China Expected To Become Top Cognac Consumer Within Four Years#

Long a favorite among upwardly mobile Chinese (or those who hope to appear that way), demand for cognac in China has surged in the last decade, with the country now poised to become the largest consumer of the French brandy within the next four years. Currently ranked second behind the US, a growing middle class and widening tastes -- beyond traditional spirits like baijiu -- as well as cognac's reputation as a status symbol, and China's deep gift-giving culture have been instrumental in the country's seemingly insatiable thirst. As the Wall Street Journal notes this week:

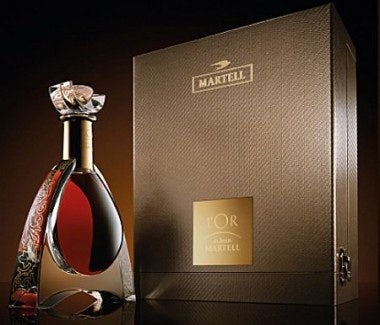

Last week, Pernod Ricard said that its Martell cognac brand was growing strong, thanks to Chinese demand. Martell sales grew 28% over the last six months of 2011, compared with the year-earlier period, making it one of the company’s fastest-growing brands. Earlier this year, Remy Cointreau SA said its sales of Remy Martin cognac grew 37% over the nine months ending in December. Like Pernod, Remy said Chinese demand was the main factor for the leap in sales.

The Chinese obsession with cognac has led its fans to chase down the most expensive and rare forms of the drink. In September, a Hong Kong woman spent more than $150,000 on a bottle of 1858 Cognac Croizet, a world record, at an auction held in Shanghai.

Last year, the four major cognac houses – Hennessy, Remy Martin, Martell and Courvoisier, which make up 97% of total production exported from France – said they were looking to diversify by developing markets outside of China. Remy, for example, sends half of its production to Asia and three-quarters of that goes to China.

Though wealthy mainland Chinese will likely continue to put a premium on cognac, following the lead of the Hong Kong drinkers who came before them, the spirit's reputation as a beverage for older individuals, growing demand among the coveted 25-35 year-old market, and aggressive campaigns by makers of premium vodka and whisky mean the battle for China's high-end spirits market will be far from easy for cognac brands. As the Wall Street Journal points out, beverage conglomerates like Diageo are expecting tastes to change rapidly in China, and are placing bets that Chinese drinkers will soon turn their attention to premium whisky. As Gilbert Ghostine, president of Asia-Pacific operations at Diageo, said last week, his company is now heavily promoting its luxury Scotch brands like Windsor and the Singleton to attract more cognac and brandy drinkers to give whisky a shot.

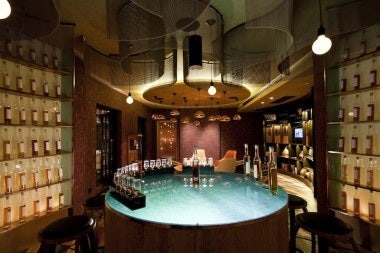

In recent years, other Scotch makers have done the same, heartened by indications that interest in "whisky culture" is deepening among wealthier urban Chinese. As Lawrence Law, brand director at Moët Hennessy Diageo, told Jing Daily at the Johnnie Walker House — which launched last May in Shanghai to promote premium Scotch whisky to a high-end Chinese clientele — a growing number of Chinese drinkers are gravitating towards the culture of Scotch, actively seeking to cultivate their understanding of the history, production and nuances of the spirit. As with French wine, which many middle-class Chinese equate with sophistication and “the good life,” premium aged Scotch is developing a reputation (particularly among middle-aged men in China) as a drink that connotes history, heritage and cultivation.

Still, amid growing competition from vodka and whisky makers, wineries and even craft breweries, cognac is likely to remain a popular gift and drink among China's well-heeled for years to come. Even in Japan, which saw demand peak in the late 1980s, continued demand among older drinkers has kept imports strong for decades. According to Vinexpo, China should be consuming around 3.3 million cases of the spirit by 2015, a figure that dwarfs the 2.3 million cases consumed in Japan at the height of its cognac fever in 1989-1990. Considering the size of China's population, and the speed with which its burgeoning middle class has taken to premium spirits, this is to be expected. But considering demand in China will likely outstrip supply -- the WSJ notes that cognac production is currently at around 12 million cases a year and unlikely to increase significantly -- as with the world's top wines, the effect of Chinese consumption on price tags around the world is expected to be substantial.