elicit strong user stickiness and loyalty that’s a step up from its rivals. Unlike social platforms with either free entry or paid membership fees, Bilibili requires a high level of commitment from its users. This type of user-platform interaction demands a certain level of dedication, and all active users have to pass an entrance examination to gain full membership, which is needed to post bullet comments.

Though Chinese consumers are sensitive to sponsored content, Bilibili has found a way to overcome this issue. In addition to normal “like” and “add to favorite” features, Bilibili monetizes user engagement through virtual tokens that are called “casting coins.” These can be spent supporting preferred video creators, and users are more willing to support contributing brands and uploaders as long as they are open about the process.

Given this unique ecosystem that actively involves users, contributors, and the platform, Bilibili’s user-generated content feels both authentic and highly-engaged. That means they can offer a more organic reach and positive conversion rates for brands. Therefore, the community-based site indicates a higher return on investment in influencer marketing than competitors like iQiyi and Youku.

Meanwhile, Bilibili’s infiltration of Chinese youth culture transcends most digital platforms. Besides being a video site, Bilibili is also an event and TV producer: It hosts offline events such as Bilibili World and produces programs ranging from documentaries to reality shows. And even a new rap competition show the platform produced, called Rap For Youth, will premiere this summer. “We hope to team up with brand partners to explore the diversity of Chinese youth culture and get closer to Gen Zers,” Bilibili told Jing Daily.

While video platforms like Douyin, Xigua Video, and Kuaishou are vying for the market, Bilibili has a singular standing among younger generations due to its authentic youth culture focus. As global shareholders bet on its promising outlook, the company’s monetizing capacity and business model have continued unchallenged. And as fashion and beauty players aggressively tick all the right marketing boxes — from WeChat and Weibo to Little Red Book — brands that also tap Bilibili will step ahead.