The rising popularity of mobile devices for internet access, messaging apps, and e-commerce had a big effect on China's luxury industry over the past year. (Jing Daily)

With rapidly changing technological developments, more Chinese tourists traveling abroad than ever before, and quickly evolving consumer demands, China's luxury market is in a constant state of transformation. This past year was no different, with a huge number of crucial new developments set to change the way high-end brands do business both inside and outside China in the years to come. In order to give an overview of these changes, Jing Daily has put together a list of the top five trends we've seen over the course of this year.

China’s luxury consumers are more global than ever.#

The Chinese luxury market is no longer limited to China’s borders as brands’ Chinese customers are more globally connected and well-traveled than ever before. Aware that prices of imported luxury goods are much higher on the mainland than abroad thanks to high tariffs, China’s luxury consumers have embraced many other avenues to purchase premium goods.

When they head abroad, Chinese shoppers aren’t just making business boom at the luxury boutiques, malls, and outlets at their destinations, but they're also shopping en route at duty-free stores. According to a Nielsen survey of Chinese luxury travelers published in October, airport duty-free stores are almost as popular as boutiques: 24 percent bought goods at the former and 26 percent purchased goods at the latter. Meanwhile, a report published in June by tax-free service Global Blue found that Chinese customers accounted for 27 percent of all of its tax-free shopping transactions. As the easy-to-reach and tariff-free destination of Hong Kong faced anti-mainland sentiment and political strife this year, Chinese consumers opted for other nearby shopping destinations such as South Korea, Taiwan, and Japan.

Those who don’t have time to travel either have their traveling friends and family pick up items for them, or they turn to “gray market” daigou (“buying on behalf”)agents on Taobao and WeChat for goods that were ostensibly purchased at reputable shops abroad.

While China's growing middle class is the most concerned about price, money is no object for many wealthy Chinese luxury consumers. According to a Ruder Finn Chinese luxury consumer survey released this month, they still preferred shopping abroad, however, where they found better selection and service than in mainland China.

China's e-commerce market went global this year as well: the introduction of new international payment solutions such as Alipay’s ePass and Asia Checkout mean that Chinese shoppers can easily buy from international sites and have the items shipped to their homes. International retailers are able to ship to Chinese fulfillment centers that handle customs and final shipping. Although this means higher prices than daigou sales on Taobao, many customers are willing to pay a premium for reliability and selection.

Duty-free shopping remained especially popular with mainland Chinese travelers this year. (Wikimedia)

“New normal” domestic market growth here to stay.#

Thanks to growing numbers of Chinese shoppers heading abroad as well as the continuation of the Chinese government’s ongoing anti-corruption campaign, luxury market growth within mainland China slowed to negative 1 percent in 2014, according to global consultancy Bain & Company. This marked a continued trend of slowing growth from last year, when the rate stood at only 2.5 percent after a decade of double-digit growth before the anti-corruption campaign started.

Brands shouldn’t panic just yet, however. Not only are traveling Chinese shoppers contributing to global growth, but China’s rising incomes mean that the country is still on track to surpass Japan as the second-largest luxury market in the world by 2019, according to Euromonitor.

Individualism is in high demand.#

China’s luxury slowdown was affected by a maturing market this year as affluent consumers expressed strong demand for unique and experiential luxury.

Ruder Finn's survey found that travel is now the ultimate luxury for wealthy Chinese consumers, who said they would be likely to spend more money on trips at a higher rate than they said they would for luxury goods. Interest in experiential luxury is on the rise: a Boston Consulting Group survey published in February found that 29 percent of Chinese consumers said they preferred “enriching experiences” over products. Chinese consumers are increasingly interested in unique travel experiences, including Antarctic expeditions, African safaris, and bespoke VIP packages with front-row seating at New York Fashion Week shows or meet-and-greets with sports stars.

When it comes to luxury items, Chinese consumers have shown a growing interest in buying unique products, local goods while traveling, bespoke items, and collectibles such as art and antiques. As logos and conspicuous displays of wealth decline in popularity both in China and across the world, quality, exclusivity, and authenticity have become key reasons for Chinese consumers’ luxury purchases, according to the results of multiple surveys conducted throughout the year.

