With slowing growth, more competition, rapid technological advancements, and changing tastes, this past year was a whirlwind for China's luxury industry. As GDP growth slowed and more brands moved in on the market, competition increased, creating winners and losers in the growth game. Just as brands were gaining command over their Sina Weibo strategies, WeChat emerged as a major force in social media marketing, and businesses are still coming up with ways to make luxury a bigger part of China’s massive e-commerce market.

Meanwhile, luxury goods took on major political significance, for better or worse: while the government’s ongoing anti-corruption campaign meant that 2013 was a year when being photographed with a luxury watch could land an official in jail, Chinese brands gained a massive sales boost when worn by the country’s beloved first lady.

Jing Daily has been covering the ups and downs in the industry all year. Without further ado, check out our list of the top China luxury stories of 2013, based on the topics most closely followed by our readers.

1. China’s luxury slowdown looms heavy on sales#

The double impact of China’s slowing GDP growth and the government’s anti-corruption campaign hit luxury hard this year, and Bain & Company estimates that the industry will only have grown by 2.5 percent by the end of 2013 after a decade of double-digit growth. However, certain industries felt more pain than others—especially those favored by government officials for gifting purposes such as baijiu and watches.

2. Chinese tourists embark in record numbers#

This spring, the United Nations World Tourism Organization reported that Chinese travelers are now the top source of tourism cash in the world. As a result, locations everywhere, from London to Thailand, Los Angeles to Iran, and Paris to the Maldives have been undertaking measures to attract these profitable visitors. Relaxed visa policies, hiring Chinese celebrities, and new safety measures have been just a few of the strategies embraced by these locations. While some may maintain stereotypes about Chinese tourists' "rude" behavior, businesses are clearly happy to welcome them.

3. Peng Liyuan boosts Chinese brands#

When China’s first lady Peng Liyuan stepped off a plane in Moscow in March for her first international appearance, her Chinese designer outfit sparked a viral sensation on Sina Weibo. The brand she was wearing, Guangzhou’s Exception de Mixmind, received instant publicity and sparked a global discussion on the future of Chinese fashion.

4. WeChat revolutionizes social media marketing#

Jing Daily noted at the beginning of the year that premium brands can’t ignore WeChat, and with more than 600 million users now, it’s more true than ever. The social-mobile app that skyrocketed to a top global spot this year has been rapidly adding new features that will help brands with their mobile marketing strategies.

5. 2013 all about stealth wealth#

As the anti-corruption crackdown carried on and Chinese consumers’ tastes changed, logo-emblazoned, ostentatious styles went on their way out this year, especially in China’s first-tier cities. Low-key luxury took its place, and some officials who didn't follow suit and still wore their fancy watches in public felt the consequences.

Gucci has stated that it increased its number of logo-free styles this year. (WWD)

6. LVMH strategizes for the future#

One company hit by China’s anti-logo trend was the world’s largest luxury conglomerate, whose cash cow Louis Vuitton had made a name for itself in the country based on its signature logo bags. As a result, the company undertook several key strategies this year: promotion of logo-free styles, greater efforts to crack down on fakes, and diversification into areas like beauty, where the company’s subsidiary L Capital Asia invested in Chinese beauty brand Marubi.

Hong Kong actress Carina Lau (L) and Chinese actresses Fan Bingbing (M) and Sun Li (R) pose at Louis Vuitton's 2013 Beijing store opening.

7. Department stores descend upon mainland#

Lane Crawford had a store in Shanghai until 2006, when it withdrew from the city and focused on Hong Kong for the next several years. This year, the luxury retailer came blazing back with a 150,000 square foot location opening in the fall. This wasn’t the only major department store to open on the mainland in 2013: French retailer Galeries Lafayette came to Beijing and Italian store 10 Corso Como arrived in Shanghai. The wide assortment of smaller, independent niche designer labels at these locations paves the way for more diversified fashion in China’s first-tier cities.

Lane Crawford's new Shanghai store. (Lane Crawford)

8. China’s middle class brings masstige to the forefront#

In June, consulting firm McKinsey & Company predicted that luxury industry growth in the coming years will be driven by China’s middle- and upper-middle class. This is already having an effect on fashion, where fast fashion is taking off, and “aspirational” luxury such as Coach, Michael Kors, and beauty brands are seeing significant growth.

9. E-commerce goes mobile#

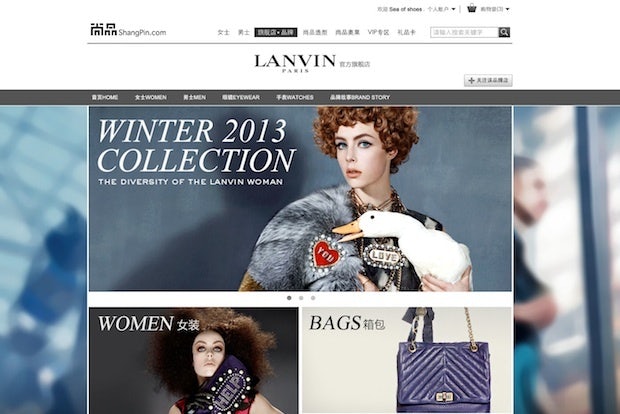

In November, just after e-tail holiday Singles’ Day once again shattered global online shopping records, consultancy A.T. Kearney pegged China as the number one country in the world for e-commerce opportunity, and mobile commerce was the fastest growing channel for e-commerce this year. While luxury still has a way to go in the e-commerce market, new mobile e-commerce and marketing strategies have helped some luxury retailers such as ShangPin log a higher transaction rate for mobile than online purchases.

10. Chinese supermodels gain record-high global standing#

In 2013, supermodel Liu Wen became the first Chinese model to make the list of the world’s highest-paid models, raking in US$4.3 million for the year. She is accompanied by a growing group of globally recognized names, including Fei Fei Sun, Ming Xi, and Sui He, all of whom graced the runways of the top designers at this year’s fashion weeks.

Sui He (L) and Liu Wen (R). (Tommy Ton)