Art collection is becoming increasingly popular with China's rich as they search for unique and meaningful ways to spend their money. (Christie's)

Brands worked to prevent overexposure.#

As China’s luxury market slowed, some of the hardest-hit labels were the biggest ones: logo-heavy mega-brands such as Louis Vuitton and Gucci have seen slowing growth rates as Chinese consumers turn away from bling. Brands suffering from their own massive popularity in China over the past decade have been working hard to prevent overexposure over the past year. While limiting the number of logo-heavy products is one key strategy of Gucci, luxury brands especially zeroed in on China’s enormous fake luxury goods market in 2014.

Most of this battle against counterfeits took place online on Alibaba’s behemoth e-commerce sites Taobao and Tmall, with brands employing a number of key strategies. Some took a more contentious route: Gucci owner Kering opted to file a lawsuit against Alibaba for allowing fakes on the site, earning a quick agreement from Alibaba as the e-commerce giant hoped to boost its image for its U.S. IPO launch. Meanwhile, British, Italian, and French luxury labels benefited from agreements signed between Alibaba and the China-Britain Business Council, Italian Ministry of Economic Development, and French Foreign Ministry to promote each country’s brands and fight fakes.

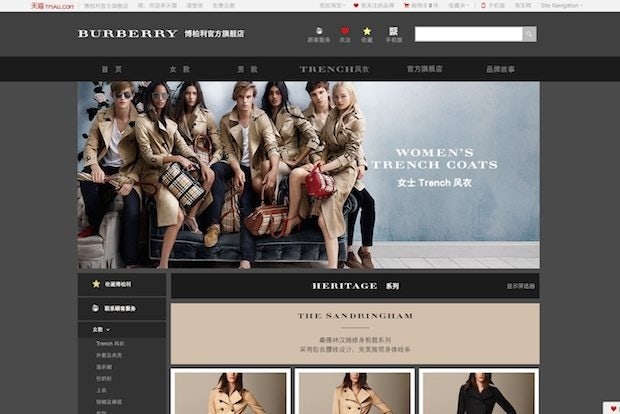

The most direct approach, however, was Burberry, with its “if you can’t beat them, join them” strategy. The British label made waves in the luxury industry when it became one of the only international luxury brands in the world to launch on Alibaba’s Tmall in April. While some experts argued that the move would dilute the brand’s image, the new shop gave the brand the leverage to ensure that Alibaba remove a large number of counterfeit Burberry goods that were populating the site. Since Burberry’s big Tmall debut, premium brands have slowly but surely been making their way onto Tmall as they continue the fight against fakes.

Burberry's Tmall shop helped cut down on counterfeits and gray-market goods.

Chinese luxury consumers go mobile.#

According to data released by the China Internet Network Information Center in July, it's now official that Chinese consumers use mobile devices more often than they use PCs. This development has had major implications for luxury brands in terms of social marketing, e-commerce, and even brick-and-mortar retail.

The growth of mobile use in China is closely related to the growing popularity of mobile messaging app WeChat, which hit 468 million monthly active users this year. The app’s rapid ascent to become China’s top mobile messaging site has had many luxury brands rushing to set up their official accounts.

Mobile dominance has huge implications for online luxury shopping as well. A survey released by marketing agency DigitasLBi in April found that 70 percent of Chinese respondents had made a purchase via smartphone within the past three months. Although many high-end brands are wary of e-commerce and m-commerce in fear that customers will miss out on the quality of the in-store experience, those who have embraced m-commerce have seen positive results. For example, luxury e-commerce site ShangPin now sees 40 percent of all sales from mobile devices, and expects that percentage to grow in the coming years.

Mobile devices are key for in-store shoppers as well. Many Chinese shoppers abroad use their phones to communicate with family and friends back home who want them to pick up luxury items on their behalf. The DigitasLBi survey also found that savvy Chinese consumers often use their smartphones for the practice of showrooming, or testing products in-store and then looking up prices and buying online. In fact, 84 percent of Chinese consumers have engaged in this practice, showing that mobile usage has become an integral part of the Chinese shopping experience in 2014.